Complex situation and 'things gone wrong'

The chip shortage is on everyone's lips and is a major concern, especially in the automotive industry. From VW, Audi, Mercedes BMW to Porsche, shifts are being canceled, plants are closing temporarily and vehicles in the six-figure range are not being produced. Customers are waiting for their vehicles and are only given a quarterly delivery date at best.

But it's not just in Europe and Germany that the automotive industry is experiencing bottlenecks, but worldwide. From Hyundai in South Korea to Subaru or Toyota in Japan - most car manufacturers are affected by the chip shortage.

A look at Europe and Germany

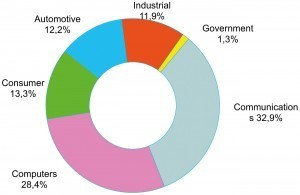

Fig. 2: Semiconductor demand worldwide by industry in 2019 in US$2016, automotive production in Germany peaked at 5.8 million cars and then shrank by -19% to 4.7 million cars by 2019 (see PLUS 3/2021). Then came a dramatic crash: while 453,605 cars were produced in April 2019, production imploded with the outbreak of the coronavirus crisis to a historic low of just 11,287 cars in April 2020. A drop of 97% compared to the same month in the previous year.

Fig. 2: Semiconductor demand worldwide by industry in 2019 in US$2016, automotive production in Germany peaked at 5.8 million cars and then shrank by -19% to 4.7 million cars by 2019 (see PLUS 3/2021). Then came a dramatic crash: while 453,605 cars were produced in April 2019, production imploded with the outbreak of the coronavirus crisis to a historic low of just 11,287 cars in April 2020. A drop of 97% compared to the same month in the previous year.

No wonder that panic broke out in materials management and call-offs and supply contracts were canceled and terminated in automotive style. At the same time, the demand for communication systems for digital conferences and events etc. skyrocketed during the coronavirus pandemic. New computers and screens were purchased for the home office and new smart TVs and games consoles were in demand at home (consumers).

If we now look at the global demand for semiconductors by industry in 2019 of USD 412 billion in Figure 2, the dilemma of the automotive industry quickly becomes clear. Here, growth markets with the coronavirus winners communication, computers and electronic consumer goods with around 75% of the global chip market demand face an automotive industry with a 12% share of demand.

Foolishly run by reallocation

In addition, the automotive industry and its suppliers are particularly proud of their tough buyers, which means that purchase prices for semiconductor manufacturers are extremely tight.

Accordingly, the additional orders from the $300 billion demand segment Communication, Computer and Consumer were gladly accepted last spring. The automotive segment with a demand of USD 50 billion was postponed due to the cancelations.

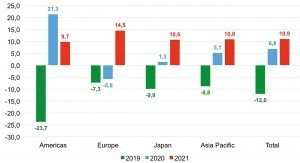

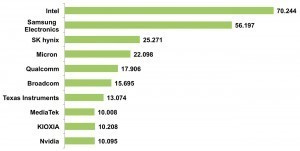

Figure 3 shows semiconductor sales by region for 2019 and 2020 with a forecast for 2021. The 14.5% increase in demand for Europe in the forecast for 2021 stands out here. The total semiconductor market has risen from USD 412 billion in 2019 to USD 440 billion in 2020 and is expected to reach a volume of USD 488 billion this year. The TOP 10 semiconductor manufacturers are listed in Figure 4.

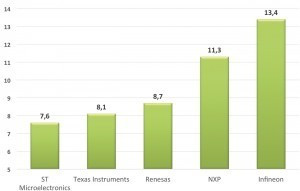

Market leader Infineon

Fig. 5: BlueBox 3.0, a new Automotive High-Performance Compute (AHPC) development platform from NXP Semiconductor Image: NXP Approximately50% of the global semiconductor market share for the automotive industry is distributed among 5 chip manufacturers(Fig. 6, 7). The market volume currently amounts to around US$ 50 billion and is growing rapidly due to assistance systems and battery-electric cars and those with hybrid drives. The market leader is the German company Infineon with a global market share of 13.4 %, ahead of NXP, which emerged from the Dutch Philips Group, with 11.3 % and the Japanese company Renesas with 8.7 %. The American Texas Instruments is in 4th place with a global market share of 8.1% and the Italian-French ST Microelectronics is in 5th place with 7.6% among semiconductor manufacturers specializing in the automotive industry.

Fig. 5: BlueBox 3.0, a new Automotive High-Performance Compute (AHPC) development platform from NXP Semiconductor Image: NXP Approximately50% of the global semiconductor market share for the automotive industry is distributed among 5 chip manufacturers(Fig. 6, 7). The market volume currently amounts to around US$ 50 billion and is growing rapidly due to assistance systems and battery-electric cars and those with hybrid drives. The market leader is the German company Infineon with a global market share of 13.4 %, ahead of NXP, which emerged from the Dutch Philips Group, with 11.3 % and the Japanese company Renesas with 8.7 %. The American Texas Instruments is in 4th place with a global market share of 8.1% and the Italian-French ST Microelectronics is in 5th place with 7.6% among semiconductor manufacturers specializing in the automotive industry.

In a nutshell

- With a global semiconductor volume of 440 billion dollars, demand in the communication, computer and consumer segment is 330 billion dollars. In contrast, the automotive segment has a demand of around USD 54 billion and is therefore in a weaker position in the event of a reallocation.

- The change in semiconductor demand from shrinkage to growth can be seen in an analysis by the Semiconductor Industry Association SIA. Only in Europe did sales skyrocket from -5.8% in 2020 to a forecast +14.5% in 2021.

- The market leader for semiconductor components for the automotive industry is the German company Infineon with a global market share of 13.4%, ahead of NXP, which emerged from the Dutch company Philips, with 11.3% and the Japanese company Renesas with 8.7%.

- The top 10 foundries represent 96.1% market share with quarterly revenues of $20.2 billion in Q3 2020. The average growth was 14% from 2019 versus 2020, with the largest foundry Taiwan Semiconductor Corporation (TSMC) achieving growth of 21.0% with a global market share of 53.9%(Fig. 7).

- A number of factors have led to the shortage of components: A strong economy in Asia despite the pandemic; the global increase in demand for communication products, computers and electronic consumer goods due to the pandemic; the cancellation of supply contracts for automotive chips in spring 2020; 'minor disasters on the fringes', such as the snowfall in Texas or the fire at Renesas Plant No. 1 in Japan.

While Europe was still incredulously discussing a V, U or W trend in the economy, Asia and China in particular were already back on the accelerator in Q2 2020. The communications, computer and electronic consumer goods sectors there recovered accordingly quickly and quickly ordered their unscheduled requirements. Additional trouble was caused by snow in Texas at the beginning of 2021, which paralyzed several chip factories, and the fire at chip manufacturer Renesas in Hitachin-Naka, Japan, in March. The week-long blockade of the Suez Canal also fits into this scenario.

At the same time, Chinese companies are stockpiling semiconductor chips and used production equipment worldwide. This behavior is due to the conflict between the USA and China. Even the world's largest foundry TSMC in Taiwan is affected by the US ban on the supply of new production facilities for semiconductor components and direct deliveries.

Even though most semiconductor manufacturers are expanding their production, it takes around 2 to 2.5 years to set up a new production facility, including clean rooms, and 1 to 1.5 years for existing clean rooms. The bottlenecks in semiconductors will therefore continue to accompany us throughout 2021.

I wish you a hopeful May!

Best regards to you

Yours

Hans-Joachim Friedrichkeit