Even if politicians often promise a reduction in bureaucracy: In practice, binding laws, rules, regulations and reporting obligations have been increasing rather than decreasing for years, especially for small and medium-sized enterprises (SMEs). We provide an overview of recent regulations and upcoming changes.

1. Supply Chain Act

2. Conflict Minerals Ordinance

3. Sustainability Report

4. REACH

5. Right to Repair

6. AI Act

7. Battery Ordinance

8. Critical Raw Materials

9. Skilled Immigration Act

1 Supply Chain Due Diligence Act (LkSG)

The law with the word monster 'Lieferkettensorgfaltspflichtengesetz' (LkSG) came into force on January 1, 2023. It requires obligated companies to take measures to comply with the human rights and environmental standards defined in the law in the supply chain. Although small and medium-sized enterprises are not initially affected by the regulations, they may need to take action if they are suppliers to a company affected by the LkSG.

Which companies are covered by the LkSG?

Companies that are based in Germany and employ more than 1000 people are currently obliged to comply with the requirements of the LkSG.

What does the LkSG require of affected companies?

In order to monitor human rights and environmental standards within their supply chain, the companies concerned are required to set up a so-called "risk management system". This includes the appointment of one or more persons within the company who are responsible for risk management - this could be a human rights officer, for example.

The company must also prepare an annual risk analysis. The management must be informed about the work of risk management at least once a year. If a company - for example with a supplier - identifies risks in relation to the human rights and environmental standards described in the law or even disregards them, it is required to take measures to remedy the situation - if necessary by terminating the business relationship.

The obligations of affected companies also include prevention, such as raising employee awareness through training. A complaints procedure must also be established in the obligated company to enable violations of human rights and environmental standards to be reported. The LkSG also stipulates that affected companies must explain to the public in an annual report what activities they have undertaken with regard to compliance with the LkSG and how they are implementing the requirements of the law. If companies do not comply with the LkSG, fines can be imposed. These can amount to up to 8 million euros or up to 2% of annual global turnover.

Consequences of the LkSG for small and medium-sized enterprises

A company affected by the LkSG must also ensure compliance with due diligence obligations in the area of suppliers. Small and medium-sized enterprises can therefore expect to be asked by obligated business partners to cooperate in complying with the LkSG. Suppliers may be obliged to contractually guarantee certain measures in relation to the LkSG, such as employee training. The customer could also demand that the supplier provides information - for example about suppliers, service providers or raw materials. If a customer even discovers violations of the LkSG requirements (e.g. child labor in the supply chain), the supplier must take remedial action.

Supply chain law of the European Union

A directive on the supply chain is about to be published in the EU. Germany will be obliged to transpose this directive into national law within two years. It is expected to apply from April or May 2026. From 2027, German companies could then be obliged to comply with the stricter rules of the EU supply chain directive.

2nd Conflict Minerals Regulation EU 2017/821

Regulation (EU) 2017/821 of the European Parliament and of the Council of 17 May 2017 laying down supply chain due diligence obligations for Union importers of tin, tantalum, tungsten, their ores and gold originating from conflict-affected and high-risk areas' - this is the rather unwieldy title of the Conflict Minerals Regulation.

The regulation came into force on January 1, 2021. Conflict minerals are used in the manufacture of many high-tech devices as well as in the automotive, electronics, aviation, packaging, construction and lighting industries, but also in the manufacture of industrial machinery, tools and jewelry.

Purpose

This Regulation aims to ensure that EU importers of tin, tungsten, tantalum and gold (3TG) comply with the international sourcing standards of the Organization for Economic Cooperation and Development (OECD) and that global and European smelters and refiners source 3TG in a responsible manner. In politically unstable regions, trade in minerals such as 3TG can be used to finance armed groups, lead to forced labor and other human rights violations, and support corruption and money laundering. This is the EU's response to the US Dodd-Frank Act (DFA), which came into force on August 22, 2012. Under Section 1502, companies listed on the US stock exchange must disclose whether their products contain 3TG originating from the conflict region of the Democratic Republic of the Congo (DRC) or its neighboring states and prove that they have been mined in a 'conflict-free' manner.

Affected companies

Companies that import 3TG into the EU (upstream industry) and exceed a certain quantity limit are directly affected. There are no binding regulations for further processing (downstream industry), i.e. producers and importers of end products. Secondary raw materials also do not fall under the scope of the regulation. However, companies must provide evidence that the raw materials were obtained exclusively from waste (e.g. scrap) or recycled material. As a rule, proof is provided by means of photographs.

Measures required

In future, importers who fall under the regulation must introduce a supply chain policy in line with the OECD approach and communicate this to their suppliers and the public. If minerals (not metals) are imported, risk management is also required. To this end, they must introduce and maintain a traceability system in which descriptions of the minerals or metals, quantities and information on origin (country of origin, supplier, smelter or refinery if applicable) are documented. In addition, they must publish a report online on their activities to implement their due diligence obligations. The fulfillment of the due diligence obligations is verified by third parties (3rd party audit). If all refineries and smelters are on the EU list in accordance with Art. 9 of the Regulation, this is considered substantial evidence.

Verification

In Germany, the Federal Institute for Geosciences (BGR) is the competent implementing authority for the inspections. Importers are inspected on the basis of data provided by customs. The law implementing the Conflict Minerals Ordinance has given the BGR powers of intervention for this purpose.

Conflict and high-risk areas

The Ordinance defines conflict and high-risk regions as areas worldwide in which armed conflicts are being waged or which are in a fragile situation following conflicts. These areas also include regions where governance and security are weak or non-existent and where there are widespread and systematic violations of international law, including human rights abuses.

Due diligence systems

Existing voluntary corporate initiatives or other systems should be recognized if they take into account the OECD Due Diligence Guidance. This means that companies that are already involved in initiatives such as EICC or ITRI are considered responsible importers and do not have to undergo a further audit.

This is intended to prevent double burdens and the resulting competitive disadvantages for the companies concerned.

Assistance for SMEs

The EU Commission has opened an online portal ('Due Diligence Ready!') to support affected companies (especially SMEs) in fulfilling their due diligence obligations. The portal helps to obtain information on the origin of metals and minerals and to facilitate their responsible sourcing. It includes an FAQ, a toolbox with practical resources for fulfilling due diligence obligations and a glossary of terms.

Further information

Conflict Minerals Ordinance:

https://eur-lex.europa.eu/eli/reg/2017/821/oj

Due Diligence Ready!

https://single-market-economy.ec.europa.eu/sectors/raw-materials/due-diligence-ready_dehttps://single-market-economy.ec.europa.eu/sectors/raw-materials/due-diligence-ready_de (accessed: 28.3.2024).

3rd EU regulation on sustainability reporting

The European Corporate Sustainability Reporting Directive (CSRD) is based on the increasing importance of environmental and social standards in corporate governance. It is intended to help raise awareness of sustainability and ESGF factors (ecology, workplace, community) in corporate management and support investors in making informed decisions. Mandatory reporting on these topics is intended to encourage companies to reduce their environmental and social impact and act responsibly.

The story

Solar installation at Eltroplan (Photo: gk)The attempt to "install" an EU directive on sustainability reporting has a relatively long history. In 2000, the European Union published the first directive on non-financial reporting by companies, the so-called European Union Non-Financial Reporting Directive (NFRD). Its aim was to oblige companies to publish information on environmental, social and employee matters as well as respect for human rights and the fight against bribery and corruption in addition to their financial figures.

Solar installation at Eltroplan (Photo: gk)The attempt to "install" an EU directive on sustainability reporting has a relatively long history. In 2000, the European Union published the first directive on non-financial reporting by companies, the so-called European Union Non-Financial Reporting Directive (NFRD). Its aim was to oblige companies to publish information on environmental, social and employee matters as well as respect for human rights and the fight against bribery and corruption in addition to their financial figures.

In the years that followed, companies and investors became increasingly interested in non-financial reporting as awareness of social and environmental issues grew. The European Commission recognized the importance of this issue and decided to revise and strengthen the NFRD.

In April 2021, it finally presented the new Corporate Sustainability Reporting Directive (CSRD, number 2021/254/EU). This extends the scope of the NFRD and obliges more companies to provide non-financial reporting. It also tightens the reporting requirements in order to improve the comparability and quality of information. The CSRD came into force on January 5, 2023. The European member states were required to transpose the directive into national law by July 6, 2024. The requirements of this directive are specified by the European Sustainability Reporting Standards (ESRS). The first set of ESRS became legally binding with the European Commission's delegated act of July 31, 2023.

Fields of action

Due to the great heterogeneity of companies, which differ greatly in terms of size, industry, history, etc., there cannot be a single CSR management system. However, four fields of action can be identified that form the orientation framework for value-based corporate management or CSR management: Economy, workplace, community and ecology. How a company assumes responsibility depends on the corporate culture, the industry, the markets and the local conditions. The following four fields of action show a possible structure for a CSR management system to be set up in a particular company:

- Economy: This field of action aims to ensure that the company's own products, services and relationships with suppliers are designed responsibly. Other aspects include fair procurement, anti-corruption and a focus on customer needs. For example, comprehensive consumer information or honesty in advertising are also topics in this field of action.

- Workplace: Many entrepreneurs know from experience that responsible treatment of employees is a key prerequisite for the economic success of their own company. This includes issues such as fair pay, work-life balance and company health management.

- Community: Many companies have strong ties to their location. They see themselves as part of society and promote the social environment in the region. The latter is not least to make their own location more attractive for potential employees. This commitment ranges from investments in social projects and corporate volunteering measures to the promotion of regional infrastructure.

- Ecology: Corporate environmental protection is becoming increasingly important. The field of action covers a wide range of topics: from dealing with hazardous substances and approaches to reducingCO2 emissions to resource efficiency measures and biodiversity.

Deadlines and dates

The CSRD EU Directive has introduced new reporting obligations for around 15,000 companies in Germany. The extended reporting obligation is intended to ensure that large companies and capital market-oriented SMEs are the first to report on what they are doing in terms of sustainability [2].

- From 2024, the largest 500 listed companies will be obliged to publish sustainability reports

- For other large corporations, the obligation will apply from 2025, for capital market-oriented SMEs from 2026 or 2028

- It is likely that smaller companies will also be affected by the reporting obligation sooner or later if they are integrated into the value chains of companies subject to reporting requirements

Large companies will increasingly start to receive reports on their sustainability activities from their business partners. This is because they themselves will have to prove that they are working with partners who operate sustainably. For small companies, it is important to find simple and pragmatic solutions and yet proceed systematically. This is because dealing with sustainability or CSRD is not a one-off affair; the concept must be regularly reviewed and adapted. As many points have not yet been conclusively clarified and additions are constantly being made, it is important to keep up to date with the status and any additions. On the Internet, smaller companies are offered various methodological support on the content and preparation of sustainability reports, for example in [1, 2]. The "SME Reporting" pilot group has published an overview of the current information requirements for SME reporting. The link to this PDF document can be found at [2].

References

[1] www.csr.bayern.de/vertieft/handlungsfelder/index.php (accessed 27.3.2024).

[2] www.lexware.de (accessed 27.3.2024).

4 REACH: European Chemicals Regulation

The industry is eagerly awaiting the ECHA's decision on the restriction of chromium trioxide (Photo: stock.adobe.com)The European Chemicals Regulation on the Registration, Evaluation, Authorization and Restriction of Chemicals has been in force since 2007. The regulation is intended to provide a high level of protection for human health and the environment. At the same time, it is intended to ensure the free movement of chemicals on the European internal market and promote competitiveness and innovation. In principle, manufacturers, importers and downstream users assume responsibility for their chemicals. REACH is derived from the English title of the regulation: Regulation concerning the Registration, Evaluation, Authorization and Restriction of Chemicals.

The industry is eagerly awaiting the ECHA's decision on the restriction of chromium trioxide (Photo: stock.adobe.com)The European Chemicals Regulation on the Registration, Evaluation, Authorization and Restriction of Chemicals has been in force since 2007. The regulation is intended to provide a high level of protection for human health and the environment. At the same time, it is intended to ensure the free movement of chemicals on the European internal market and promote competitiveness and innovation. In principle, manufacturers, importers and downstream users assume responsibility for their chemicals. REACH is derived from the English title of the regulation: Regulation concerning the Registration, Evaluation, Authorization and Restriction of Chemicals.

The following applies: chemicals may not be placed on the market without registration. The responsible European authority, the European Chemicals Agency (ECHA), is currently working on the following authorization processes:

- According to the ECHA, an elaborated proposal for a restriction of chromium trioxide is expected in October. It will be possible to comment on it in a "public consultation"

- Scientific evaluation of the restriction dossier for per- and polyfluoroalkyl substances (PFAS)

- With the end of the public consultation on the restriction dossier for PFAS on 25.09.2023, the evaluation by ECHA's scientific committees for risk assessment and socio-economic analysis started. In June 2024, the authority dealt with PFAS products for metal coating and the manufacture of metal products, among other things

- The dossier stipulates that PFAS may only be used in areas where there will be no suitable alternatives in the foreseeable future or where the socio-economic advantages outweigh the disadvantages for humans and the environment

- In September 2024, the petroleum refining and mining industries, among others, are on the agenda

- Once this process has been completed, the revised dossier will be forwarded to the European Commission. The Commission will then decide together with the EU member states on a possible restriction

- REACH restriction dossier on bisphenols withdrawn. The German authorities involved already decided last year that a significant redesign of the logic underlying the restriction proposal was necessary and therefore temporarily withdrew the dossier in order to make the necessary revisions. A resubmission will be announced again via ECHA's Registry of Intentions as soon as the resubmission timeline is finalized

- Longer transition periods for restricted use of C9-C14 PFCAs

- The use of perfluorinated carboxylic acids with 9-14 carbon atoms (C9-C14 PFCA) has already been restricted in the EU since 2023. The substances hardly degrade in the environment and accumulate in organisms. Longer transition periods apply, for example, to

- photolithographic processes or etching processes in semiconductor production (July 4, 2025)

- photographic coatings for films

- invasive and implantable medical devices (the last two: July 4, 2025)

Further information can be found at

www.umweltbundesamt.de/themen/chemikalien/reach-chemikalienreach (retrieval: 28.3.2024).

5 Right to repair and new Ecodesign Regulation

In February 2024, the European Parliament and the Council agreed on the new rules for the right to repair proposed by the EU Commission. The directive officially entered into force on 18.7.2024. It makes repairs simpler, more accessible and affordable. The EU Commission is convinced that sustainable business models and investments in repairs will pay off for companies.

What does the directive provide for?

Once the statutory minimum warranty period of two years has expired, consumers can request a simpler and more cost-effective repair of defects in all devices that must be technically repairable (e.g. tablets, smartphones, washing machines, dishwashers, televisions). There is therefore a right to repair. Manufacturers will therefore be obliged to provide public information about their repair services and, in particular, how much the most common repairs will approximately cost.

The EU Member States will also be obliged to promote repairs with further measures, e.g. repair vouchers or repair funds. Such measures can be supported with EU funds. A new European repair platform with simple search tools will make it possible to find suitable repair shops in future. Repair shops, often small and medium-sized enterprises, can then offer their services via the platform. In parallel to the agreement on the right to repair, the EU member states have reached a political agreement on the new Ecodesign Regulation, which sets requirements for manufacturers regarding reparability in product design. The new ecodesign requirements will go beyond energy efficiency, promote the circular economy and cover the following, among other things:

- Durability, reusability, upgradability and reparability of products

- Presence of chemical substances that prevent the reuse and recycling of materials

- Energy and resource efficiency

- Recyclate content

- CO2 and environmental footprint

- available product information, in particular a digital product passport.

The new regulation applies to a list of products, which will be successively expanded. Priority will be given to high-impact products such as electronic products, especially from the information and communication technology sector, but also iron and steel, aluminum, paints, lubricants and chemicals.

Further information can be found at

https://germany.representation.ec.europa.eu/

(accessed: 28.3.2024).

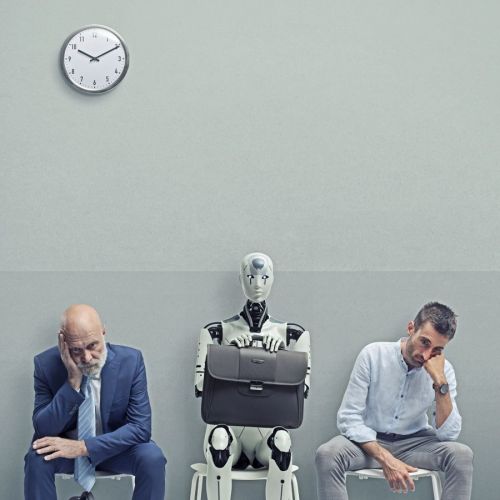

6th EU AI Act: The world's first law for artificial intelligence

Artificial intelligence is currently penetrating all areas of society, especially in automation solutions that can be optimized using AI processes. Read the interview with Howard Boville on page 1104 of Galvanotechnik 8/2024 on this topic (Photo: stock.adobe.com)The EU AI Act is the world's first comprehensive legal framework for AI and regulates the development and use of AI systems in the EU. The law is intended to ensure the safety and fundamental rights of people and companies with regard to AI, but also to promote investment and innovation in the AI sector by providing a clear legal situation. However, this expectation is controversial: critics speak of over-regulation that could even slow down the European economy's process of catching up with competitors in the USA and China.

Artificial intelligence is currently penetrating all areas of society, especially in automation solutions that can be optimized using AI processes. Read the interview with Howard Boville on page 1104 of Galvanotechnik 8/2024 on this topic (Photo: stock.adobe.com)The EU AI Act is the world's first comprehensive legal framework for AI and regulates the development and use of AI systems in the EU. The law is intended to ensure the safety and fundamental rights of people and companies with regard to AI, but also to promote investment and innovation in the AI sector by providing a clear legal situation. However, this expectation is controversial: critics speak of over-regulation that could even slow down the European economy's process of catching up with competitors in the USA and China.

The AI Act is likely to become even more important for companies in the electronics industry. This is because AI is increasingly being used embedded in electronic systems and in the production of electronic components and devices. Examples include quality control, Industry 4.0 scenarios and enhancing the usability of electronic products.

The new AI Act distinguishes between four categories of AI systems:

- Prohibited AI systems: These systems are incompatible with fundamental rights and freedoms and are therefore prohibited. This includes systems that manipulate people or lead to social discrimination, such as 'social scoring' as in China or emotion recognition in the workplace

- High-risk AI systems: These systems pose a high risk to people's safety or fundamental rights. They are subject to strict requirements before they can be placed on the market. These are, for example, systems for facial recognition or credit scoring. Some large basic models also fall into the high-risk category. This could apply, for example, to models from OpenAI (ChatGPT, Dall-E etc.) or Google (Gemini)

- AI systems subject to regulation: These systems pose a lower risk, but are subject to certain requirements. These include systems that are used to personalize advertising or control machines

- AI systems with minimal risk: These systems pose no risk to safety or fundamental rights and are therefore not subject to any special requirements.

The AI Regulation has far-reaching consequences for companies that develop, use or distribute AI systems. The following points are particularly relevant for small and medium-sized enterprises (SMEs): SMEs must meet the requirements of the AI Regulation, regardless of their size or risk profile. This means, for example, that they must ensure the conformity of their AI systems with the essential requirements of the regulation. SMEs have access to various resources to help them meet the requirements of the AI Regulation. These include, for example, guidelines, checklists and training. The EU's 'AI Office' monitors compliance with the AI law.

The AI Regulation also offers opportunities. It can help SMEs gain access to new markets and customers. The EU is setting up an AI observatory to support SMEs with implementation.

Dates and deadlines

The AI Act will enter into force 20 days after publication in the Official Journal of the EU (expected in summer 2024), with many regulations only taking effect after two years. The bans and requirements for prohibited AI systems will come into force after just six months. The requirements for high-risk systems will only apply after three years.

Further information

EU AI Regulation: https://artificialintelligenceact.eu/de/ai-act-explorer/

AI Observatory: https://www.ki-observatorium.de/

7th Battery Regulation (EU-BattV)

A new EU Battery Regulation has been in force since February 18, 2024 and will take effect in several stages. It aims to improve sustainability, safety and transparency. It brings new requirements for manufacturers and retailers:

A new EU Battery Regulation has been in force since February 18, 2024 and will take effect in several stages. It aims to improve sustainability, safety and transparency. It brings new requirements for manufacturers and retailers:

- Higher recycling quotas: From 2027, 45% of the lithium used in portable batteries and 70% of the cobalt used in industrial batteries must be recycled.

- Ban on harmful substances: The use of mercury, cadmium and lead in batteries is banned with immediate effect

- Ecodesign requirements: Manufacturers must meet certain requirements for the environmental compatibility of their batteries

- Stricter testing standards: Batteries must meet stricter safety standards to be allowed on the EU market

- Improved labeling: Batteries must be labeled with a QR code containing information about the battery and its disposal

- Battery passport: Manufacturers must create a digital battery passport that contains information about the entire life cycle of the battery

- Sustainability reporting: Large companies must report on their sustainability efforts in the battery sector

- Increased requirements for SMEs, which may entail costs. The documentation requirements for batteries are becoming more extensive

- Increased competition: SMEs must compete with larger companies that have more resources at their disposal.

Deadlines and dates

On August 18, 2024, a partial package with new labeling and control obligations for battery producers, importers and distributors came into force.

Further information

The Battery Regulation in the new version of 2024: www.batteriegesetz.de/gesetzestexte/battv-eu (accessed: 28.3.2024).

Explanations on the August 2024 package of obligations: it-recht-kanzlei.de/eu-batterieverordnung-pflichten-erzeuger-haendler-einfuehreraugust-2024.html (accessed: 28.3.2024).

8 Critical Raw Materials Act: less dependence, more resilience

Panopticon of critical raw materials (Photo: vti)The Critical Raw Materials Act (CRMA) aims to reduce the European economy's dependence on critical raw materials and strengthen the resilience of supply chains. The CRMA defines 30 raw materials as critical, which are required for the production of key technologies such as batteries, wind turbines and electronics. These include lithium, cobalt, antimony, beryllium, gallium, germanium, hafnium, indium and rare earths.

Panopticon of critical raw materials (Photo: vti)The Critical Raw Materials Act (CRMA) aims to reduce the European economy's dependence on critical raw materials and strengthen the resilience of supply chains. The CRMA defines 30 raw materials as critical, which are required for the production of key technologies such as batteries, wind turbines and electronics. These include lithium, cobalt, antimony, beryllium, gallium, germanium, hafnium, indium and rare earths.

Companies and SMEs that use critical raw materials need to diversify their supply chains and find alternative suppliers. This may mean focusing on suppliers in other countries or regions or increasing their focus on recycling and substitution. This can involve considerable costs and challenges. Companies with more than 500 employees and an annual turnover of more than €150 million that use strategic raw materials in some particularly sensitive sectors, such as defense, energy transition, information technology, aerospace, must carry out a risk analysis of dependencies on strategic raw materials in their supply chain at least every three years, including a mapping of where these strategic raw materials are extracted, processed and recycled.

The Commission wants to support SMEs by providing them with access to information and advice as well as financial support. It also wants to work with other countries and international organizations to secure the supply chains for critical raw materials. This includes promoting sustainable and responsible mining practices.

Dates and deadlines

On March 18, the Council of the European Union endorsed the Critical Raw Materials Act (CRMA), which came into force in summer 2024. Germany has until 2026 to transpose the legislation into national law.

Further information

Press release from the Council of the European Union: www.consilium.europa.eu/en/press/press-releases/2024/03/18/strategic-autonomycouncil-gives-its-final-approval-on-the-critical-raw-materials-act/

You can find the text of the law at www.europarl.europa.eu/doceo/document/A-9-2023-0260-AM-026-026_EN.pdf

9th amended Skilled Immigration Act

With the amendment to the Skilled Immigration Act (FachKrEG), the German government is facilitating the immigration of non-academic skilled workers from non-EU countries. The core provisions: The minimum salary threshold for immigration with the "EU Blue Card" has been reduced from 56,400 to 43,992 per year. The recognition of professional qualifications from non-EU countries has been simplified. Anyone with at least two years of professional experience and a professional qualification recognized by the state in their country of origin can immigrate as a worker. In future, the professional qualification no longer has to be recognized in Germany.

Skilled workers with professional experience

and language skills can enter the country according to a points system, even if they do not have a recognized professional qualification. Skilled workers with potential can enter Germany with an "opportunity card" and look for a job for six months. Special regulations apply to IT specialists, which make immigration easier.

Consequences for SMEs

Easier immigration regulations give SMEs access to a larger pool of skilled workers. The lowered salary threshold makes it easier to attract foreign skilled workers that they would otherwise not be able to afford. The recognition of professional qualifications has been simplified, which reduces the bureaucratic burden.

Dates and deadlines

The first stage of the new regulations for the immigration of skilled workers came into force in November 2023. These include the Blue Card, the new regulations for residence permits for skilled workers with vocational training and skilled workers with an academic education, the simplified approval process of the employment agency for professional drivers from non-EU countries and the removal of the time limit for the Western Balkans regulation. Since March 1, 2024: The regulation for experienced professionals has been extended to all professions (previously: only IT professions) With a new regulation on the short-term employment of third-country nationals, companies can react more easily to fluctuating personnel requirements.

Further information

Overview of the Federal Government:

www.bundesregierung.de/breg-de/themen/arbeitund-soziales/ fachkraefteeinwanderungsgesetz-2182168 (accessed: 28.3.2024).

The new Skilled Immigration Act at a glance:

www.make-itin-germany.com/de/visum-aufenthalt/fachkraefteeinwanderungsgesetz

Text of the law:

www.recht.bund.de/bgbl/1/