Anyone who is intensively involved with China has a feel for the state-led strategy. From 2000 to 2020, the motto was "market access for technology transfer". Key industries such as automotive production had to take a Chinese manufacturer on board with a 51% share, thereby siphoning off manufacturing expertise and technology. The huge market opportunities and profits masked the risks for Western automotive managers and governments.

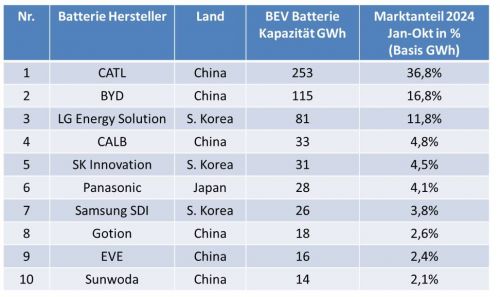

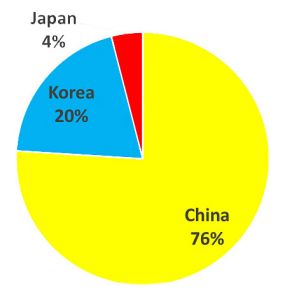

With the green doctrine of "we are saving the world" and the technology switch from combustion engines to electromobility, which was never questioned in its entirety, China has been able to become the dominant competitor since around 2020. The business strategy is: "Volume segment first and luxury later". Chinese e-car manufacturers initially focused on the volume segment. Now that they have gained a foothold, they are also launching BEVs in the luxury segment, such as BYD(Fig. 1). This means that the current withdrawal from the Smart, A-Class and B-Class from Mercedes-Benz and concentration on the 'luxury segment' is certainly not a unique selling point. Added to this is the serious Chinese plan to become the dominant world market leader in automotive manufacturing by 2049, the 100th anniversary of the People's Republic of China. This goal has already been achieved for batteries for BEVs, as Fig. 2 and Fig. 3 show. China dominates battery production for e-cars with 76%, followed by South Korea with 20% and Japan with 4%.

Lithium iron phosphate battery (LFP)

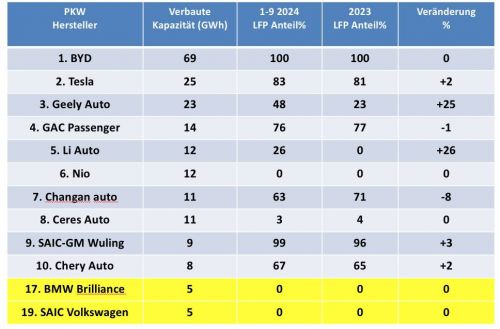

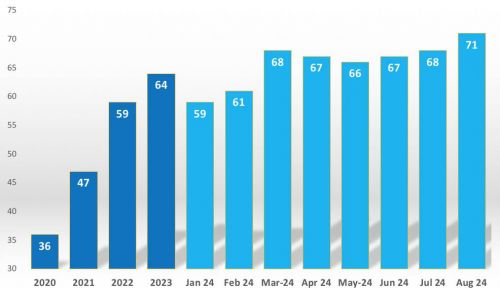

The triumph of LFP batteries began in 2021. Today, the share of LFP batteries in China is over 65% for passenger cars and almost 100% for electric commercial vehicles. In the first half of 2024, the installed capacity of LFP batteries amounted to 194 GWh, accounting for 66%. In July and August, the share of installed LFP capacity exceeded 70% due to the increase in BYD sales(Fig. 4/5). From January to August 2024, 162 GWh of batteries were installed in passenger cars in China, with LFP accounting for 62%. Geely, Li Auto, Xiaomi, Leapmotor and other automakers have increased their share of LFP batteries by more than 20%. All new 2024 mainstream models are now equipped with LFP battery types. German e-car manufacturers such as BMW rely on nickel-manganese-cobalt (NMC) batteries, which are approx. 25 - 30 % more expensive. They have an energy density of 230 - 250 Wh/kg with 3000 - 5000 charging cycles.

Advantages:

- LFP batteries offer excellent thermal stability and are less prone to ignition.

- LFPs have a long life cycle: 5000 to 10,000 charge cycles.

- They are cheaper to manufacture as readily available and inexpensive raw materials are used.

- Compared to other lithium-ion batteries, they have a lower environmental impact in terms of the materials used.

- LFPs offer 50 % more electrical capacity than lead-acid batteries.

- Energy density 130 - 160 Wh/kg

Disadvantages:

- Low temperature stability. At 0 °C their performance drops by 10-20 %, and at -20 °C it is only around 60 %.

- Lithium-manganese-iron-phosphate batteries (LMFP) are a new development. These have a better energy density at similar costs and safety standards.

- LMFP batteries have better performance at low temperatures compared to LFP batteries. Nevertheless, the capacity retention rate of LMFPs at -20 °C is around 75 %.

- Low temperatures also lead to increased internal resistance, resulting in lower power output.

- Voltcore's filament solution can both insulate and heat the battery. The heat output of the filament starts immediately after switching on, without any waiting time.

The drop in battery prices

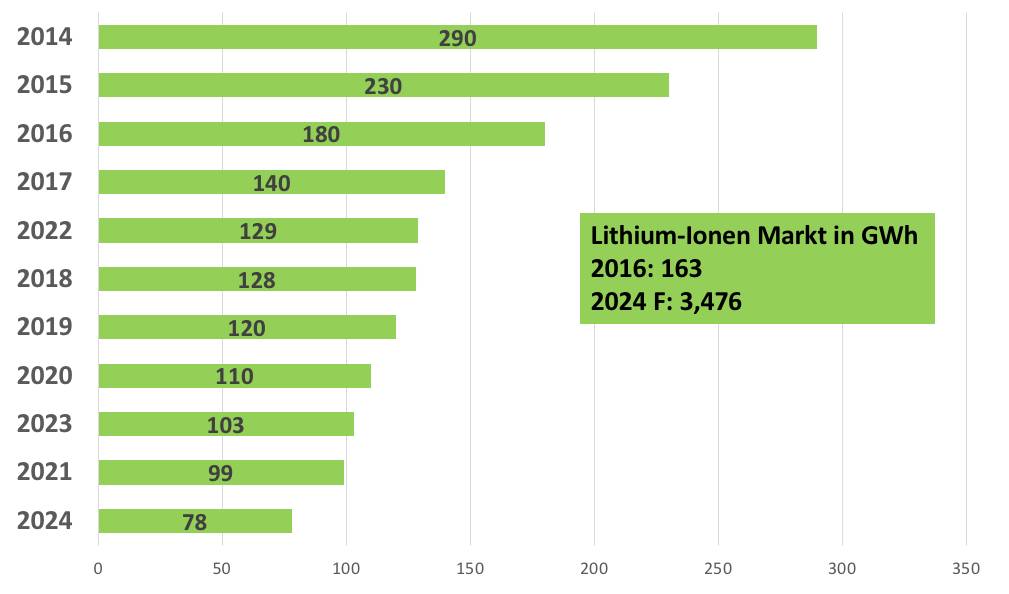

In addition to the battery cell prices in Fig. 6, the battery pack, i.e. the housing with the battery management system, costs around 25 to 30 % more. The cell price of 99 $/kWh in 2021 is made up of 61 % cathode price and 16 % anode price. In 2024, the cathode share has fallen to 54% and the anode share to 18%, with a cell price of $78. Overall, cell prices have fallen by 73% in ten years since 2014. According to an analysis by Goldman Sachs, prices for electric vehicle batteries are expected to fall by a further 50 % by 2026. The reasons for the fall in prices are multi-layered. The first is technological progress, which enables manufacturers of electric vehicle batteries to increase energy density. In combination with a fall in the prices of metals essential for batteries such as lithium, gallium, vanadium, graphite, cobalt, nickel and copper, battery prices will be lower than previously expected. The fall in battery prices could also soon create cost parity between BEVs and ICEs (internal combustion engines). Global battery prices have fallen from 153 $/kWh in 2022 to 149 $/kWh in 2023 and 111 $/kWh in 2024 (Fig. 6). By 2026, prices could reach $80/kWh, which would achieve cost parity between BEVs and ICEs on a non-subsidized basis in the US.

Fig. 6: Price decline of Li-ion battery cells in $/kWh, plus approx. 25 to 30 % for the battery pack (data: benchmark 9-2024)

Fig. 6: Price decline of Li-ion battery cells in $/kWh, plus approx. 25 to 30 % for the battery pack (data: benchmark 9-2024)

Outlook for solid-state batteries

The market launch of SSBs has been postponed until later in the decade, as the transition from laboratory scale to mass production is difficult. In the meantime, lithium-based chemical processes will continue to improve, making it more difficult for solid-state batteries to replace existing technology.

Outlook LFP vs. NMC batteries

LFP batteries will continue to increase their market share, with advanced nickel batteries continuing to dominate competition in the higher energy sector.

The attempt to build battery competition with Southeast Asia (Northvolt)

The barrier to entry in the battery industry is high. It takes about ten years between the start of research and development and the first production. And it takes even longer to achieve a good production yield. Companies that have been in the industry for ten to 15 years do not yet reach EBITDA break-even. Even if you can start production, it takes time to reach a good yield level and a good cost structure. Five companies dominate 80% of the market. Each of these battery manufacturers has more than two decades of R&D experience in the industry. In the last three to five years, they have increased their R&D spending even more aggressively, with global market leader CATL spending $2 billion a year. This creates a vicious circle, to which the Swedish battery manufacturer Northvolt initially fell victim through insolvency (Chapter 11). The convertible bond from the German Ministry of Economic Affairs of €600 million plus €20 million in interest on damages may become a total loss, as reported by the Handelsblatt.

In a nutshell

- China dominates battery production for e-cars with 76%, followed by South Korea with 20%.

- Overall, cell prices have fallen by 73% since 2014.

- In 2024, battery prices were €111/kWh and are expected to fall further to €80/kWh by 2026.

- Today, 65% of batteries in the low-cost lithium iron phosphate (LFP) technology are installed in Chinese e-cars, and this proportion continues to rise.

The idea of the German Ministry of Economic Affairs to build up a European supply for batteries with the Swedish manufacturer Northvolt, among others, has initially failed with a crash due to Northvolt's insolvency. The fact is that the barriers to market entry are very high and one to two decades of R&D and production experience are difficult to catch up with.

Manufacturers such as BYD have a vertical structure along the entire supply chain. From lithium hexafluorophosphate to cathode production, factory automation, larger blade cell format and higher production yield, costs are reduced. The result is lower battery prices for the company's own cars, beating even the market leader CATL. With battery prices continuing to fall, total cost of ownership parity over the entire lifecycle between battery electric cars and cars with combustion engines is in sight.

I wish you a good start to the new year and remain optimistic despite everything.

Best regards

Yours

Hans-Joachim Friedrichkeit