For political, economic and technological reasons, India is currently in the international headlines more often than in the past. No wonder, because as the world's most populous country, India offers a lot at the same time: a vibrant democracy with an age-old tradition, a stable and growing economy with low inflation, favorable demographics, an investment-friendly climate, clear legal protection, a skilled workforce at relatively low wages and more.

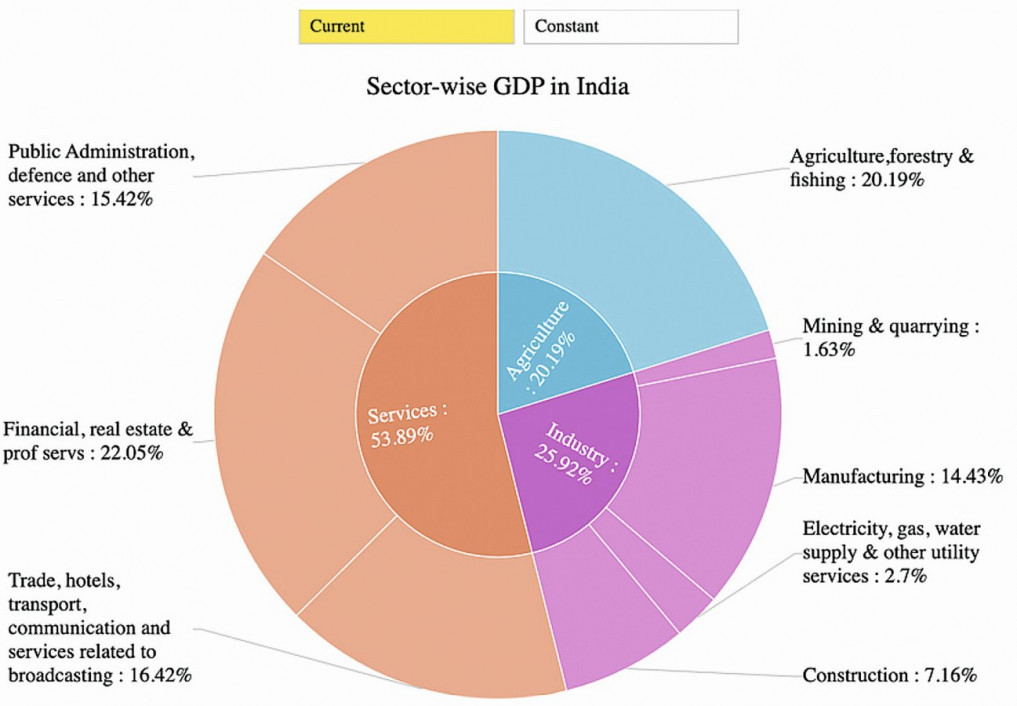

Fig. 1: India's gross national product at a glance (Source Fig. 1 and Fig. 2: India Stat).

Fig. 1: India's gross national product at a glance (Source Fig. 1 and Fig. 2: India Stat).

India's gross national product is dominated by the service sector, as can be seen in Figure 1. The growth of India's service sector, especially the IT sector, has attracted global attention. Unlike other developing economies where economic growth has led to a shift from agriculture to industry, India has seen a shift from agriculture to services. Almost 40% of the population now lives in urban areas. The growth of the service sector has led to the development of various industries such as IT, healthcare, tourism, transportation and finance. India's booming service sector is a remarkable example of how modern economic growth models can outperform the traditionally established models.

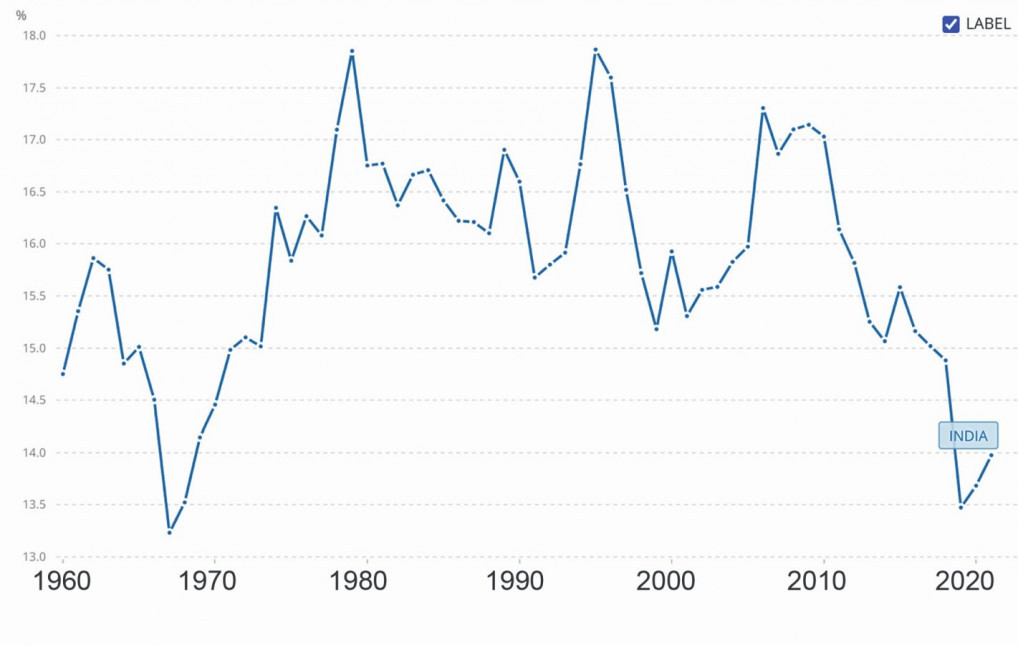

The manufacturing sector, of which the surface technology industry is an important link, currently lies in the shadow of the services sector. As shown graphically in Figure 2, the manufacturing sector currently contributes less than 15% to India's GDP. However, there are clear and strong indications and reasons for this contribution to increase.

Fig. 2: Percentage contribution of the manufacturing sector to GDP

Fig. 2: Percentage contribution of the manufacturing sector to GDP

Building on the competitive advantage of a skilled workforce and lower labor costs, the manufacturing sector is experiencing an increased inflow of investment and increased merger and acquisition activity, leading to an increase in manufacturing output and a resulting higher contribution to exports. The production linked incentive scheme has been notified for manufacturing in India. This scheme aims to increase the attractiveness of the manufacturing industry for large investments. The positive developments in the manufacturing sector, driven by the expansion of production capacities, government support, political stability, increased M&A activities and investments, are creating a robust framework for sustained economic growth in the subcontinent in the coming years.

Current state of electroplating in India

Several Indian companies that produce the chemicals required for the electroplating industry are also active in the export market. Many Indian companies offer products at unbeatable prices, particularly in the classic processes for zinc, nickel and copper. Globally active companies, especially German companies such as MKS-Atotech, MacDermid-Enthone/Coventya and BASF, usually have their own production facilities in India. Other companies, such as Dr. Hesse, produce and market under license in India. Some companies, such as Schlötter or Brünofix, export directly to Indian customers, with strong local technical support. Many basic chemicals for electroplating and surface technology (surfactants, organic compounds, metal salts) are produced in India and also exported globally.

In the field of plant engineering, there are only a few companies such as Kamtress, Dürr and Grauer & Weil that build large automatic plants for electroplating or waste water treatment. There are many manufacturers of rectifiers, drums, tanks, gas scrubbers, pumps, filters and other accessories. Many foreign companies, especially Chinese, German and Italian companies, have active representatives in India who import such equipment and accessories on behalf of customers. However, when it comes to electroplating systems for large projects, these systems are usually brought into the country as part of the project, often including the associated chemicals. Used automatic electroplating systems are also regularly imported, especially from East Asian countries.

Contract electroplating, associations and industry visibility

The demand for functional and decorative coatings (Figure 3) in the automotive industry is mostly met by contract electroplating companies. Aggressive buyers from automobile manufacturers get their goods coated at lower prices, and the development of the electroplating industry in India suffers greatly as a result. There are often price wars among contract electroplaters. When the contract is awarded, the contract electroplater is often expected to have his factory inspected and to disclose his technology. However, the information obtained is not treated confidentially later on. The trend in contract electroplating is mainly towards increasing capacity through automation, accompanied by in-house quality assurance.

Fig. 3: Plastic electroplating at Polyplastics Yamuna Nagar

Fig. 3: Plastic electroplating at Polyplastics Yamuna Nagar

There are only a few associations, federations or chambers of commerce in India that are actively focused on the electroplating industry and regularly organize conferences and trade fairs. For this reason, it is difficult for the industry to lobby effectively. However, large chambers of commerce organize conferences, often with electroplating and corrosion protection as topics. The electroplating industry presents itself at trade fairs in other industrial sectors to showcase its product range and popularize its critical role in the production chain.