Opportunities for heavy weather captains in business and politics

"Pessimists stand in the rain, optimists shower under clouds" is a current book title; but what we need in 2023 are realists (Latin realis = real).

Only reality shows us the measures we need to take to get through a time of crisis. Every deep-sea sailor approaching a heavy weather zone knows that only a realistic assessment of the situation, followed by thorough preparation for conceivable eventualities, will ensure getting through as unscathed as possible.

A look into the crystal ball at the end of the year

Purchasing Manager Index PMI

Fig. 1: Growth in real gross domestic product (GDP), IMF data 10/2022ThePurchasing Manager Index PMI offers a good preview of the next 3 to 6 months. Materials management managers or supply chain managers need to know when to order the relevant raw materials or supplier parts, depending on the product lead time in their own company.

Fig. 1: Growth in real gross domestic product (GDP), IMF data 10/2022ThePurchasing Manager Index PMI offers a good preview of the next 3 to 6 months. Materials management managers or supply chain managers need to know when to order the relevant raw materials or supplier parts, depending on the product lead time in their own company.

If, for example, multilayer ceramic chip capacitors (MLCCs) are required, delivery times of 4 to 12 months and more have been a reality over the last two years. PCBs, on the other hand, can be procured in 4 to 8 weeks, even though they are produced to customer specifications.

The PMI also provides information on whether the market is growing (a value > 50) or shrinking (a value < 50).

If you follow the dynamics of the curve over several months, you can see whether the downward trend is accelerating further.

The global PMI

The JPMorgan Global Manufacturing Purchasing Managers' Index (PMI) calculated by S&P Global fell further below the neutral mark of 50.0 in October. The overall index fell from 49.4 in October to 48.8 in November, its lowest level in 28 months.

The detailed analysis of the survey points to a continued decline in production in the face of falling demand and a deteriorating outlook. Although the easing in the supply chain and the easing of price pressure are encouraging, they are essentially due to the slowdown in global demand.

The output index of the global manufacturing PMI survey, which is considered a reliable leading indicator of actual global production trends, showed the fourth consecutive monthly decline in global factory output in November.

IMF's October GDP forecast

Figure 1 shows how the experts at the International Monetary Fund (IMF) estimate real gross domestic product (GDP) growth for 2023. A decline of -0.2% is forecast for Germany, which corresponds to a medium recession in 2023.

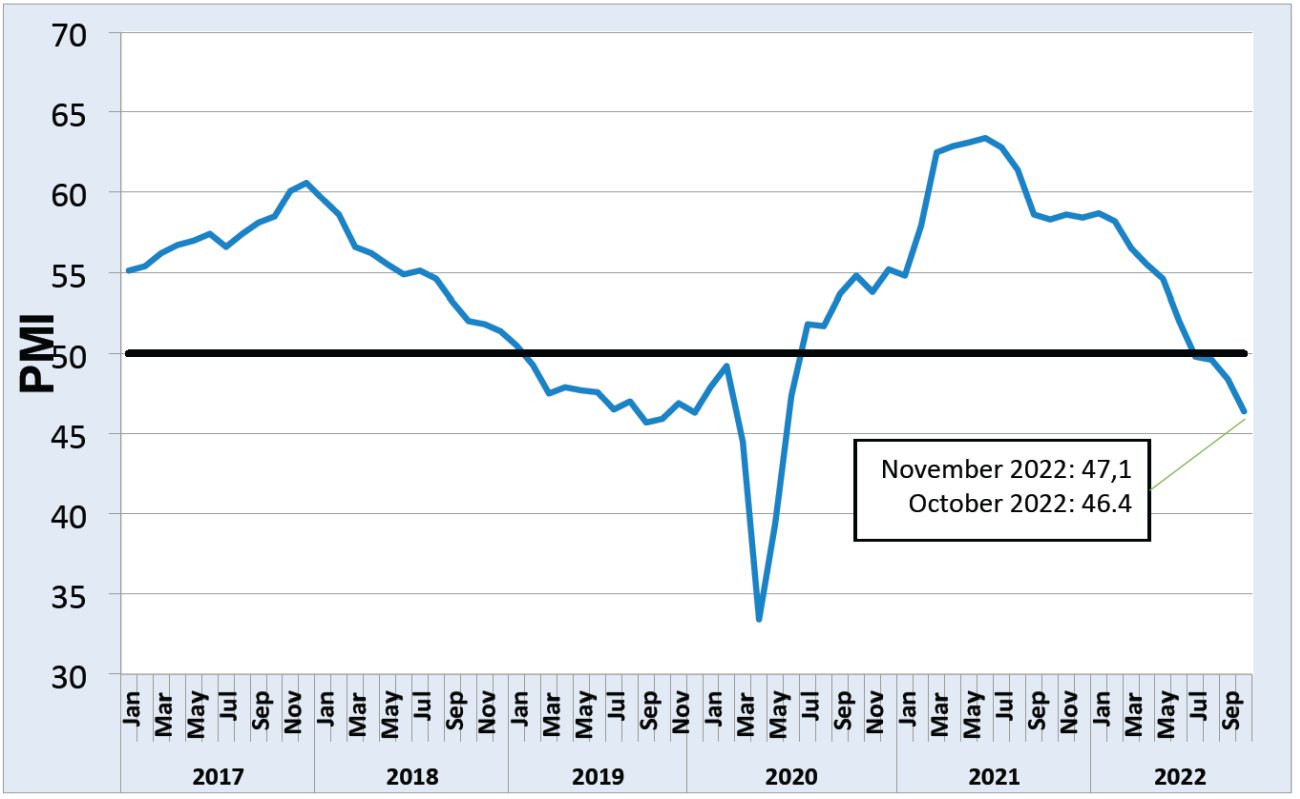

Eurozone PMI for the manufacturing sector

Although the S&P Global Eurozone Manufacturing PMI improved by 0.7 points to 47.1 compared to October 2022, it remained below the neutral 50 line for the fifth consecutive month (Fig. 2). Eurozone manufacturing thus remains on course for contraction, but without falling any further at present.

Fig. 2: Eurozone PMI for the manufacturing sector (source Markit Economics)

Fig. 2: Eurozone PMI for the manufacturing sector (source Markit Economics)

However, production and demand fell less sharply in November than in October of this year. An improved supply chain and a simultaneous decline in demand reduced price pressure and thus inflation.

Production and new orders fell at near-record rates and export demand also fell sharply as geopolitical uncertainty, high inflation and weaker economic conditions around the world weighed on spending by foreign customers.

Manufacturers expect production volumes to continue to decline over the next 12 months due to high inflation, geopolitical uncertainty and deteriorating global economic conditions.

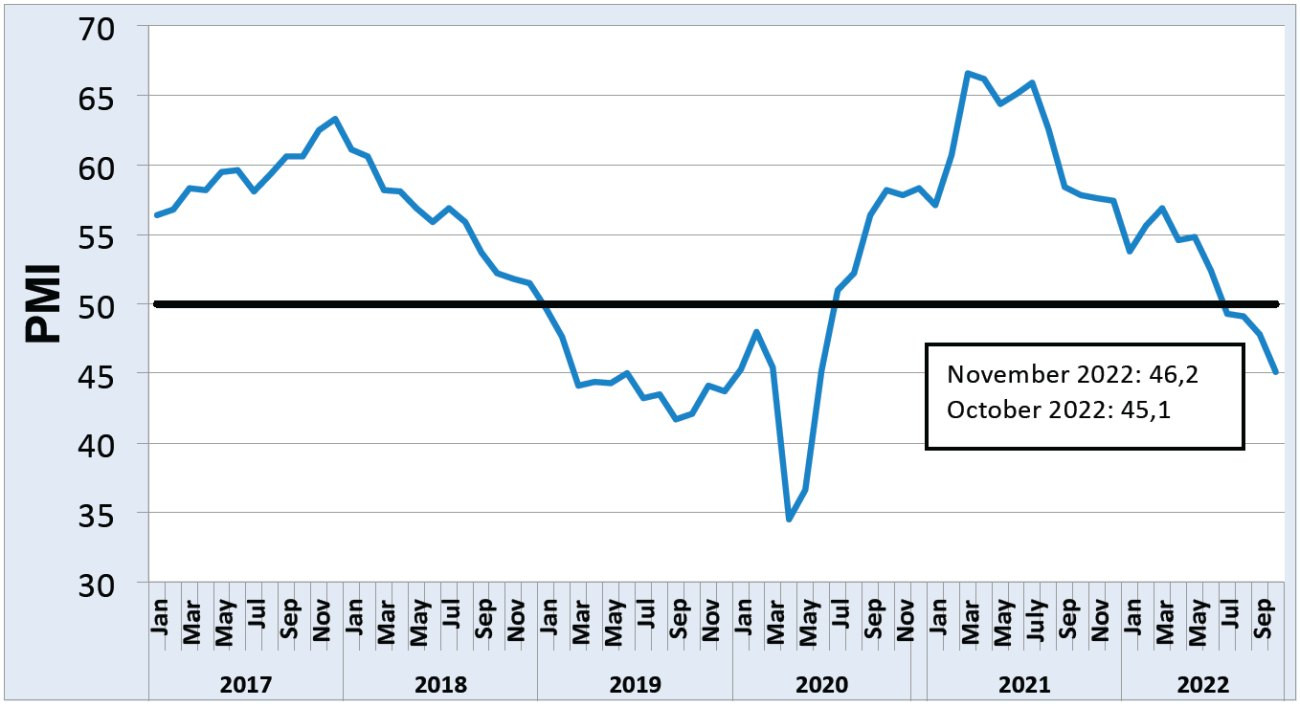

Germany PMI for the manufacturing sector

The S&P Global/BME Manufacturing PMI in Germany improved to 46.2 in November 2022 from 45.1 in October, indicating a fifth consecutive month of declining manufacturing activity(Fig. 3).

Fig. 3: Germany PMI for the manufacturing sector (source: Markit Economics 12/22)

Fig. 3: Germany PMI for the manufacturing sector (source: Markit Economics 12/22)

As in the eurozone, however, the decline has slowed and indicates an initial bottoming out (reversal point).

In the meantime, backlogs have continued to fall and purchases have fallen more sharply than at any time since June 2020. Companies suddenly have sufficient or even too much stock again; material shortages are a thing of the past.

This takes pressure off supply chains and inflation rates, which slows down inflation.

Looking ahead, expectations fell due to concerns about persistently high inflation, high energy costs, rising interest rates and the prospect of a recession.

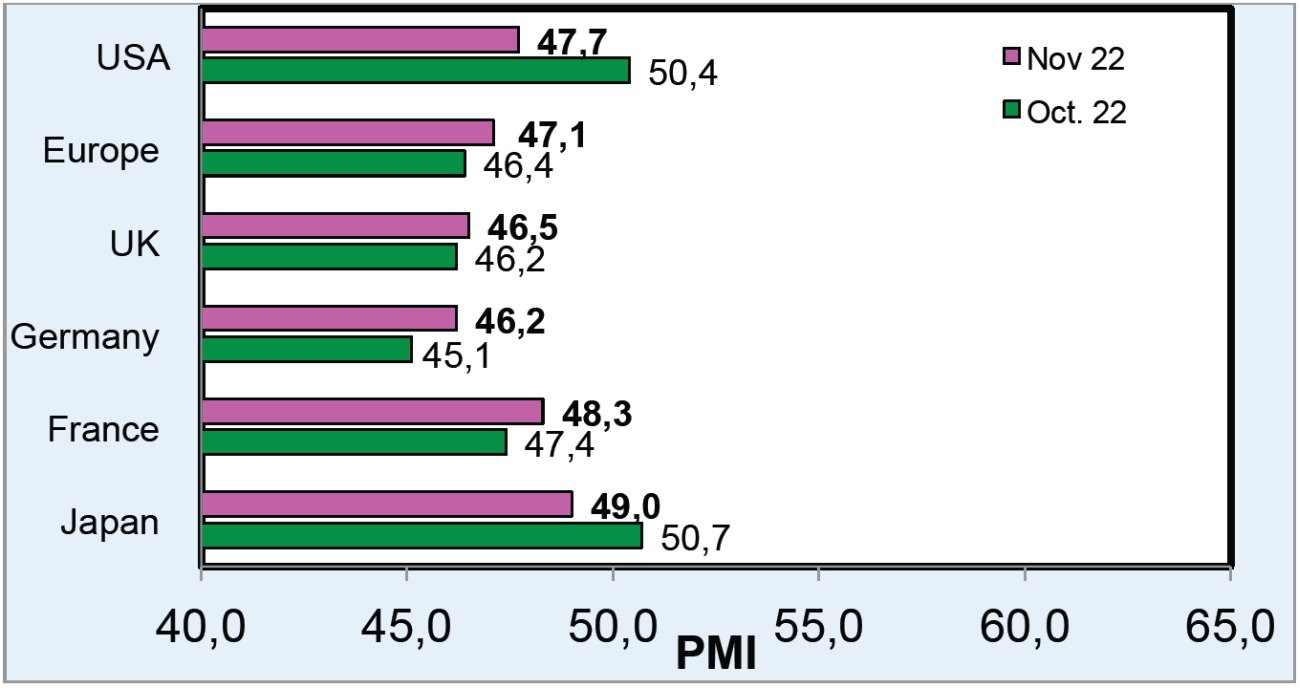

PMI overview Europe and Asia

Figure 4 shows once again in detail for the individual countries that the declines in purchasing and therefore in production are slowing down.

Fig. 4: Purchasing Manager Index November versus October 2022 (source: Markit Economics 12/22)

Fig. 4: Purchasing Manager Index November versus October 2022 (source: Markit Economics 12/22)

Manufacturing companies in the US are seeing a renewed deterioration in November. The downturn from October's growth zone of 50.4 to 47.7 was the sharpest downturn since May 2020 and was caused by declines in production and new orders. Demand conditions weakened in domestic and foreign markets as new export orders also continued to decline.

Employment growth slowed as pressure on capacity decreased and backlogs shrank significantly. On the positive side, supply chains improved for the first time since October 2019, as did price pressure due to lower demand for inputs.

Japan was still able to record growth in October at 50.7, but reached the contraction phase in November at 49.0. In China, with a value of 49.4 in November, the contraction phase did not accelerate further after 49.2 in October. This is also reflected in the GDP/GDP forecasts for 2023 shown in Figure 1. China is being hit hard by the ongoing rigid Covid-19 restrictions, but also by the decline in demand in the western world and thus the Chinese export volume.

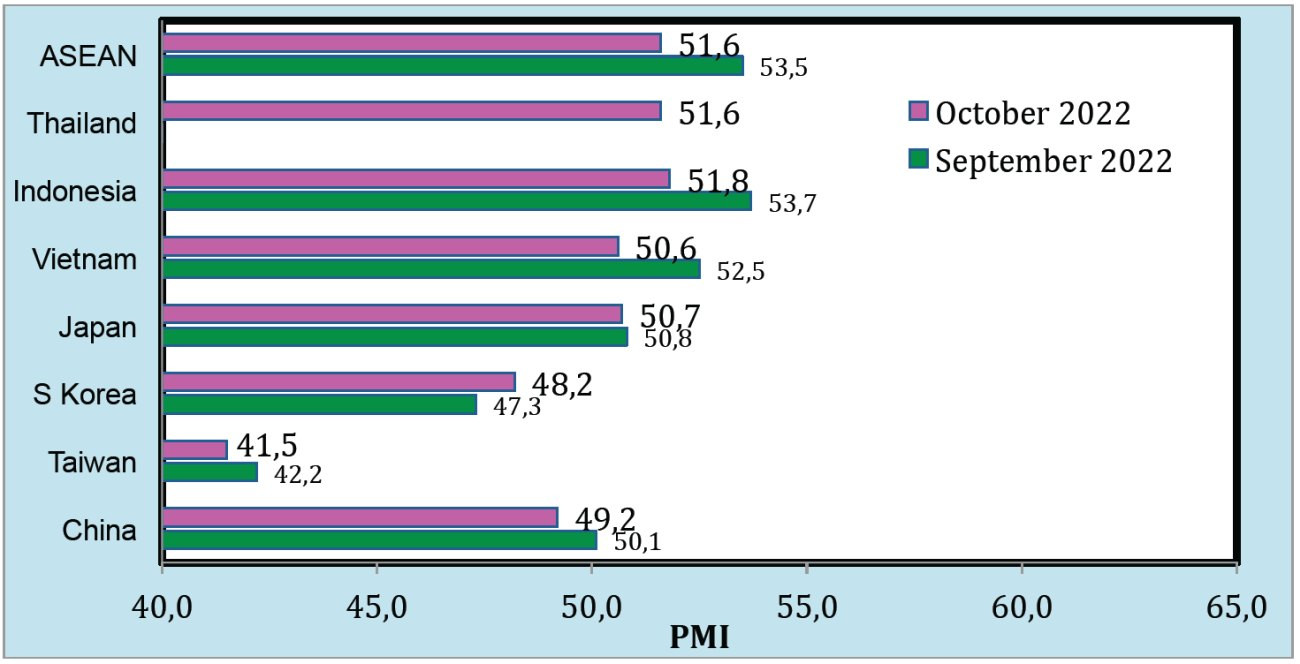

The PMI values of the ASEAN countries for October shown in Figure 5 present a mixed picture. While Thailand, Vietnam and Indonesia are still showing slight PMI growth, China, Taiwan, Japan and South Korea have entered the contraction zone.

Fig. 5: Purchasing Manager Index Asia October versus September 2022 (source: Markit Economics)

Fig. 5: Purchasing Manager Index Asia October versus September 2022 (source: Markit Economics)

To the point

- In its October World Economic Outlook (WEO), the Washington-based IMF lowered its forecast for global growth next year to 2.7%, down from 2.9% in July and 3.8% in January, adding that it sees a 25% chance that growth will slow to less than 2%.

- The Global Manufacturing PMI fell for the fourth consecutive month. After 49.4 in October, the PMI fell to 48.8, a 29-month low.

- 23 of the 31 countries that make up the global manufacturing PMI are in the contraction zone, including China, the USA, the eurozone and Japan.

- Even if Germany comes through the 2023 recession with a "black eye", the medium-term question is which new German business model promises continued success in the future.

- The Ukraine/energy crisis, the aftermath of the pandemic, China's zero Covid policy and the geopolitical conflict between the USA and China are creating a toxic situation. Added to this is a German "nanny state" with increasing intervention in the market without regard for debt or the proportionality of the measures. The social market economy with competition and individual responsibility seems like a relic from another era.

As Confucius said: "If a man does not think about what lies in the distant future, he will regret it in the near future".

As the year draws to a close, I would like to thank you, our readers, for your suggestions, advice and comments. But also to my long-time friends and industry colleagues Walt Custer(www.custerconsulting.com) for his Business Outlook of the Global Electronic Industry and Dr. Hayao Nakahara for NTI 100 and his many reports.

My thanks are combined with my best wishes for a peaceful Advent and Christmas season.

Please stay with us in the New Year.

Best regards

Yours

Hans-Joachim Friedrichkeit