Graphene: How quickly will the wonder material with just one crystalline bonded atomic layer ('2D') of carbon, which has been heavily hyped for more than ten years, get out of the labs and into the fabs of various user markets?

This is the fundamental question that a new report by British market researcher IDTechEx raises and seeks to answer based on a series of quantitative analyses and interviews with leading researchers and developers.

Under the title 'Graphene Market and 2D Materials Assessment 2021-2031', IDTechEx analyst Dr. Richard Collins examines the current situation and the longer-term development of the emerging markets for extremely thin layers of graphene and 2D materials of a similar type with just a few atomic layers. His conclusion from observing numerous international players, researchers and developers is that the overall market for 2D materials and their as yet hardly foreseeable applications, especially in microelectronics, could reach a volume of 700 million dollars in the next ten years, according to IDTechEx.

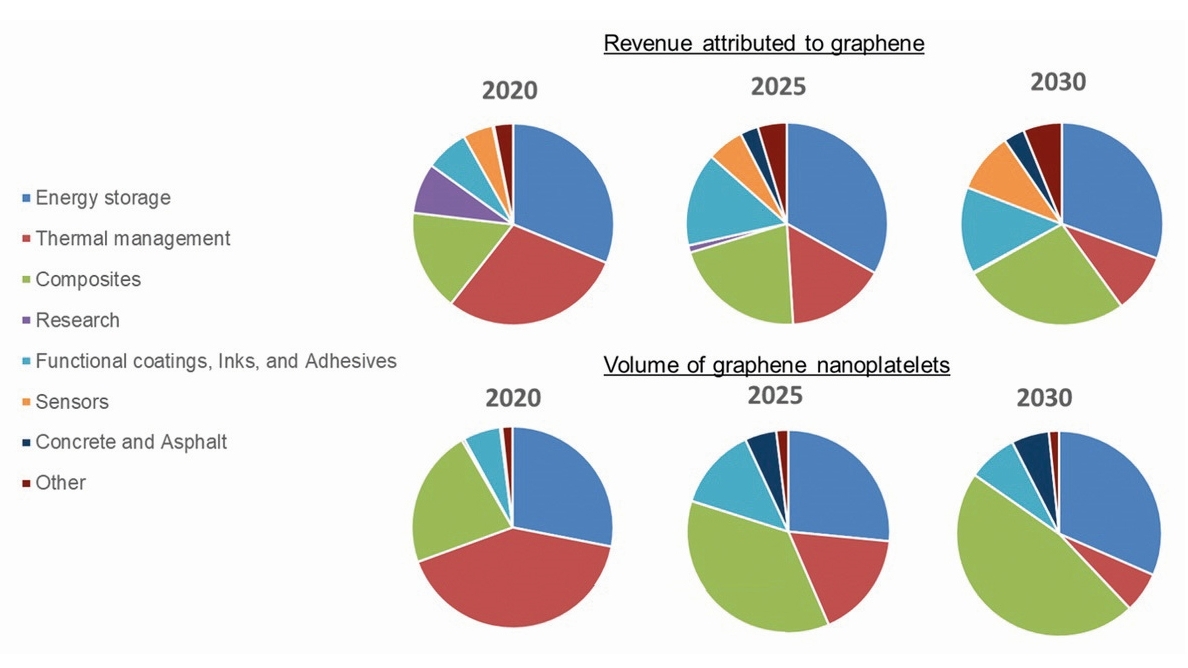

Compared to the sales of traditional semiconductor materials, which are an order of magnitude higher, this is still a very modest sum. But it is still a multiplication of the current market volume of less than USD 100 million - most of it in the form of experimental preliminary work with prototypes and performance demonstrations below the level of large-scale use. To date, the major companies Samsung and IBM have made the strongest mark in graphene marketing, measured in terms of patents granted. Collins sees graphene nanoplatelets (flakes) as the most promising preliminary stage of graphene/2D commercialization in the short term, primarily because they combine the right market forces and technological expertise.

Another aspect of future development is that more and more varieties of 2D materials with diverse morphology and formulation parameters are being discovered and analyzed for large-scale production, for example through catalytic processes or the reduction of graphite oxide, meaning that the range of possible and probably dominant applications continues to expand. The first approaches to standardization and qualification as a utility material and the associated legal regulations for its safety in use are also becoming apparent.

The functional TMD monolayers (transition metal dichalcogenides) produced by SALD (Spatial Atomic Layer Deposition) on silicon substrates for semiconductor production, with structures similar to carbon-based graphene, should also be mentioned in this context. Compounds such as MoS2 (molybdenum disulphide) and tungsten disulphide (WS2), which promise new circuit properties, are primarily in demand here. These 2D coatings are produced using special deposition processes with suitable precursor materials from the gas phase, also specifically in selected areas. The Dutch Eindhoven University of Technology (with associated start-up companies and research institutes such as TNO) and the Fraunhofer Institute IVV in Freising near Munich are particularly active in the development of selective atomic layer deposition using SALD, also with contour-true patterns on flexible polymer substrates. Together with TNO, Fraunhofer is working on high-performance '1000-km batteries' as a further development of Li-ion technology with nano-coatings for electromobility.

According to Collins, most prospective target applications for 2D materials are likely to be aimed at volume markets. This includes specific risks for suppliers as to whether and how demand will develop in these applications. The foreseeable return on investment is correspondingly uncertain. This slows down the expansion of capacities and leads to the currently prevailing impression that not enough funds are being invested in the new technology. Here too, according to Collins, the growing scope and influence of Chinese activities as a 'significant territory of production capacity' is evident, with a focus on the exfoliation of graphene from the liquid phase as the predominant manufacturing process.

Another aspect of the development of graphene production is the cost-effectiveness of graphene powders and nanoplatelets as substitutes for carbon black, graphite and other additives. Graphene competes with these both in terms of price and performance. Initially, according to IDTechEx analyst Collins, it had serious disadvantages due to its orders of magnitude higher price. According to Collins, this has now changed. The prices for platelets have fallen sharply, so that some providers already see the danger of (premature and too cheap) commoditization. In the longer term, IDTechEx sees the consolidation in the field of providers over the next ten years that is common in the industry.

On the other hand, they also note the slow but steady growth in sales of most existing providers since 2013. This could continue until a certain turning point in the market and the entry into a steep expansion phase. This could begin as early as 2022. However, Collins believes that the profit situation is a different story: with certain exceptions, the industry as a whole is still operating at a loss. This is typical of the subsidy-requiring commercialization of new materials, which usually takes years or decades.

The IDTechEx report identifies end-user applications of 2D materials to improve the mechanical resistance and higher electrical and thermal conductivity of components, better electromagnetic (EMI) shielding, as substitutes for polymers, for energy storage with lithium-sulphur batteries (Fraunhofer IWS), silicon anodes for rechargeable batteries, supercapacitors, transparent conductive (anti-corrosion) coatings, metal matrix composites, e-textiles, in general, as key market drivers: more sustainable and lighter consumer products.

The initially favored prospective applications as innovative transistor substitutes have since lost their appeal due to the lack of an (artificially created) band gap in the graphene material and the rather complex production of such components, Collins sums up. The development of graphene-based sensors and optoelectronic components and systems appears more promising.

Countless other emergent 2D materials, each with their own exotic properties, have hardly been properly investigated and researched in the wake of the discovery of graphene 17 years ago. This report is also dedicated to these potential materials as game changers in industrial electronics and their manufacturing processes. Particular attention is paid to boron nitride and transition metal dichalcogenides, as well as other nanocarbon structures such as carbon nanotubes. Here the report offers the usual quantitative analyses and overviews of suppliers, long-term technology developments, assessments of individual companies and their position in the market, benchmarks, the patent situation, price trends, and finally an insightful look at China and the newly emerged and rapidly growing suppliers there (with the latest 'super battery' from car manufacturer GAC).

Not to be neglected in the development of such an important and fundamentally new technology, which has an impact on countless applications and industrial sectors, is public funding, whether to accelerate development or to strengthen the location. On the European side, the EU is making its mark here with its Graphene Flagship research initiative launched in 2019 as part of FET (Future and Emerging Technologies), which aims to drive forward the commercialization of graphene with eleven 'spearhead projects' in partnership with industry. In total, the EU is providing the impressive sum of €1 billion over a period of ten years for graphene development with more than 100 academic research teams and interested European companies. Graphene Week 2021, a virtual event taking place this year from September 20 to 24, is an expression of this broad cooperation. More than 200 researchers and developers will take part in this interactive platform.