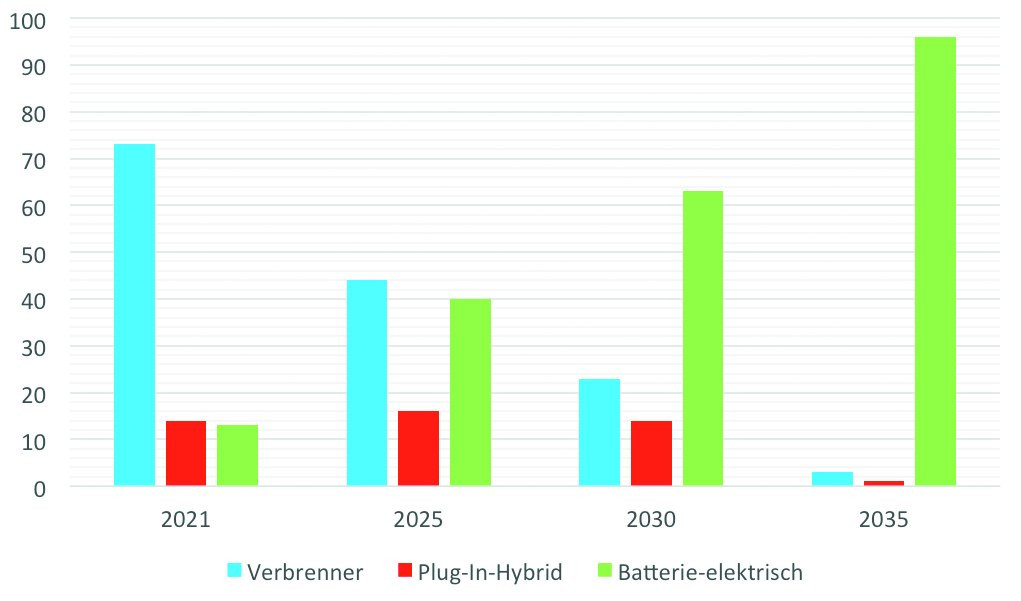

From 2035, 96% of all new registrations in Germany will have a battery-electric drive, predicts a Boston Consulting study (Fig. 1). As a bridging technology, plug-in hybrids will still have a share of around 15% between 2021 and 2030 before disappearing from the new vehicle market. This is in line with the plans of the EU, which decided in mid-June of this year to 'phase out' combustion engines from 2035.

But the feeling creeps up on us that it all looks a bit like the children of Bullerbü or the proverbial pony farm: It's all just a colorful dream of naive politicians who don't want to understand that geopolitics and therefore the global supply of raw materials doesn't run according to their wishes, but follows other laws?

The EU decision has already been anticipated by some car manufacturers, but has also been clearly criticized by others [1]. It is also interesting to note in this context that Japanese car manufacturers are more open to technology. Manufacturers such as Toyota, Nissan and Honda are much more differentiated than the major German carmakers when it comes to the phase-out of combustion engines.

On the one hand, they see a need for hybrid vehicles and cars with combustion engines in third world countries, outside the conurbations in Europe, the USA and China, well beyond 2035. On the other hand, they are working on small BEV cars at attractive prices that are accessible to broad sections of the population even without subsidies. Japanese car manufacturers are also asking many questions about 100% battery electric vehicles more clearly: Is it still politically correct 'tomorrow' to source batteries from China? Where do the raw materials for the batteries come from? And linking the financial sustainability of companies with ecological sustainability is also part of the comprehensive Japanese way of thinking.

Moving forward into a new raw materials trap?

We are currently trying, with great effort and at great risk to the economy - and thus to jobs and prosperity - to free ourselves from our self-inflicted dependence on gas and oil from Russia.

Fig. 2: New registrations in Germany 2021-2035 by drive type in percent (Graphic: Friedrichkeit; Data: BCG)

Fig. 2: New registrations in Germany 2021-2035 by drive type in percent (Graphic: Friedrichkeit; Data: BCG)

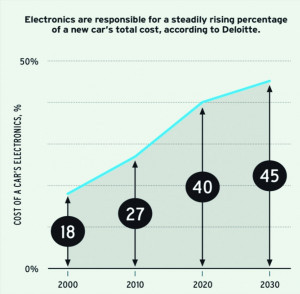

If we manage to do this without a massive economic slump, questions will soon arise regarding the availability of rare earths, lithium, cobalt, nickel and other raw materials that are needed for the ever-increasing proportion of electronics (Fig. 2). In other words: Are we entering into a new dependency?

Fig. 3: Share of electronics in passenger cars continues to rise significantly (here in percent)Lithium (carbonate) cost 6700 $/t on January 1, 2021; by June 2022, the price had risen by a whopping 935% to 70 000 $/t. Chile, Australia, Argentina and China have the largest deposits.

Fig. 3: Share of electronics in passenger cars continues to rise significantly (here in percent)Lithium (carbonate) cost 6700 $/t on January 1, 2021; by June 2022, the price had risen by a whopping 935% to 70 000 $/t. Chile, Australia, Argentina and China have the largest deposits.

The situation is similar for cobalt. In 2021, 120,000 tons of the cobalt offered on the global commodity markets [2] came from the Congo (partly mined under questionable conditions) [3], followed by 7,600 tons from Russia and 5,600 tons from Australia. The price has risen from 30,000 $/t in January 2019 to currently over 80,000 $/t.

So far, these raw material dependencies have not attracted much attention. The lithium required for 10,000 smartphones is roughly equivalent to a car battery with a range of 600 km (Fig. 1). With the ramp-up of electromobility, however, the supply of raw materials is taking on a different dimension.

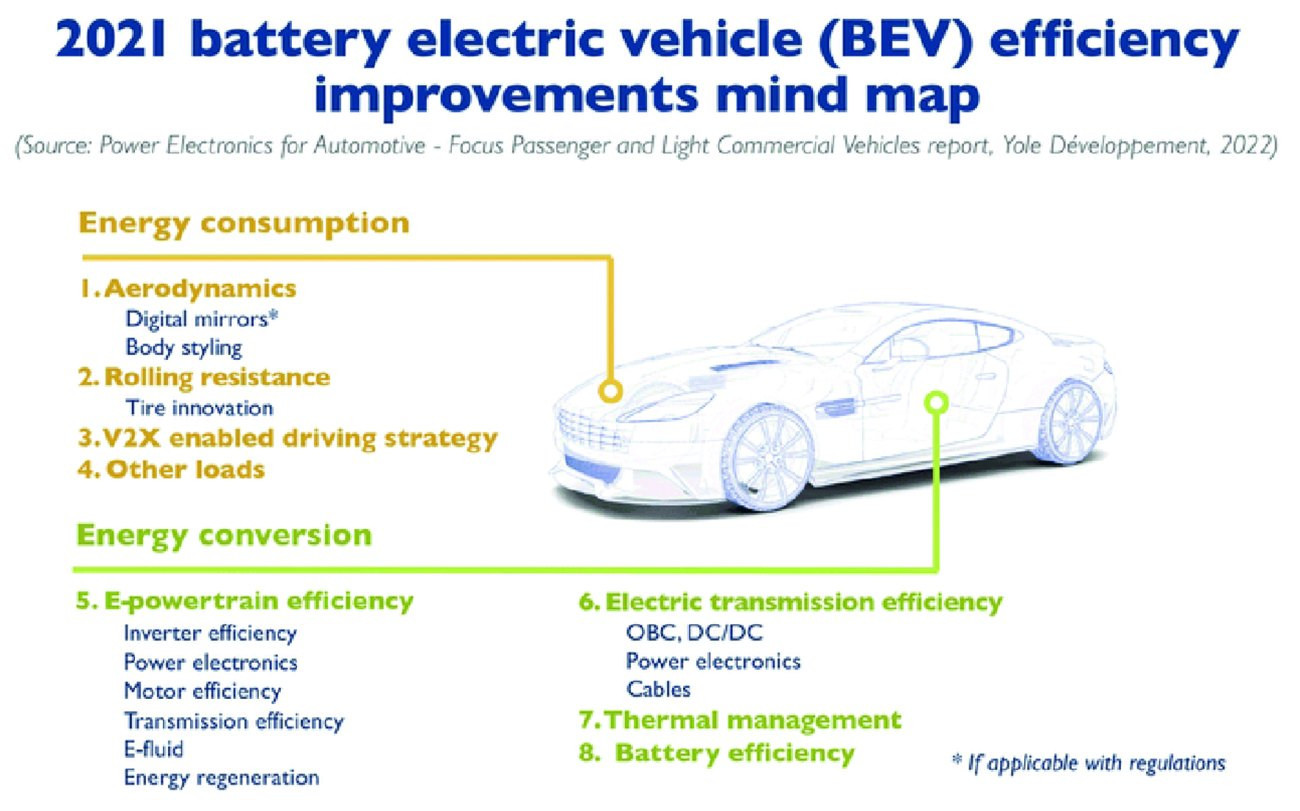

Efficiency factors for battery electric cars

In order to build a modern battery electric car with a consumption of < 10 KWh/100 km, a number of factors are required(Fig. 3). An aerodynamic body with a drag coefficient CW of approx. 0.17 is crucial. Equally helpful are digital exterior mirrors based on camera systems, which are already on board for comfort and safety functions and also make it possible to observe traffic behind. Smooth-running tires improve fuel efficiency. The efficiency of the e-drive train also has a major influence - in detail, it is about the efficiency of the inverter, the power electronics, the e-motor efficiency or the correct design of the recuperation. Added to this are energy management through OBCs and DC/DC converters and the energy density of the battery.

Fig. 4: Yole Developpement has summarized the efficiency influencing parameters on battery-electric passenger cars

Fig. 4: Yole Developpement has summarized the efficiency influencing parameters on battery-electric passenger cars

Mercedes has put the efficiency criteria shown in Figure 3 by Yole into practice in the Vision EQXX. With a range of more than 1000 km on a single charge and an energy consumption of less than 10 kWh/100 km, this vehicle(Fig. 4) is a blueprint for the future of efficiency. In addition to the state-of-the-art electric powertrain, the world's best drag coefficient of cw 0.17 and bionic lightweight construction, the Vision EQXX is also a pioneer of a radically new software-driven UI/UX approach (UI - User Interface, UX - User Experience Design). The user interface shows how real-time graphics open up new digital possibilities by responding immediately to the driver's needs and bringing the real world into the vehicle.

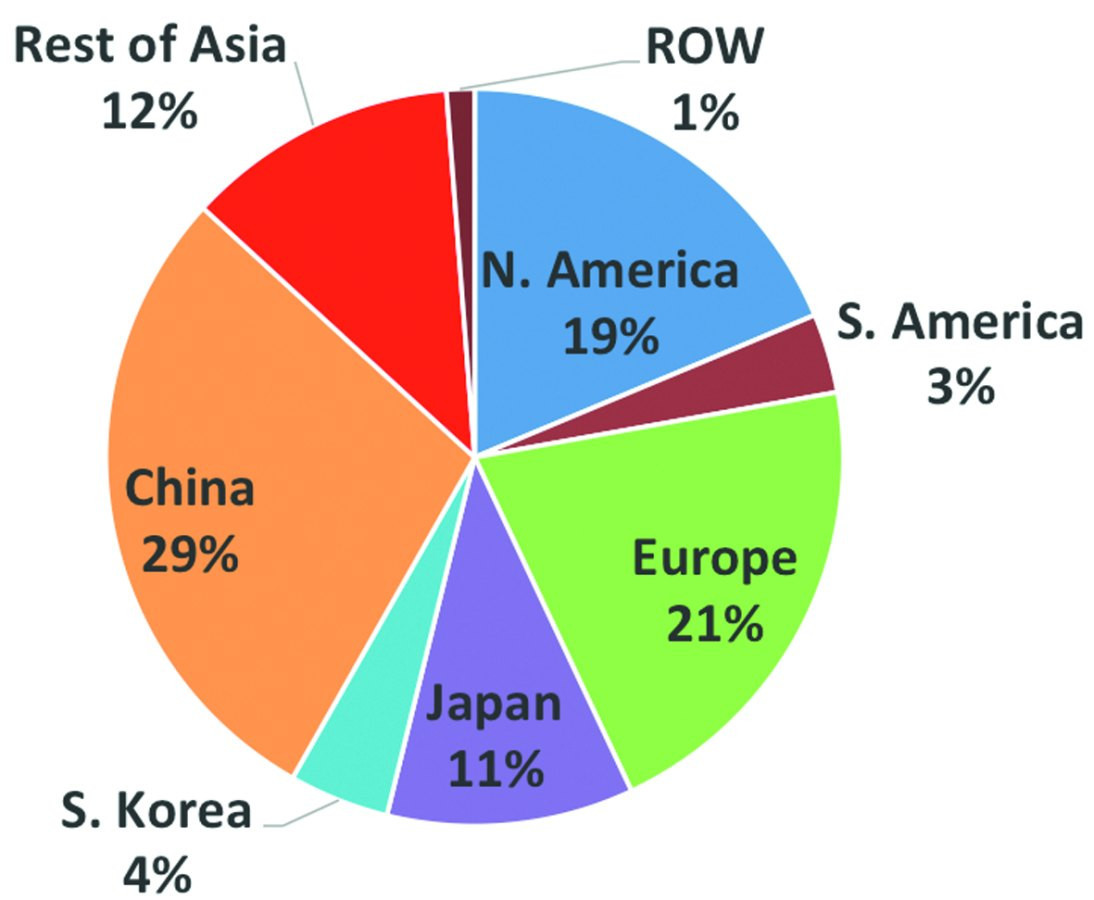

Fig. 5: Global car production 2021 (cars, trucks, buses) by country

Fig. 5: Global car production 2021 (cars, trucks, buses) by country

Global car production in 2021 (cars, trucks, buses)

Global vehicle production amounted to a total of 80.1 million units in 2021(Fig. 5). China leads the way with a global production share of 28.0%, followed by Europe with 20.4%. Japan is in third place with 10.6%, followed by South Korea with 4.3% and South America with 3.4%.

In a nutshell

- Only 23% of new car registrations in Germany are expected to be with combustion engines by the end of this decade, compared to 63% of new battery-electric car registrations. The rest will be plug-in hybrids

- In 2030, electronics will account for 45% of vehicle costs - according to a study by Deloitte

- 29% of the global vehicle market, cars, trucks and buses, is covered by China, 21% by Europe, 19% by the USA and 11% by Japan

Fig. 6: The future of efficiency - the Mercedes Vision EQXX (Source: Mercedes)Are we sawing off the branch we are sitting on by driving our technologically sophisticated petrol and diesel engines to the scrapyard of history without a fight and not even leaving the niche for e-fuels? The countries with the highestCO2 emissions worldwide, China (30%) and the USA (14%), are not in such a hurry to ban combustion engines. According to a PwC study, the share of new vehicles in Europe as a whole is 17%, in China 35% and in the USA a whopping 75%. Surprised? The continued technological openness of Japanese automotive companies such as Toyota, Nissan and Honda seems to be more balanced here than the full-bodied announcements of many of our politicians without a global connection to reality.

Fig. 6: The future of efficiency - the Mercedes Vision EQXX (Source: Mercedes)Are we sawing off the branch we are sitting on by driving our technologically sophisticated petrol and diesel engines to the scrapyard of history without a fight and not even leaving the niche for e-fuels? The countries with the highestCO2 emissions worldwide, China (30%) and the USA (14%), are not in such a hurry to ban combustion engines. According to a PwC study, the share of new vehicles in Europe as a whole is 17%, in China 35% and in the USA a whopping 75%. Surprised? The continued technological openness of Japanese automotive companies such as Toyota, Nissan and Honda seems to be more balanced here than the full-bodied announcements of many of our politicians without a global connection to reality.

I hope that we do not have to witness the decline of our only world-class industry.

I wish you a relaxing vacation and summertime

Yours

Hans-Joachim Friedrichkeit

contact

Notes/References:

[1] www.sparneuwagen.de/news/pro-verbrenner-aus-vw-undmercedes-begruessen-plan-des-eu-parlaments/

[2] see https://de.statista.com/statistik/daten/studie/38452/umfrage/produktion-von-cobalt-in-ausgewaehlten-laendern/

[3] www.wiwo.de/unternehmen/auto/kobalt-und-die-kinderarbeit-der-hype-um-kobalt-koennte-schon-bald-vorbei-sein/27585126.html