The German Surface Finishing Association (Verband für die Oberflächenveredelung e. V. - VOA) has been conducting regular surveys on the situation in the surface finishing industry among its members for several years in order to gain an up-to-date picture of the economic situation of its member companies. The VOA compares the results with those of previous years. The results of the most recent survey are now available.

Fortunately, some of the VOA member companies can look forward to a more positive development in 2024 than initially expected, but most still see their current situation as mediocre to negative. In addition to geopolitical risks and new challenges on international markets, rising non-wage labor costs, excessive energy costs, excessive bureaucracy and internationally uncompetitive tax burdens are having a negative impact on Germany and its economy. The surface finishing sector is moving in line with German industry. It is to be hoped that the future German government will tackle its tasks in an objective, energetic and courageous manner in order to relieve the burden on companies and strengthen the economy again.

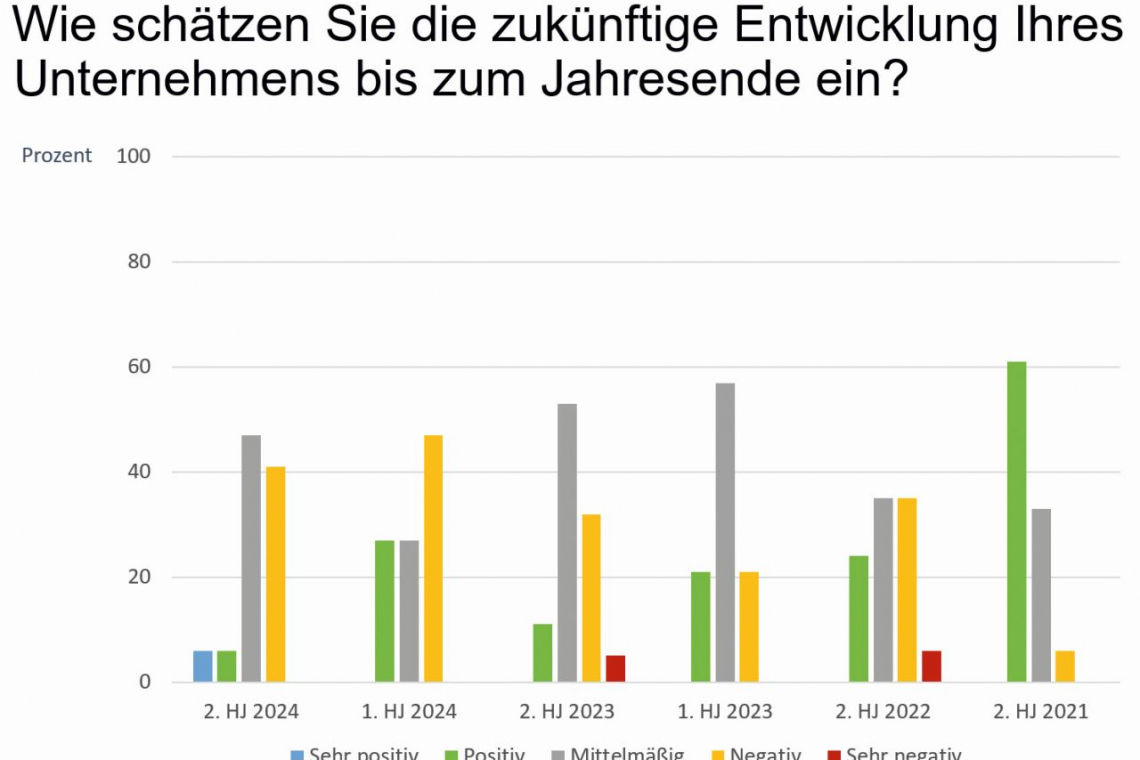

Impact of energy price trends on VOA member companiesThefigures from the latest VOA survey speak for themselves. At the end of the second half of 2024, 47% of the ordinary members participating in the survey rate the development of their company as mediocre, 41% as negative. Very positive or positive opinions are few and far between at 6% each. Compared to the results from the first half of the year - 27% positive and 27% mediocre, 47% negative - the figures for 12% of VOA member companies were better than expected, while 15% were slightly worse than expected.

Impact of energy price trends on VOA member companiesThefigures from the latest VOA survey speak for themselves. At the end of the second half of 2024, 47% of the ordinary members participating in the survey rate the development of their company as mediocre, 41% as negative. Very positive or positive opinions are few and far between at 6% each. Compared to the results from the first half of the year - 27% positive and 27% mediocre, 47% negative - the figures for 12% of VOA member companies were better than expected, while 15% were slightly worse than expected.

A detailed look at the industry

The companies' capacity utilization is currently at 68% (March 2024: 71%). It fell by 16% on average, marking the sixth consecutive decline. In comparison: in 2021, average capacity utilization was still at 90%. Turnover fell at 71% of companies, on average by 13%. It only remained the same for 23% of VOA members and increased for 6%. The negative trend since 2021 is also clearly evident here, as only 11% of companies reported a decline in turnover at that time.

In terms of orders received in 2024, 71% also reported a decrease of 15% on average compared to the previous year. 29% stated that orders had remained the same. Three years ago, only 6% of member companies noticed a decline.

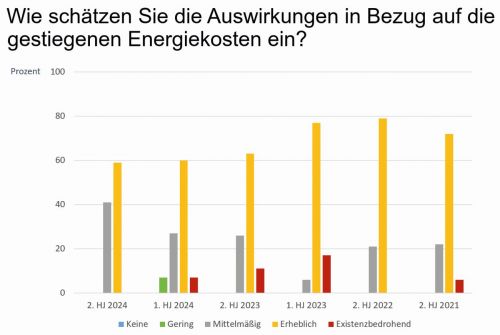

Despite a 27% decline in energy costs since March 2024, 53% of the companies surveyed cited energy price trends as a factor behind the reduction in production. They have had a significant impact on 59% (+1% since March 2024) and a moderate impact on 41% (+20% since March 2024). At least none of the companies currently see the energy price trend as a threat to their existence (-7% since March 2024). The number of companies that feel strongly affected by the current high prices has fallen by 19% since 2021. This development may be related to the fact that VOA member companies are looking for solutions to reduce their dependency in light of the high cost of electricity and gas. 53% of ordinary members now state that they use energy they generate themselves. In 2021, the figure was only 9%.

In second and third place among the reasons for limited production are the shortage of labor and skilled workers at 47% (-13% since March 2024) and - new - sick leave at 35%. Although the shortage of labor and skilled workers is still a high priority for VOA member companies, it is no longer as important as before. This is presumably in relation to the ever-decreasing order situation and, as a result, the decreasing relevance of recruiting employees and hiring temporary workers. Unfortunately, the poor situation also led to 12% of companies making redundancies for operational reasons for the first time since 2022. A small glimmer of hope: 53% of VOA member companies are still training apprentices and plan to do so in the future. This means that the surface finishing industry's commitment to training young talent remains high. Fortunately, the figures have been rising steadily since 2021, when only 29% were training apprentices.

Both anodizing and coating companies as well as one paint stripping company took part in the current survey in November 2024. The majority of VOA members - 88% - work for the construction/architecture sector, but compared to the last survey in spring 2024, a decline of 5% can be observed, parallel to the general construction crisis. The automotive sector has been hit even harder, with a drop of 18% to 35%. By contrast, the mechanical engineering sector remains relatively stable at 59% (+6% compared to March 2024).

Graphics: VOA