The current strategy against the part of global warming that can still be influenced by humans is the 'All Electric Society'. It aims for a global vision of the future in whichCO2-neutral electricity is the central form of energy. This also includes the mobility of the future in road traffic.

The four automotive megatrends are: alternative drive systems with battery-electric powertrains or hydrogen fuel cells. Other megatrends include connected vehicles (connected cars or car2x) and autonomous driving, particularly in SAE classes 3 to 5 and new mobility services (shared mobility) from e-scooters and e-bikes to BEVs, battery-electric cars(Fig. 1).

Drive portfolio 2030+ (road traffic)

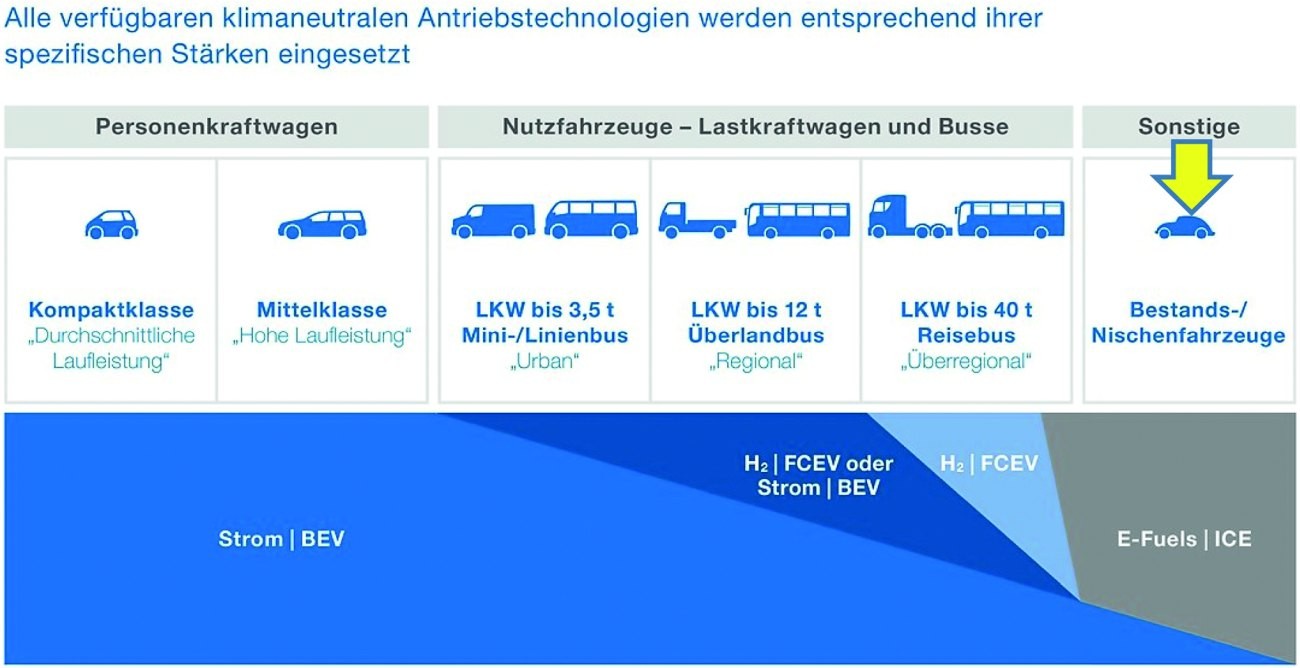

Looking at the 2030+ drive portfolio in Figure 2, all climate-neutral drive technologies are used according to their specific strengths. Passenger cars of all mileages are primarily powered by battery electric drives. In the case of commercial vehicles, trucks and buses, battery-electric drives are predominant in urban areas. With increasing ranges and total weights, the proportion of hydrogen fuel cells is increasing, particularly in trucks up to 40 tons or coaches in long-distance transport.

Fig. 2: Drive portfolio 2030+ (road transport) according to a study by the VDI 2021

Fig. 2: Drive portfolio 2030+ (road transport) according to a study by the VDI 2021

A particular problem of the energy transition are the approximately 50 million existing vehicles, on the far right in Figure 2 . The addition of synthetic fuels would make sense here as soon as they are more competitive. In contrast to biofuels, only 5 to 10 % of which are drop-in-capable, i.e. they can be blended without changing the engine, synthetic fuels could be blended in any quantity.

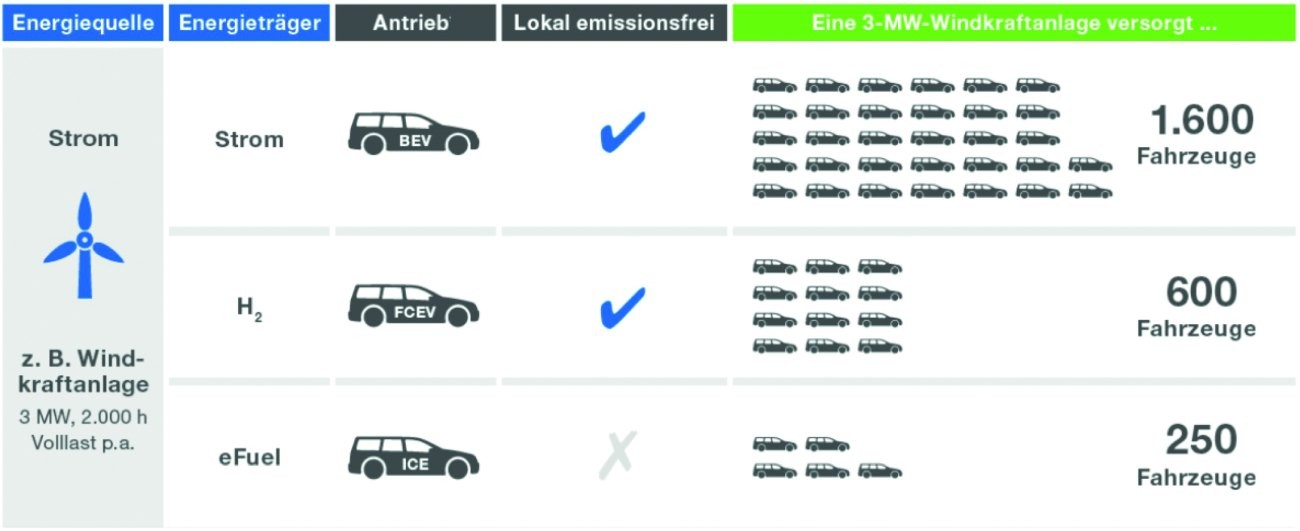

Fig. 3: Comparison of the supply capacity of an average wind turbine for different drive technologies

Fig. 3: Comparison of the supply capacity of an average wind turbine for different drive technologies

Primary energy demand by drive type

If we compare the supply capacity of an average wind turbine of 3 MWp at 2000h full load p.a. for different drive technologies, this could be used to charge 1600 battery electric cars. An annual mileage of 20,000 km was assumed. In contrast, only 600 cars can be charged with hydrogen fuel cells for one year. The conversion losses from green electricity to green hydrogen and then back to green electricity amount to around 75 %.

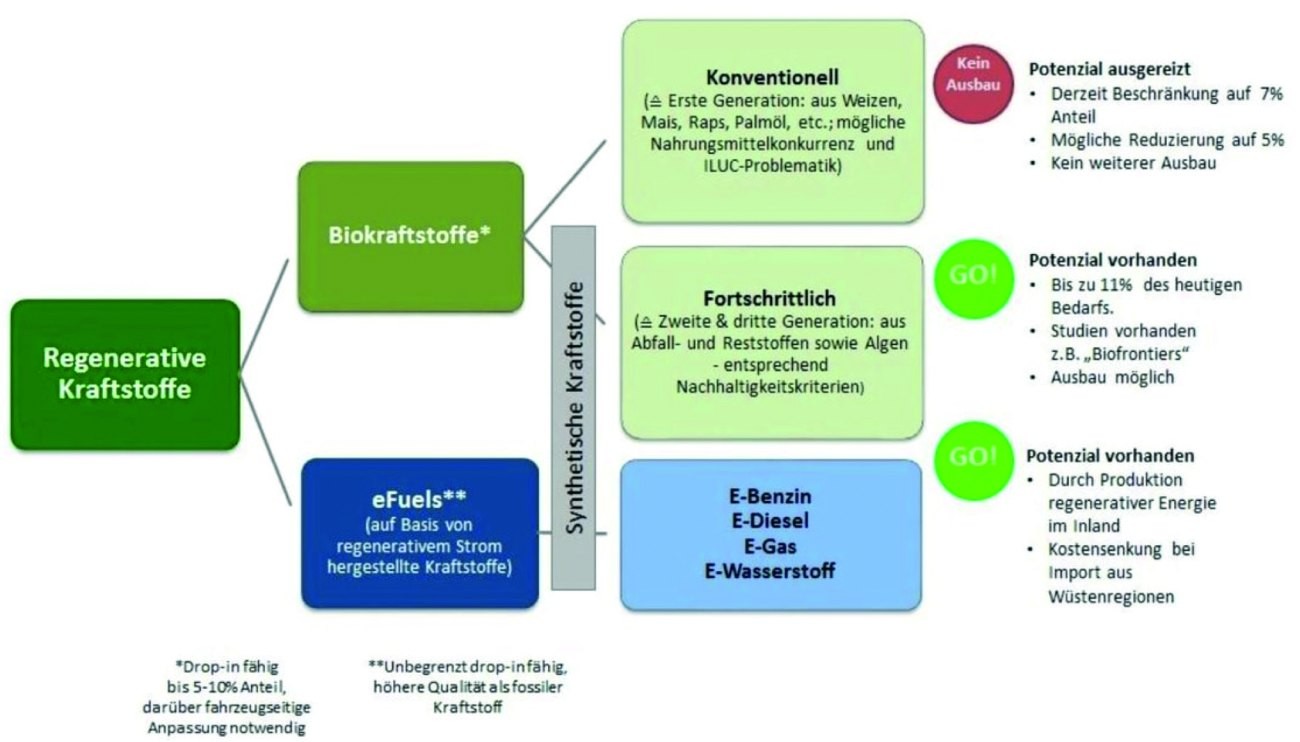

Fig. 4: E-fuels can be petrol, diesel, kerosene, gas or hydrogen

Fig. 4: E-fuels can be petrol, diesel, kerosene, gas or hydrogen

The conversion loss of 1:6 to 1:8 for synthetic fuel is even more striking. For the foreseeable future, this will probably be reserved for car drivers who are prepared to pay almost any price. Commercially, synthetic kerosene will initially gain importance in aviation.

Renewable fuels

Renewable fuels can be gasoline, diesel, kerosene, gas or hydrogen. The originally favored biofuels made from wheat, corn, rapeseed or palm oil will become less important in the future. They are in competition with foodstuffs. In addition, blending is limited to 7%, as otherwise combustion engines will have to be adapted.

The main aspect is synthetic fuels (e-fuels), which are produced using green electricity andCO2. They are thereforeCO2 neutral, as theCO2 produced during combustion has been removed from the environment during synthesis. Synthetic kerosene will probably initially be used in air traffic.

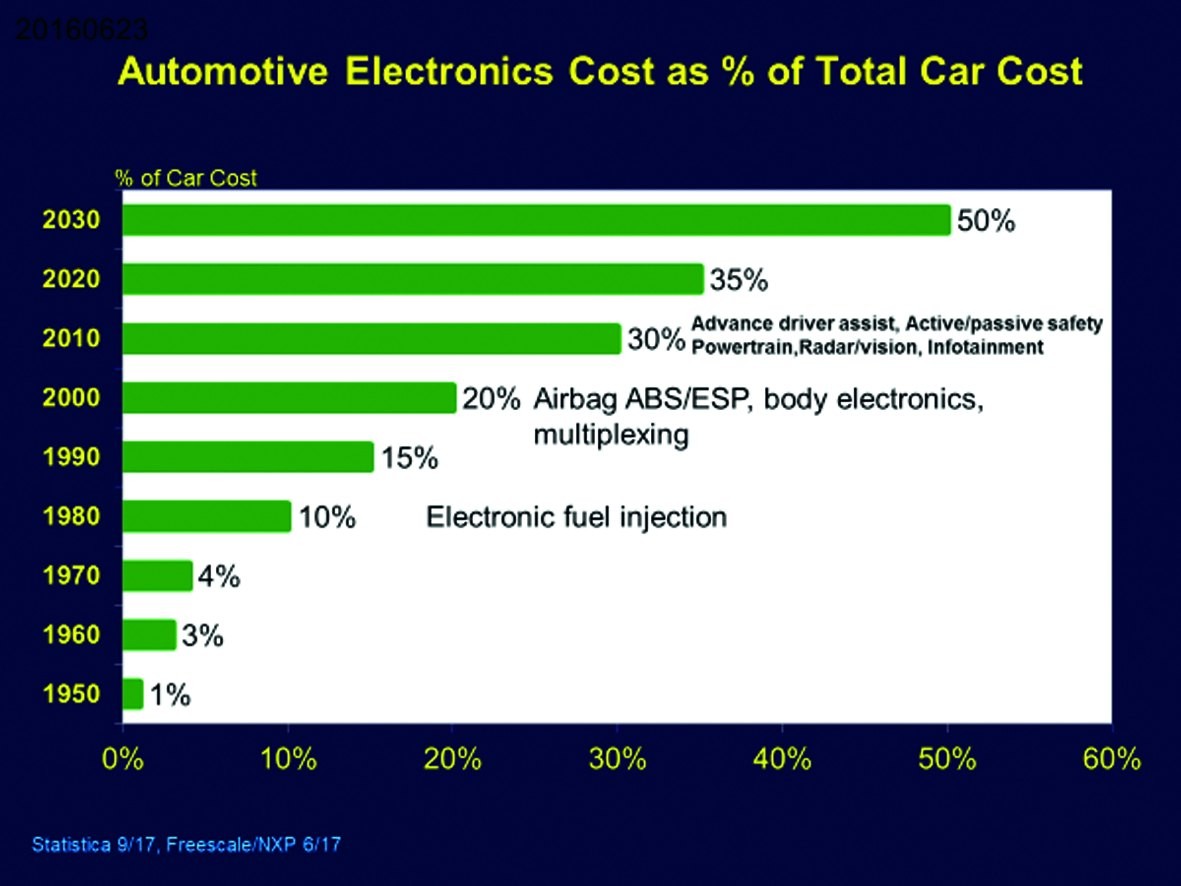

Share of electronics costs for cars

The share of electronics costs in the total cost of a car has risen sharply in recent years. With the advance of ADAS (Advanced Driver Assistance Systems) from around 2010, the proportion of electronics has risen to 35%. This also includes the battery management system (BMS) and, in some cases, the batteries in BEVs. According to the NXP forecast(Fig. 5), the share of electronics is expected to rise to around 50% by 2030.

Fig. 5: Share of electronics costs in the total costs of a car

Fig. 5: Share of electronics costs in the total costs of a car

PCB volume 2020 to 2025

Accordingly, the volume of PCBs for automotive applications will also increase significantly. Table 1 lists the top 12 PCB manufacturers worldwide, with a 'best estimate' of the revenue share in the automotive segment. The top 3 CMK, Nippon Mektron and Meiko, alone supply printed circuit boards worth around $0.5 billion each to the automotive industry. It is also interesting to note that these are three Japanese PCB manufacturers. The total global demand for PCBs in the automotive industry is currently around $8 billion and is expected to grow to $16 to 17 billion by 2025.

In a nutshell

- In future, passenger cars of all mileages will primarily be powered by batteries. In the case of commercial vehicles, trucks and buses, battery electric drives will predominate in urban areas. With increasing total weights, the proportion of hydrogen fuel cells is increasing, especially for trucks up to 40 tons or long-distance coaches.

- For the 50 million or so existing vehicles, the only option is to add the currently still prohibitively expensive synthetic fuels or to phase them out until the 'end of life' of the vehicle

- Synthetic fuels require around 6 to 8 times more green electricity to produce than a battery electric vehicle (BEV) with the same mileage

- The share of electronics costs in passenger cars is currently 35% and is expected to rise to 50% by 2030

Total global LP demand in the automotive industry amounted to around $8 billion in 2020 and is expected to double to $16-17 billion by 2025 The energy transition in the automotive sector is therefore a booster for the global PCB industry. On the one hand, Europe's share depends on the innovative capacity of European PCB manufacturers and thus on qualified employees. On the other hand, the willingness of shareholders and investors to invest plays a major role, because embedded power electronics or structure widths of 10 to 15 µm cannot be produced on old equipment.

I wish you a brilliant start to November

Best regards

Hans-Joachim Friedrichkeit

contact

F