Iron phosphate replaces nickel-manganese-cobalt as cathode material

We can still afford the politically promoted electric mobility booster with subsidies of up to €9,000 per vehicle(Fig. 1). And with 50 million existing vehicles with combustion engines in Germany versus 0.6 million battery electric vehicles (BEV) - as of the end of 2021 - this is still just a bigger drop in the ocean. However, if the planned 10 million BEVs charge together at the wallboxes in the evening by 2030, the question of where the necessary energy will come from remains unanswered.

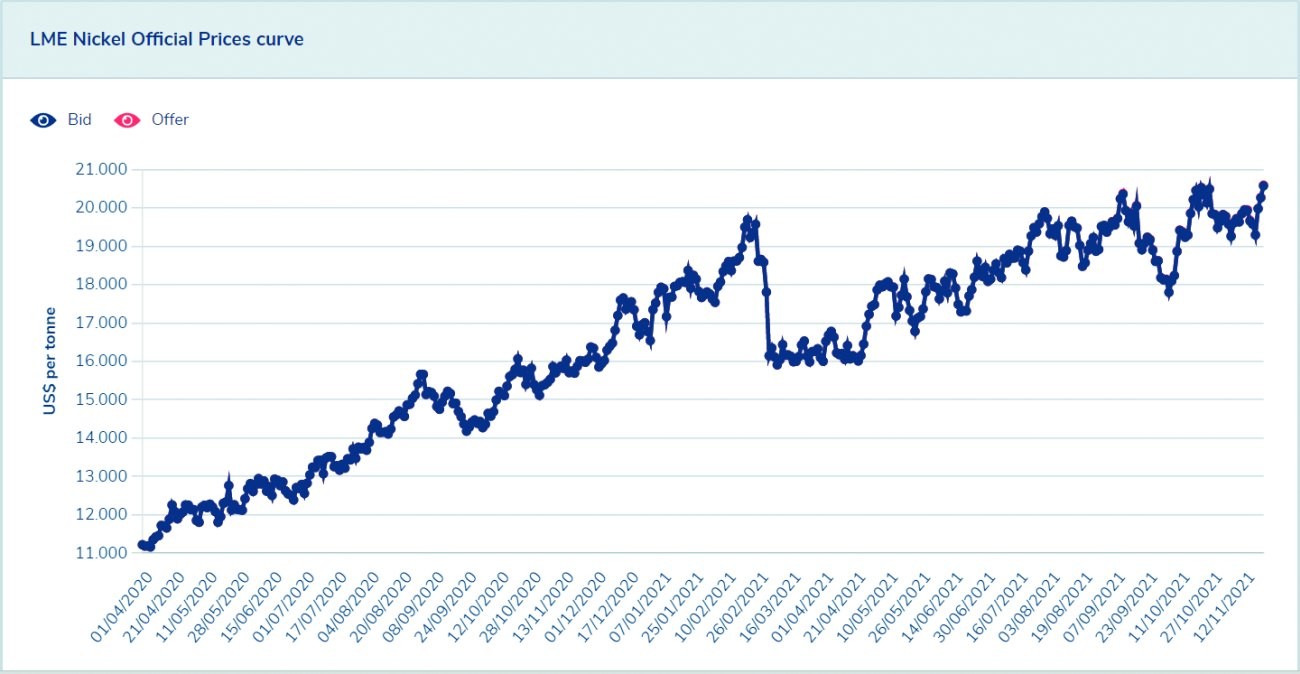

The question of the working conditions under which lithium, nickel, manganese and cobalt are mined and the environmental damage they cause has also only been of interest to a few so far. Quite apart from the fact that prices are also exploding due to the high demand for electromobility. Nickel, for example, cost around USD 11,000 per tonne on the London Metal Exchange (LME) in April 2020 and has doubled to USD 20,500 per tonne to date(Fig. 2).

Fig. 2: London Metal Exchange price trend for nickel 4-2020 to 11-2021 from US$ 11,000/tonne to US$ 20,500/tonne

Fig. 2: London Metal Exchange price trend for nickel 4-2020 to 11-2021 from US$ 11,000/tonne to US$ 20,500/tonne

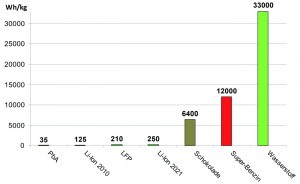

Energy density in Wh/kg

Fig. 3: Energy density in Wh/kg for battery systems and fuelsTheenergy density of batteries is the capacity in watt hours per kilogram of mass. While the good old lead batteries only have an energy density of 35 Wh/kg, Li-ion batteries already achieved a density of 125 Wh/kg in 2010. This year, Li-ion batteries with up to 250 Wh/kg are being used in electric cars. In comparison, chocolate has an energy density of 6400 Wh/kg, super petrol 12,000 Wh/kg and hydrogen (H2) 33,000 Wh/kg. This is why this figure has been nicknamed 'chocolate foil' since its first presentation at lectures(Fig. 3).

Fig. 3: Energy density in Wh/kg for battery systems and fuelsTheenergy density of batteries is the capacity in watt hours per kilogram of mass. While the good old lead batteries only have an energy density of 35 Wh/kg, Li-ion batteries already achieved a density of 125 Wh/kg in 2010. This year, Li-ion batteries with up to 250 Wh/kg are being used in electric cars. In comparison, chocolate has an energy density of 6400 Wh/kg, super petrol 12,000 Wh/kg and hydrogen (H2) 33,000 Wh/kg. This is why this figure has been nicknamed 'chocolate foil' since its first presentation at lectures(Fig. 3).

Saves raw materials, lithium iron phosphate batteries

The usual cell chemistry for batteries uses cobalt oxide, manganese, nickel or lithium iron phosphate. The lithium iron phosphate battery (LiFePO4) (LFP) belongs to the family of lithium-ion batteries. The positive electrode consists of iron phosphate as opposed to the cobalt oxide electrode that is otherwise commonly used. Lithium iron phosphate battery cells were developed around 20 years ago.

They are manufactured in the standard cylindrical 18650 and 26650 designs. The exact size of the battery can be read from the type designation: an 18650 battery has a diameter of 18 mm and is 65 mm long. Flat pouch-shaped pouch cells are also possible. Iron phosphate cells have a nominal voltage of 3.2 to 3.3 volts, which is lower than that of other lithium-ion batteries. The discharge voltage is 2 to 2.5 volts.

The advantage of lithium iron phosphate batteries lies in their high cycle stability and service life (10,000 charging cycles) as well as stable high discharge currents and 30 to 50 % lower manufacturing costs.

In ecological terms, an LFP battery contains no heavy metals such as nickel, cadmium or cobalt. The combination of materials allows almost 100 % recycling of the metals used and 90 % of the electrode materials and the polymer separator can also be recycled.

But there is also a disadvantage: lithium iron phosphate batteries have an energy density of only 210 Wh/Kg, which is around 10 to 15 % lower than lithium-ion batteries with 250 Wh/Kg [l]. This means additional weight and therefore a loss of range, as well as greater sensitivity to cold.

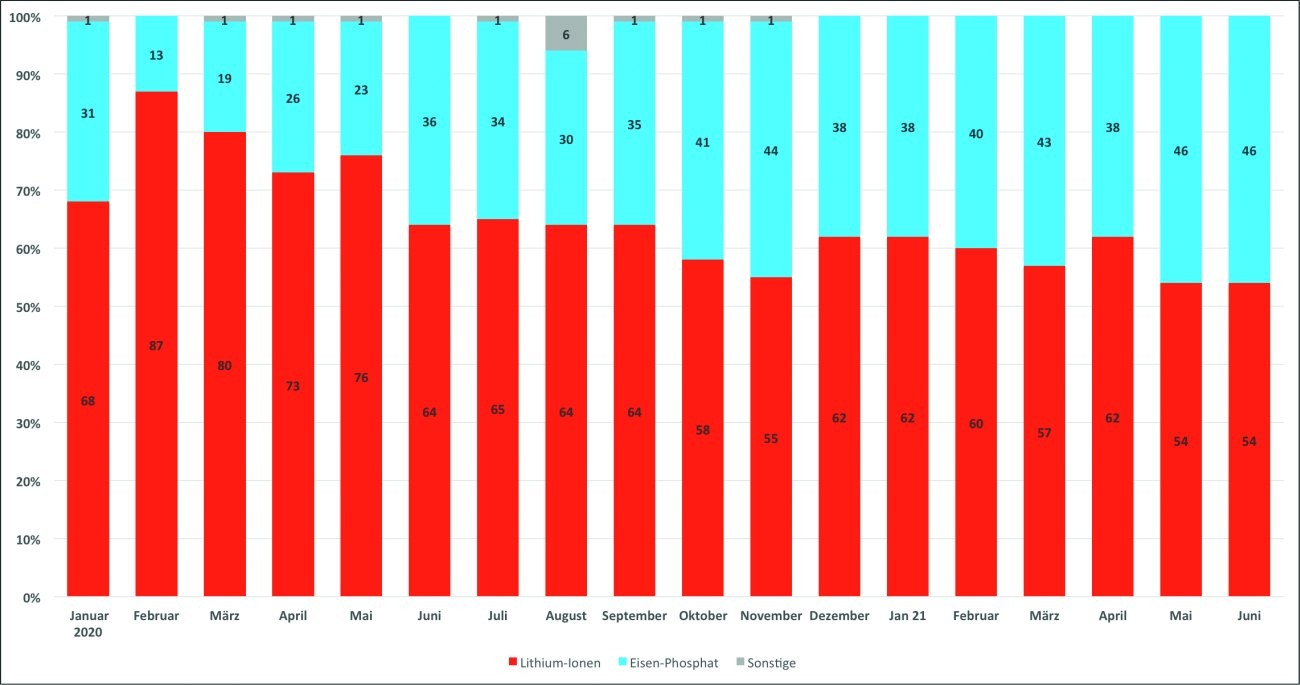

Fig. 4: Iron phosphate versus lithium-ion batteries China 2020/2021

Fig. 4: Iron phosphate versus lithium-ion batteries China 2020/2021

E-car manufacturers discover lithium iron phosphate batteries

Fig. 5: Tesla Model 3 with lithium iron phosphate batteries (LFP) Alongside various Chinese users and battery manufacturers such as BYD and CATL, Tesla has been installing the more cost-effective LFP batteries in base models such as the Model 3 since 2020(Fig. 5). This is also intended to reduce the dependency on raw materials of the nickel-manganese-cobalt batteries that were previously used.

Fig. 5: Tesla Model 3 with lithium iron phosphate batteries (LFP) Alongside various Chinese users and battery manufacturers such as BYD and CATL, Tesla has been installing the more cost-effective LFP batteries in base models such as the Model 3 since 2020(Fig. 5). This is also intended to reduce the dependency on raw materials of the nickel-manganese-cobalt batteries that were previously used.

Mercedes is planning to install LFP batteries in its EQA and EQB entry-level models from 2024. VW is also planning to use this technology in its ID small car series, as are Ford, Renault and Hyundai.

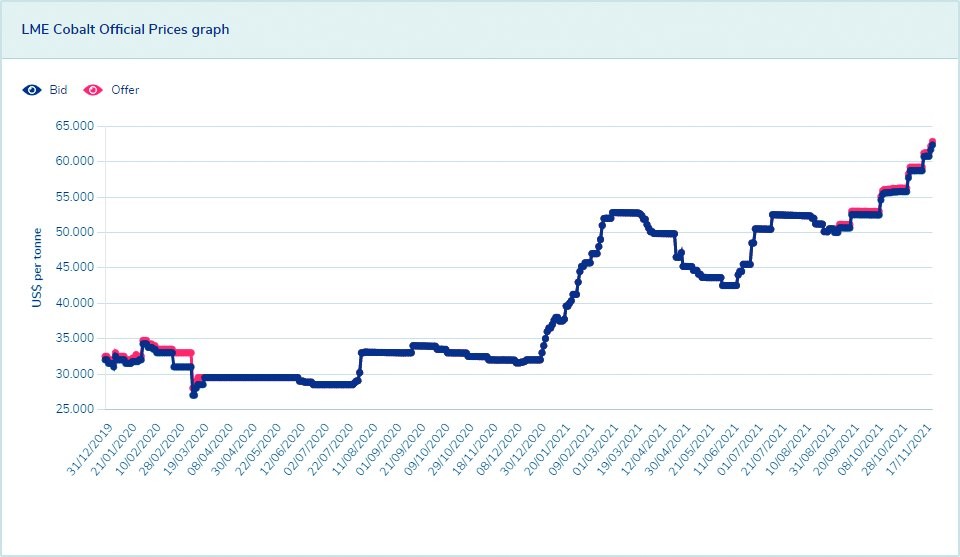

With 30 to 50 % lower manufacturing costs, this run on lithium iron phosphate batteries is no wonder. In addition to nickel, the price of cobalt has also doubled from US$ 30,000/tonne to over US$ 60,000/tonne(Fig. 6).

Fig. 6: London Metal Exchange price trend for cobalt 1-2020 to 11-2021 from US$ 30,000/tonne to > US$ 60,000/tonne

Fig. 6: London Metal Exchange price trend for cobalt 1-2020 to 11-2021 from US$ 30,000/tonne to > US$ 60,000/tonne

CATL and BYD in particular have been able to further reduce manufacturing costs through blade technology(Fig. 7). 'Blade Battery' is a marketing name for BYD's LFP batteries (lithium iron phosphate batteries), which use the cell-to-pack approach, i.e. the cells are installed directly into the battery pack without the intermediate step of modules.

Battery prices for BEVs on the decline

Fig. 7: Blade battery from the Chinese manufacturer BYD using LiFePO4 technologyLi-ionbatteries are experiencing an unprecedented drop in price. As recently as 2010, the price was USD 1100/Wh and would theoretically have meant USD 110,000 for a Tesla with a 100 KWh battery.

Fig. 7: Blade battery from the Chinese manufacturer BYD using LiFePO4 technologyLi-ionbatteries are experiencing an unprecedented drop in price. As recently as 2010, the price was USD 1100/Wh and would theoretically have meant USD 110,000 for a Tesla with a 100 KWh battery.

As early as 2019, average prices were only around US$ 160 per kilowatt hour and fell by 13% to US$ 137/KWh last year. In these years, the magic threshold of US$ 100/KWh was reached for the first time in China.

New material combinations improve charging behavior and energy density and reduce costs. These include lithium nickel manganese cobalt oxide and lithium nickel manganese cobalt aluminum oxide, which are already being produced on a large scale.

In China in particular, the lithium iron phosphate combination is being pushed onto the market as a particularly cost-effective alternative and has contributed to the lowest cell prices to date of 80 US dollars per kilowatt hour in 2020(Fig. 4).

Mass production and high plant capacity utilization are driving cost degression. The target by 2030 is 50 US$/KWh with a further increase in energy density to a forecast 400 Wh/Kg.

Solid-state batteries are also being developed, which can be produced at 40% of the cost of current lithium-ion batteries.

In a nutshell

- There are around 50 million cars in Germany. This year, there will be around 1 million BEVs and plug-in hybrids.

- Exploding raw material prices have accelerated the search for alternatives for battery chemistry. Nickel is currently trading at US$ 20,500 per tonne on the LME, up from US$ 11,000 per tonne at the start of 2020. Cobalt has also doubled from US$ 30,000 per tonne to over US$ 60,000 per tonne in the same period

- The lithium iron phosphate battery does not contain any heavy metals and is 30 to 50 % cheaper than the conventional lithium-ion battery. CATL and BYD build these batteries for Chinese base models, but also for the Tesla Model 3 or soon for the new Mercedes EQA and EQB class.

- Advantages: Cycle-proof, robust, high discharge currents, long service life and recyclable. Disadvantages: 10 to 15 % lower energy density and therefore range, sensitive to low temperatures

E-mobility is like PCs in the 1990s (or, for younger people, like the Apple iPhone from 2007): As soon as they were unpacked, they were already obsolete. One innovation followed the next with ever new applications and apps. Then, however, the increment of new features decreased from smartphone generation to smartphone generation.

In electromobility, we are still at the beginning of the innovation cycle, especially when it comes to battery technology, which is so important for range and costs.

Practical tip: buy e-cars yes, but lease them so that the return is secured after 3 to 4 years.

Another unusual year full of special pandemic challenges is drawing to a close. In the first few months of the year and now at the end of the year, Corona is once again setting the pace. Many conversations, visits and events are no longer possible for the safety of us all.

As we enter the 20th year of my PLUS column, I would like to thank you for your suggestions, feedback and good cooperation. My thanks are combined with best wishes for a peaceful Advent and Christmas season. I look forward to meeting you in person again in the new year.

Yours

Hans-Joachim Friedrichkeit