A caricature perhaps sums it up quite well: Who is leading the digital transformation in your company? A) The managing director B) The technical director C) Covid-19!

Significant changes in companies are often not driven by their own initiative - as is often portrayed afterwards - but by external pressure. Market changes, aggressive competitors, disruptive innovations, changes in the legal situation or new social megatrends are the drivers in many cases.

Networked production facilities, real-time communication between machines, individual support from robots: the digitalization of industrial companies in Germany is making progress. Almost 6 out of 10 industrial companies with more than 100 employees in Germany (59%) use special Industry 4.0 applications, compared to just 49% two years ago. At the same time, the proportion of companies for which Industry 4.0 is not an issue at all has shrunk to 1%.

'Corona' is an additional driver

The more digital industrial companies are, the faster they will recover from the consequences of the shutdown. This realization is also firmly anchored in the majority of companies: 94% see Industry 4.0 as the prerequisite for maintaining the competitiveness of German industry.

More than one in two (55%) emphasize that Industry 4.0 generally gives their own business a new boost. Overall, an overwhelming majority of 93% of industrial companies see the digital transformation as an opportunity - and only 5% as a risk.

Digitalization creates new business models

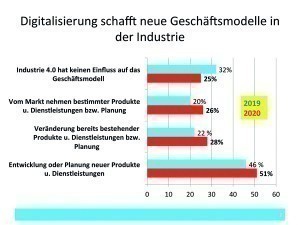

For almost three quarters (73%) of German industrial companies, Industry 4.0 will not only change individual workflows or processes, but entire Fig. 1 : Digitalization creates new business models in industry Business models - a significant increase since 2018, when the figure was 59% (Fig. 1).

Fig. 1 : Digitalization creates new business models in industry Business models - a significant increase since 2018, when the figure was 59% (Fig. 1).

Slightly more than one in two companies (51%) are developing new products and services or are planning to do so (2018: 39%). One in four are changing existing products or are planning to do so. Automotive manufacturers are evolving into providers of mobility solutions and medical technology manufacturers are becoming smart healthcare service providers. If production is now slowly being ramped up again as coronavirus restrictions are eased, companies should put their own business to the test again.

The business models of the future are exclusively digital. The majority of industrial companies that are developing new products and services as part of Industry 4.0 are relying on platforms.

88% are developing new or further digital platforms or are participating in them. They can be used to sell products or services or connect customers with suppliers. 45% have introduced pay-per-use or production-as-a-service models:  Fig.2 : Barriers to the use of Industry 4.0

Fig.2 : Barriers to the use of Industry 4.0

For example, a machine manufacturer no longer sells machines, but rather production capacities, depending on the customer's needs. The tire company Michelin developed a new, particularly durable but costly truck tire that flopped on the market. This changed abruptly when a pay-per-use solution was offered to haulage companies based on kilometers driven.

18% of the companies surveyed in which new products and services are being developed or planned as part of Industry 4.0 rely on data-based business models. However, only a small proportion of the new business models are currently having a disruptive effect: previous business models have been completely replaced at 3% of the companies concerned. For a majority of 77%, new and old business models still coexist for the time being.

Of course, there are also obstacles to the introduction of Industry 4.0, as Figure 2 illustrates.

What is a platform economy?

The platform economy refers to internet-based business models in which providers are brought together with interested parties / customers in a digital marketplace, e.g. trading platforms such as Amazon, searchers and advertisers (search engines such as Google), hungry people and restaurants (delivery service), prospective tenants with real estate providers (real estate portals), self-employed people with clients (freelancer and project sites),

Drivers and cars with people in need of transport (MyTaxi), travelers and homeowners (accommodation agencies, Airbnb ) or hotels (hotel portals Booking.com, HRS)

5G - the nervous system of Industry 4.0

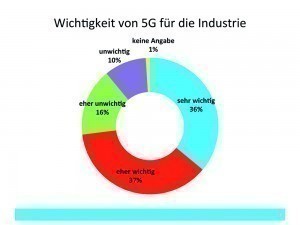

Fig.3 : Importance of 5G for industryThemajority of German industrial companies have high hopes for the new 5G mobile communications standard, which allows large amounts of data to be transmitted wirelessly and in real time. 73% of industrial companies consider the availability of 5G to be important for their own business - 36% of them as 'very important' and 37% as 'somewhat important' (Fig. 3). 5G is a key technology for German industry and the nervous system of Industry 4.0

Fig.3 : Importance of 5G for industryThemajority of German industrial companies have high hopes for the new 5G mobile communications standard, which allows large amounts of data to be transmitted wirelessly and in real time. 73% of industrial companies consider the availability of 5G to be important for their own business - 36% of them as 'very important' and 37% as 'somewhat important' (Fig. 3). 5G is a key technology for German industry and the nervous system of Industry 4.0

Artificial intelligence in one in seven companies

Artificial intelligence (AI) is also considered to be very important. One in seven companies (14%) currently uses artificial intelligence in the context of Industry 4.0, with larger companies with 500 or more employees using AI significantly more often (23%) than smaller companies with fewer than 200 employees (9%) or 200 to 499 employees (11%).

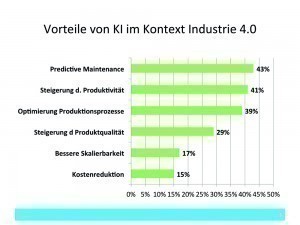

Common AI applications include predictive maintenance, in which algorithms and sensors are used to monitor the operation of machines so that the AI indicates the need for maintenance before an impending failure (Fig. 4). Robots that can independently adapt their work processes to current requirements are another example.

In addition to the aforementioned possibility of predictive maintenance (43%), the most important benefits of AI in industry include an increase in productivity (41%) and the optimization of production and manufacturing processes (39%). More than one in two industrial companies (58%) see disruptive potential in AI, meaning that they believe it is likely to bring about lasting and far-reaching changes to business models.

Germany far ahead internationally?

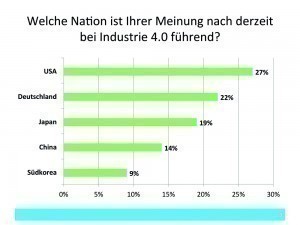

Fig. 4: The most important advantages of AI in the context of Industry 4.0Germanindustry is very self-confident when it comes to Industry 4.0: More than one in five companies (22%) currently see Germany in a leading position worldwide, just behind the USA, which 27% see in first place. 19% see Japan in the lead and one in seven (14%) China. South Korea is positioned at the top by 9% (Fig. 5). Digitalization creates more competition and this competition leads to more innovation - a stroke of luck for Germany.

Fig. 4: The most important advantages of AI in the context of Industry 4.0Germanindustry is very self-confident when it comes to Industry 4.0: More than one in five companies (22%) currently see Germany in a leading position worldwide, just behind the USA, which 27% see in first place. 19% see Japan in the lead and one in seven (14%) China. South Korea is positioned at the top by 9% (Fig. 5). Digitalization creates more competition and this competition leads to more innovation - a stroke of luck for Germany.

The figures are based on the results of a representative study on the digitalization of German industry commissioned by the digital association Bitkom, for which 552 industrial companies with 100 or more employees were surveyed from mid-February to the beginning of April 2020.

In a nutshell:

- 81% of industrial companies in Germany are using or planning to use Industry 4.0 applications in 2020, according to a new survey by industry association bitkom

- Industry 4.0 influences the business model of 73% of industrial companies; this figure was only 59% in 2018

- Platform-based business models are at the forefront with 88%, followed by pay-per-use models with 45% and data-based business models with 18%

Fig. 5: In your opinion, which nation is currently leading the way in Industry 4.0 ?

Fig. 5: In your opinion, which nation is currently leading the way in Industry 4.0 ? - 58 % of the industrial companies surveyed believe that artificial intelligence (AI) will profoundly change their business models, with a variety of benefits to be gained (Fig. 4)

Industry 4.0 is an essential prerequisite for maintaining the competitiveness of German industry. Artificial intelligence must become a key European technology if the transition from old to new business models is to succeed. This also includes digital sovereignty and data sovereignty in Europe. A secure European cloud infrastructure is an urgent prerequisite,

All the best in these extraordinary times

Yours

Hans-Joachim Friedrichkeit

contact

www.pcb-network.com