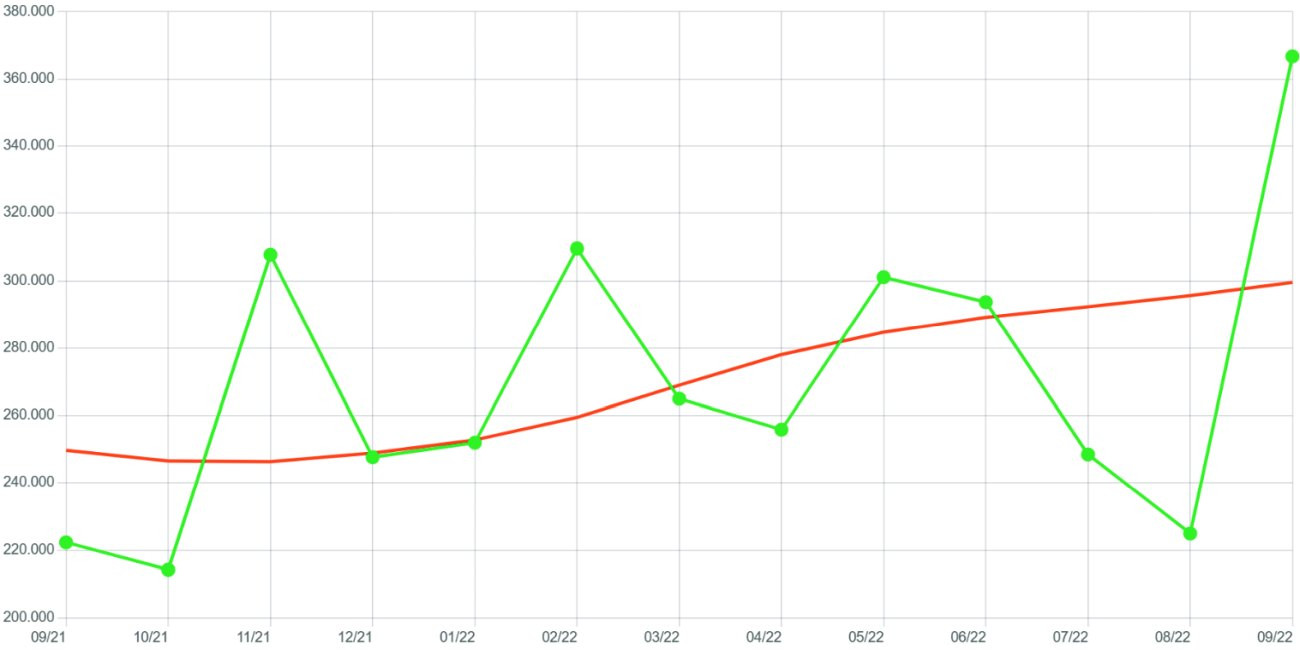

Loss of market share in China and launch of Chinese passenger cars in Germany. The automotive sky is getting darker for the German vehicle industry. The chip crisis seems to have been partially overcome, production figures in Germany have been rising for 5 months, but they are still 30% below the pre-corona level of 2019(Fig. 4). Delivery times are falling, but are being met with a clear reluctance to buy among people who are forced to spend their money on rising energy and living costs. At the same time, the premiums for e-vehicles will fall at the end of the year and will be completely abolished for hybrid cars. Increased electricity prices at charging stations are also eroding the previous consumption cost advantage over diesel and petrol engines. On top of this, effective sales prices have risen by up to 12% this year. Not a good starting point for manufacturers, OEMs and suppliers.

German manufacturers are losing market share in China

The Volkswagen Group's high-margin share of sales in China was still 37% in 2021 (40% in 2020), followed by BMW with 34% and Mercedes Benz with 31%. The world's largest automotive market, China, grew to 16.8 million units in the first nine months of the year, an impressive +15%.

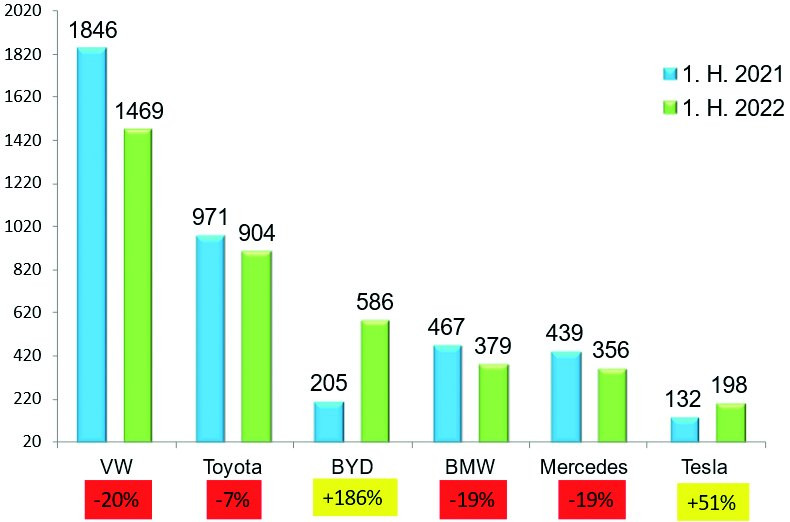

This makes it all the more sad that the Volkswagen Group only sold 1.469 million vehicles in the first half of 2022, a drop of 20%(Fig. 2). BMW and Mercedes also lost sales, each down 19%. BYD (Build your dreams), on the other hand, increased its sales by 186 % and Tesla as a foreign manufacturer also managed +51 %. BYD and Tesla produce 100% battery electric vehicles.

E-car boom in China - VW weakens

Fig. 1: At the German premiere in October, NIO founder and CEO William Li presented the ET7 saloon to the trade audience. It can be ordered immediatelyByJuly 2022, 3.2 million electric cars had been registered in China. The PCA (China Passenger Car Association) expects sales of 5.5 to 6 million e-cars including hybrid vehicles. This corresponds to a doubling compared to 2021.

Fig. 1: At the German premiere in October, NIO founder and CEO William Li presented the ET7 saloon to the trade audience. It can be ordered immediatelyByJuly 2022, 3.2 million electric cars had been registered in China. The PCA (China Passenger Car Association) expects sales of 5.5 to 6 million e-cars including hybrid vehicles. This corresponds to a doubling compared to 2021.

Volkswagen only managed to sell 16,000 e-cars in September this year, a particularly strong month for sales, while Tesla managed to sell 83,000 units, while its domestic Chinese competitor BYD sold around 200,000 e-cars (NEV-New Electric Vehicle).

Chinese car buyers do not see enough digital features in Volkswagen's ID series and also see weaknesses in autonomous driving. Volkswagen is therefore investing €2.4 billion in the race to catch up, €1.3 billion of which is being invested in the joint venture with Chinese company Horizon Robotics. The aim is to develop new software with the Chinese partners and drive forward digitalization, as competitors such as BYD, NIO and Great Wall are already much more advanced.

VW's aim here is to develop country-specific software solutions.

The new competitors from China in Europe

BYD, MG, NIO, Aiways, Lynk & Co. and Chery are becoming increasingly active on the German and European automotive market with a focus on electromobility.

NIO, which had its European launch in Berlin on October 7, is presented here as an example.

Fig. 2: German manufacturers are losing market share in China. Car sales in thousands and percent, change vs. previous year period

Fig. 2: German manufacturers are losing market share in China. Car sales in thousands and percent, change vs. previous year period

The ET7(Fig. 1) is 5.10 m long and impresses with a drag coefficient of 0.23, which promises high efficiency. The drive consists of a 180 kW / 245 hp electric motor on the front axle and a 300 kW / 408 hp counterpart at the rear. The all-wheel drive with 480 kW / 653 hp and 850 Newton meters of system power allows a sprint to 100 km/h in 3.9 seconds. A 75 KWh and 100 KWh battery are available, and the 150 KWh battery system for a range of 1000 km, which is already in use in China, is to be added at a later date.

Fig. 3: The BYD blade battery based on lithium iron phosphate The battery changing system, which takes just a few minutes, is very clever. The first automatic system is in Berlin, with a further 15 under construction. In addition to the speed of a conventional gasoline refueling process, the advantage is that different battery sizes can be exchanged if you have a long journey ahead of you.

Fig. 3: The BYD blade battery based on lithium iron phosphate The battery changing system, which takes just a few minutes, is very clever. The first automatic system is in Berlin, with a further 15 under construction. In addition to the speed of a conventional gasoline refueling process, the advantage is that different battery sizes can be exchanged if you have a long journey ahead of you.

The comprehensive assistance systems including LiDAR are remarkable. LiDAR stands for Light Detection and Ranging and is a method of detecting the surroundings. It uses light in the form of a pulsed laser to detect and categorize objects. The delivery time for individually configured ET7s is around four months.

Blade batteries in BYD e-cars

BYD has been active in the battery industry for more than 27 years and achieved a market share of 11.8% for e-car batteries in the first half of 2022. BYD's new Blade Battery has passed a series of extreme tests, making it one of the safest batteries in the world today(Fig. 3) The Blade technology is a lithium iron phosphate battery that does not require cobalt. The advantages of lithium iron phosphate batteries are that they function optimally at high starting temperatures and that they dissipate heat slowly and generate little heat. In addition, the space utilization of the battery pack is increased by over 50 % compared to conventional lON batteries. The flat rectangular shape improves cooling efficiency and pre-heating performance.

Global automotive market Q1 to Q3 2022

New registrations in the European passenger car market (EU27, EFTA & UK) reached a level of just under 8.3 million vehicles in the first nine months of this year, down 10% on the previous year. The European car market even fell 32% short of the pre-corona level of 2019. However, the five major individual markets all grew in September(Fig. 4): Germany (+14%) and Spain (+13%) achieved double-digit growth. France, Italy and the United Kingdom each grew by 5%. Overall, new registrations on the European market rose by 8% to just over 1.0 million passenger cars in September.

Fig. 4: Passenger car production by German manufacturers in Germany - Production - Trend

Fig. 4: Passenger car production by German manufacturers in Germany - Production - Trend

With a good 16.8 million newly registered cars so far this year, the Chinese passenger car market is 15% above the previous year's level. Alongside India, it is the only major international automotive market that is well above the pre-coronavirus level of 2019. The growth rally of the previous months continued in September: a volume of 2.3 million new vehicles represents an increase of 33% compared to the same month last year. Since the middle of the year, car sales have been boosted by a tax cut, among other things.

In the US light vehicle market (passenger cars and light trucks), 10.1 million light vehicles have been sold so far this year, 13% fewer than in the same period last year. The share of the light truck segment has also increased in the year to date and most recently stood at 79%. The remaining 21% is accounted for by passenger cars. In September, light vehicle sales rose to 1.1 million (+9%).

In Japan, a total of 2.6 million new passenger cars have been sold since the beginning of the year, a drop of 11% compared to the first nine months of the previous year. At 324,900 units, sales in September were a good 26% above the low level of the same month last year.

The Russian passenger car market has seen significant declines over the course of the year. The consequences of the Russian war of aggression against Ukraine had a massive impact: At 506,700 vehicles, 60% fewer passenger cars have been sold this year than in the same period last year.

In the Indian passenger car market, a market volume of just under 2.9 million passenger cars has been achieved in the year to date. This represents an increase of 23%. In September, sales of new vehicles were up 92% on the previous year at 307,400 cars.

In a nutshell

- Discontinued premiums for e-vehicles, increased electricity prices at charging stations are eroding the previous consumption cost advantage over diesel and petrol engines, an increase in effective sales prices of up to 12% and consumer reluctance to buy are creating new supply pressure.

- German manufacturers are losing market share in China, partly due to software and digitalization features that are no longer in line with the market. In the 1st half of 2022 in units: Volkswagen -20%, BMW and Mercedes -19%, but Tesla +51% and BYD +186%.

- The new competitors from China in Europe BYD, MG, NIO, Aiways, Lynk & Co. and Chery are becoming increasingly active on the German and European automotive market with a focus on electromobility.

- The European passenger car market (EU27, EFTA & UK) with 8.3 million vehicles from Q1 to Q3 lost -10%. The Chinese passenger car market is 15% above the previous year's level with a good 16.8 million newly registered passenger cars in the year to date. In the US light vehicle market (passenger cars and light trucks), 10.1 million light vehicles have been sold in the year to date, 13% fewer than in the same period of the previous year. Japan, with 2.6 million passenger cars, is down -11%, while India, with 2.9 million passenger cars, is up +23%.

German car manufacturers with their large and small suppliers are in a quandary. Now that battery technology, software, digitalization and autonomous driving are the 'game changers' in the new energy vehicle (NEV) market and no longer the core competence of combustion engines with cutting-edge technology, European manufacturers are falling behind in China, the world's largest car market. At the same time, Chinese manufacturers with an interesting price/performance ratio are starting to roll up the German and European markets, a pincer movement. So much for the market.

On top of this, an ideology-driven policy is now making things more difficult. In Germany, with fixed registration bans for combustion engines that outstrip each other in time; in China, with the unrestricted state-sponsored goal of becoming the global technology leader for electromobility and autonomous driving.

This gives us every chance of destroying our only globally recognized industry segment - including many automotive-related SMEs - in record time.

"We can do it!"

It is worth fighting against unreasonableness, because we all have a lot to lose!

Best regards

Yours

Hans-Joachim Friedrichkeit