In October, China once again reminded experts of its dependence on supply chains. The export of graphite is to be restricted for reasons of national security, the Chinese Ministry of Commerce announced. Graphite is a mineral that is crucial for the production of Li-ION batteries for electric vehicles (EVs).

Lithium-ion battery pack for electric vehicles or hybrid cars; Image: Ivan Milovanov / IM Imagery OU (AdobeStock)

Lithium-ion battery pack for electric vehicles or hybrid cars; Image: Ivan Milovanov / IM Imagery OU (AdobeStock)

The announcement came just days after the US introduced additional restrictions on certain types of semiconductors that American companies are allowed to sell to Chinese firms. Pressure creates counter-pressure, according to Newton's third law.

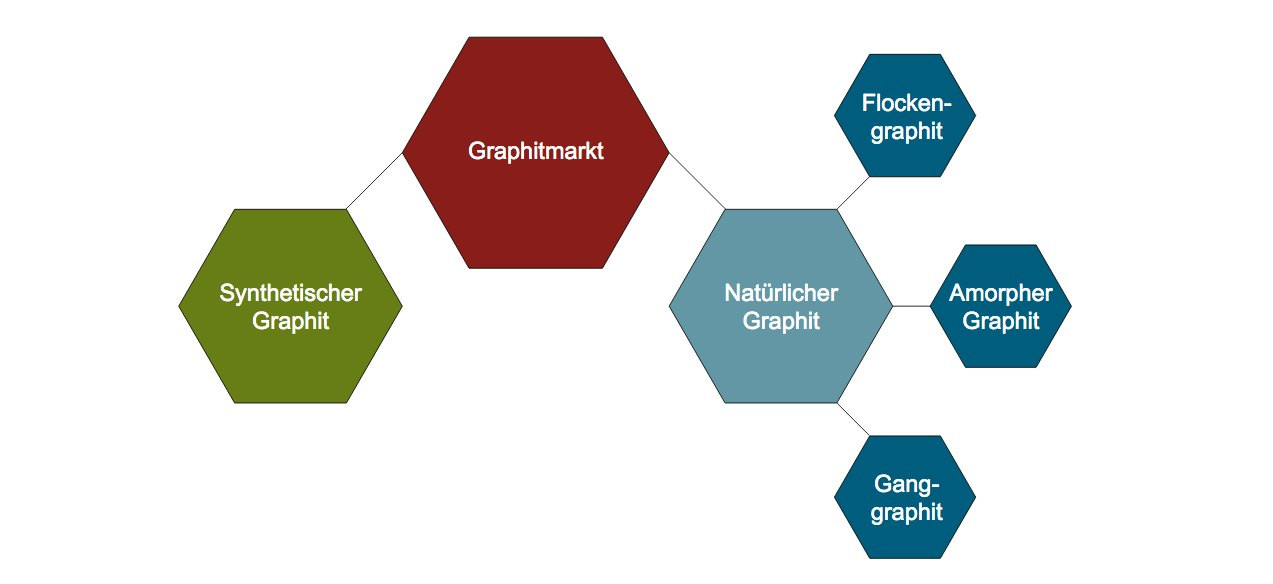

China, which dominates the global production and processing of graphite, will regulate exports from December 2023 through export licenses for synthetic graphite material - including high-purity, high-strength and high-density versions - as well as natural flake graphite(Fig. 1).

Fig. 1: Overview of the graphite market; Image: German Mineral Resources Agency

Fig. 1: Overview of the graphite market; Image: German Mineral Resources Agency

Graphite - a common mineral?

Graphite is a very common mineral from the mineral class of "elements". It is one of the natural manifestations of the chemical element carbon in its pure form and crystallizes externally in the hexagonal crystal system, explains Wikipedia.

The optimum material for the anode is graphite

It is applied to a copper foil together with binding agents and usually with conductive additives, forcing the lithium atoms to find a fixed place in the lattice structure of the material. This has the following advantages: higher cycle stability, better performance during fast charging and higher quality consistency compared to other battery types such as lead batteries. The purer the graphite, the better this mechanism works. Synthetic graphite performs this task particularly well thanks to its optimized and adaptable properties.

China has the monopoly

Even if graphite appears at first glance to be a commonplace mineral that can even be found in a pencil, it has been classified as a so-called 'critical material' in its processed, high-purity form as an anode by the German Raw Materials Agency.

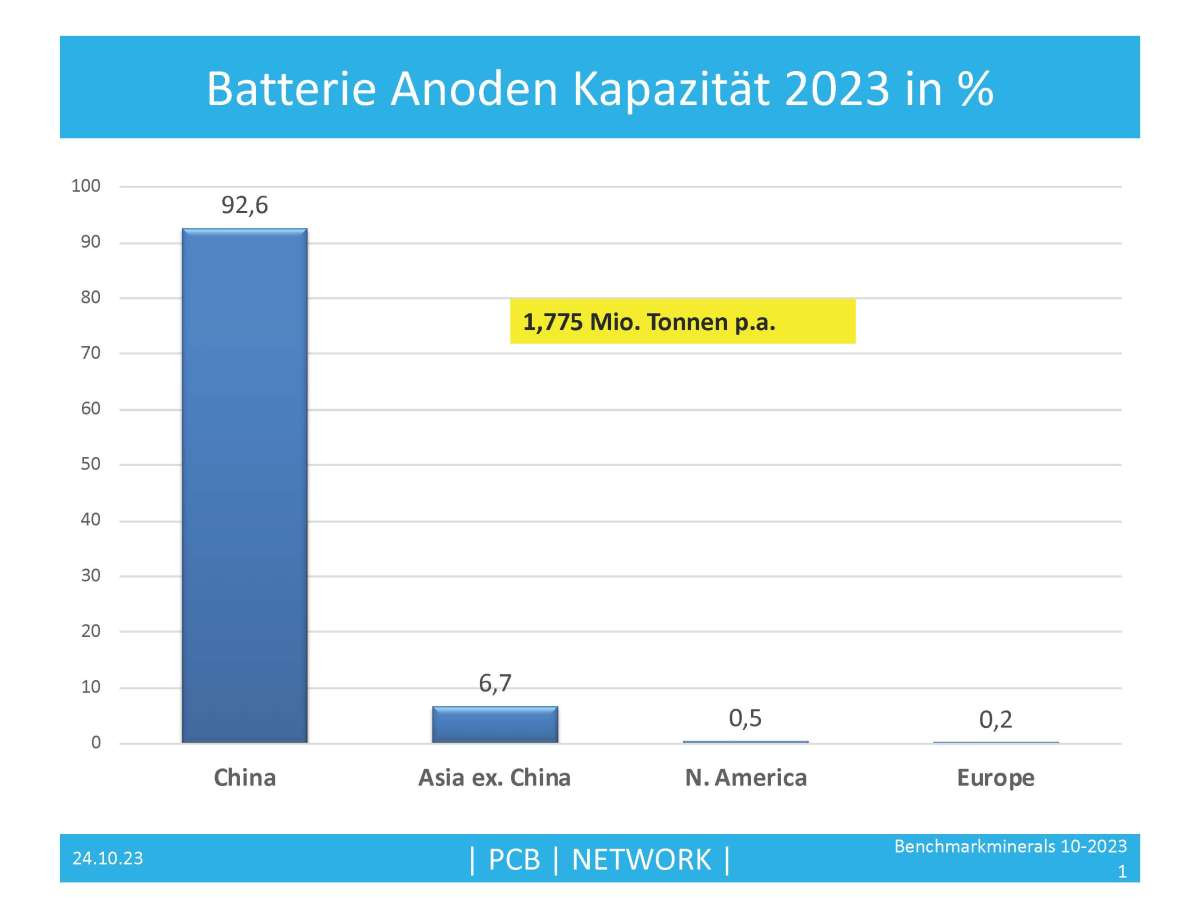

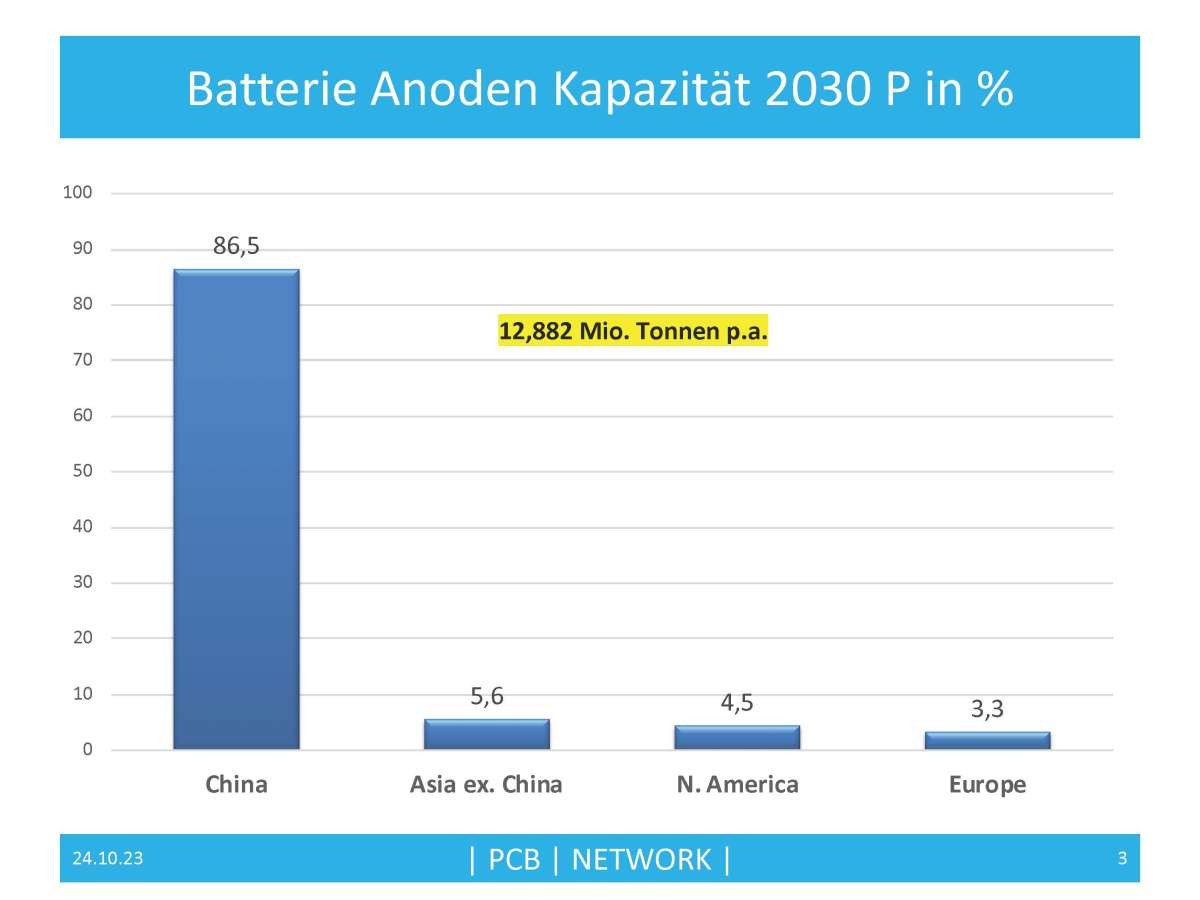

Looking at production capacities by country as a percentage, China dominates the battery anode market with 92.6%. Asia follows a long way behind with 6.7 % capacity share and the USA and Europe with less than one percent (Fig. 2-4).

Fig. 2: Graphite capacity for Li-ION battery anodes in 2023 (data: Benchmark Mineral Intelligence)

Fig. 2: Graphite capacity for Li-ION battery anodes in 2023 (data: Benchmark Mineral Intelligence)

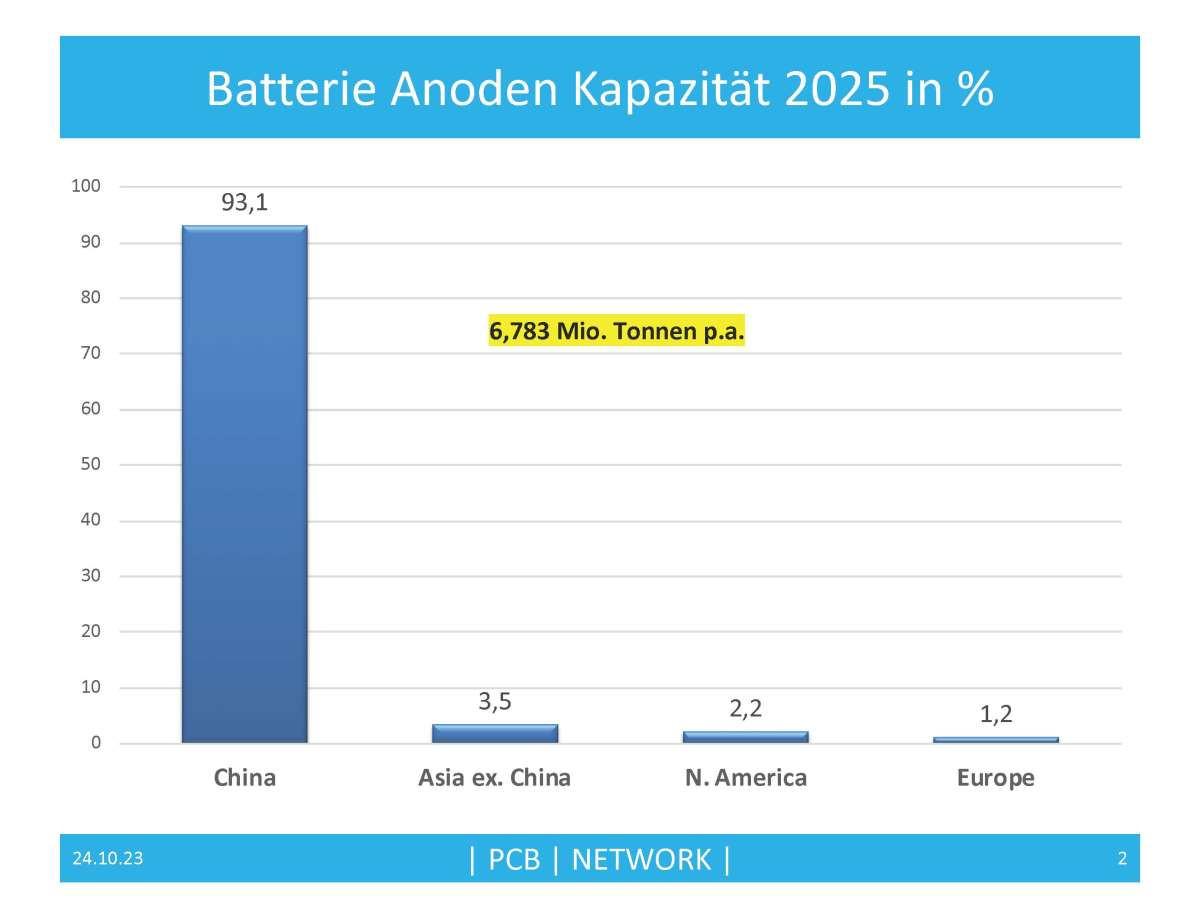

Fig. 3: Graphite capacity for Li-ION battery anodes 2025 forecast (data: Benchmark Mineral Intelligence)

Fig. 3: Graphite capacity for Li-ION battery anodes 2025 forecast (data: Benchmark Mineral Intelligence)

Fig. 4: Graphite capacity for Li-ION battery anodes 2030 forecast (data: Benchmark Mineral Intelligence)

Fig. 4: Graphite capacity for Li-ION battery anodes 2030 forecast (data: Benchmark Mineral Intelligence)

According to an analysis by Benchmark Minerals, capacities in other countries will only be built up from 2030, reducing the Chinese share to 86.5%. However, it will remain a monopoly.

Capacities for highly refined anode material are expected to almost quadruple from 1.8 million tons per year today to 6.8 million tpa in 2025 and double again to 12.8 million tpa by 2030.

China's influence on raw materials

China has a massive influence on the global supply chain of key minerals needed for the production of EV batteries. According to the US Department of Energy, China refines 60% of the world's lithium and 80% of its cobalt.

When it comes to rare earths, equally essential for chips, smartphones, LEDs, wind turbines and electric motors, China dominates far ahead of Vietnam, Brazil and Russia. For example, 95% of gallium and 67% of germanium come from Chinese production, a fatal dependency in the event of supply disruptions.

In the case of graphite, batteries are the exception in the field of application, where both flake graphite in the form of spherical graphite and synthetic graphite are used as anode materials. The production of battery-grade spherical graphite from flake graphite involves a series of process steps and is associated with losses of between 30 and 70 %. As described above, its production and the downstream value chain for the production of anode materials are currently heavily concentrated in China. Due to their specific properties, both types of graphite are suitable for different battery applications. In the important market segment of lithium-ion batteries (LIB), a ratio of natural to synthetic graphite of 40:60 can currently be assumed across all areas of application.

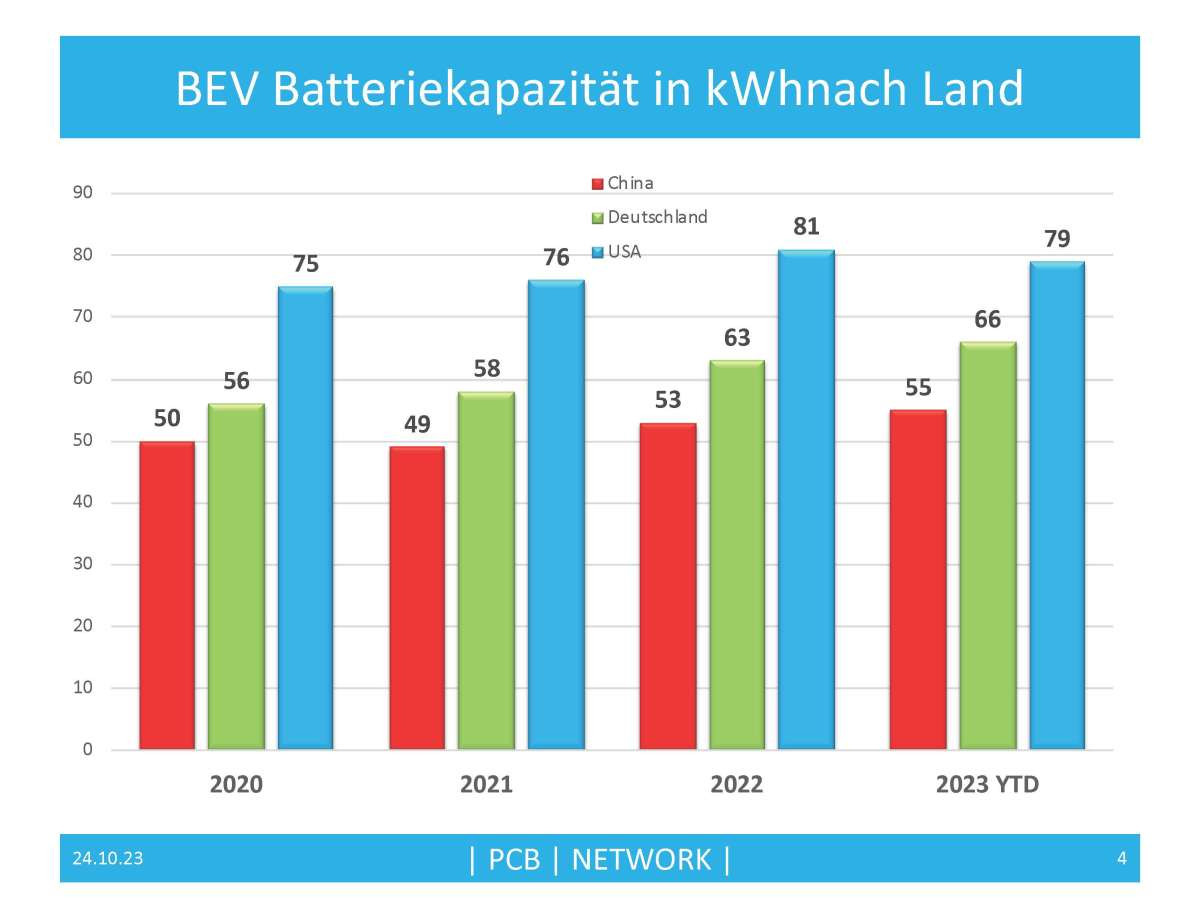

Electric car sales are driving demand for anodes

The driver is the rapidly increasing sales of battery electric cars and hybrid cars. Last year, more than 10 million e-vehicles were sold, an increase of 55% compared to 2021, and this year an increase to almost 14 million e-vehicles is expected.

The European battery market

The European battery market is dominated by the South Korean manufacturer LG Energy Solution and the Chinese manufacturer CATL. 50% of the cells in electric vehicles sold were manufactured by LG, 25% by CATL. The other battery suppliers Samsung SDI (10 %), SK On (9 %), Panasonic (2 %) and Envision AESC (2 %) also come from Asia. This means that more than 98% of battery cells sold in Europe are produced by Asian companies. Further data can be found in my column 3-2023 'Battery raw materials'.

Fig. 5: Average battery capacities in KWh 2020-2023 YDT for BEVs in China, Germany and the USA (data: AlixPartner)

Fig. 5: Average battery capacities in KWh 2020-2023 YDT for BEVs in China, Germany and the USA (data: AlixPartner)

In a nutshell

- China is the absolute world market leader for highly refined and particularly pure graphite for battery anodes with 93% capacity share

- New export licenses for anode graphite (spherical graphite) will be required from December 2023

- Capacities for highly refined anode material are set to almost quadruple from 1.8 million tons per year today to 6.8 million tpa in 2025 and double again to 12.8 million tpa by 2030

- After 10 million BEVs and PHEVs in 2022, around 14 million cars are expected to be sold worldwide this year, which will drive demand for spherical graphite for battery anodes

- Chinese CATL and Korean LG dominate 75% of the European battery market as battery manufacturers.

At the moment, the Chinese authorities only expect a license to export graphite products to be applied for, as they are increasingly focusing on strategic industries - especially batteries.

However, the strong reactions and fears from the rest of the world are telling: the countries that rely on China's graphite and anode supply chain have hardly planned for this moment.

Figures 2 to 4 summarize the main problem the rest of the world faces with graphite and anode materials. While the rest of the world was sleeping, China was expanding its leading position for anode material on a large scale. The price explosion of lithium, nickel and cobalt had woken up manufacturers, but the underestimated common element graphite has been ignored so far.

But perhaps this incident will sensitize the graphite world outside China and give new impetus to the development of non-Chinese production capacities, especially for highly refined graphites, for which China has a near monopoly.

Best regards

Yours

Hans-Joachim Friedrichkeit