The high-tech region 'Silicon Saxony' around Dresden is currently striving for a new evolutionary push and broader value creation: On the one hand, the Saxons are striving to build a mega chip factory of the latest generation that will make Europe more resilient to pandemics, trade wars and semiconductor bottlenecks in the long term. On the other hand, they are promoting the development and expansion of industries in the state that are technologically close to microelectronics: robotics, artificial intelligence (AI), predictive maintenance, business-related software and modern environmental technology ('green tech').

Microelectronics pioneer Werner Hartmann (Image: Private archive Renee Hartmann/Repro: hw)The greatest hopes are currently focused on investment decisions expected soon from US company Intel, Samsung from South Korea and TSMC from Taiwan. All three are - with varying degrees of vehemence - looking for locations for one or more semiconductor plants in the five to ten billion euro price range. Such a factory would manufacture semiconductors of the structure generations below ten nanometers and thus close a gap in the Saxon microelectronics cluster: None of the plants already established by Globalfoundries, Infineon, Bosch and Co. can currently offer anything below 22 nanometers. As it takes at least three years from the ground-breaking ceremony to volume production, such a factory would probably come too late to eliminate the current semiconductor bottlenecks in the German automotive industry. In the medium and long term, such a top contract manufacturer ('foundry') in Silicon Saxony could reduce the dependence of many European industries on key suppliers from the Far East.

Microelectronics pioneer Werner Hartmann (Image: Private archive Renee Hartmann/Repro: hw)The greatest hopes are currently focused on investment decisions expected soon from US company Intel, Samsung from South Korea and TSMC from Taiwan. All three are - with varying degrees of vehemence - looking for locations for one or more semiconductor plants in the five to ten billion euro price range. Such a factory would manufacture semiconductors of the structure generations below ten nanometers and thus close a gap in the Saxon microelectronics cluster: None of the plants already established by Globalfoundries, Infineon, Bosch and Co. can currently offer anything below 22 nanometers. As it takes at least three years from the ground-breaking ceremony to volume production, such a factory would probably come too late to eliminate the current semiconductor bottlenecks in the German automotive industry. In the medium and long term, such a top contract manufacturer ('foundry') in Silicon Saxony could reduce the dependence of many European industries on key suppliers from the Far East.

However, such an investment, for which more than 70 locations in Europe have already applied in the case of Intel alone, would involve subsidies running into the billions. In other words: without subsidies from the federal government and the EU, it will hardly be possible to realize this. In this respect, political considerations will also play a role in the choice of location. However, if you look at the technical criteria alone, such as existing semiconductor ecosystems, infrastructure, relevant research facilities, availability of skilled workers and long industry traditions, there are many arguments in favor of Dresden.

Dresden celebrates its entry into microelectronics 60 years ago

Dresden's status as the largest semiconductor location in Europe did not come about overnight, but has traditions that go back to the early days of microelectronics. Just recently, 'Silicon Saxony' celebrated a milestone anniversary: 60 years ago, on October 2, 1961, the Dresden physics professor and electronics visionary Werner Hartmann (1912-1988) officially opened the Laboratory for Molecular Electronics (AME) in Dresden, thus laying the foundation for what is now the largest microelectronics location in Europe.

In fact, Hartmann succeeded relatively quickly in making up for some of the backlog that the GDR had already accumulated in this still young key technology: Eight years after the invention of the 'integrated circuit' (IC) in the USA, AME built its first experimental circuits, delivered the first series chips for the GDR national economy two years later, and soon also built calculator chips and other microelectronics - partly cribbed from its US competitors, but increasingly also its own developments. Hartmann was an extremely forward-looking and determined manager, but also a pragmatic problem solver, recalls his colleague Dr. Hans Becker.

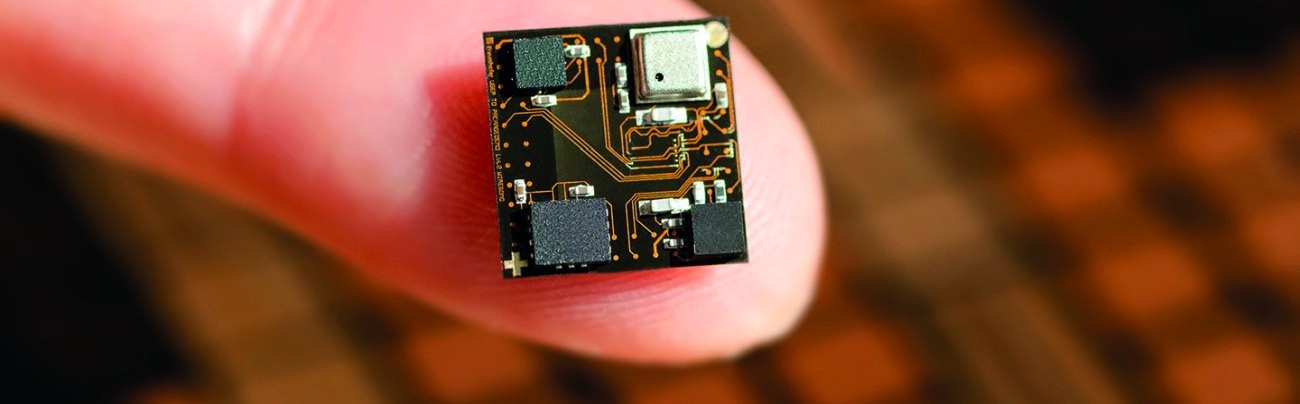

Also designed for retrofitting: this universal sensor platform with AI on board was developed by Globalfoundries, several Fraunhofer Institutes and Dresden-based companies. It is used for predictive maintenance solutions, among other things

Also designed for retrofitting: this universal sensor platform with AI on board was developed by Globalfoundries, several Fraunhofer Institutes and Dresden-based companies. It is used for predictive maintenance solutions, among other things

This stringency was reflected in the initially very dynamic growth of the still young East German microelectronics nucleus: the workplace with its eight-person starting collective eventually grew into the 'Zentrum Mikroelektronik Dresden' (ZMD), which had around 2,000 employees shortly before reunification. However, the founder did not live to see this: as early as 1974, he was dismissed and relegated to a subordinate position in Freiberg.

This was partly due to the personnel and political changes in Berlin: The new General Secretary Erich Honecker (SED) set other priorities and cut Walter Ulbricht's modernization programmes. The GDR then lost ground in microelectronics. However, when the export revenues of an important source of foreign currency - the GDR machine tool industry - soon dwindled because hardly any customers wanted machines without modern computer control, the next turnaround began: From 1977, the party and state leadership rediscovered the semiconductor industry and then pumped a lot of money into megabit chips, 32-bit processors and other ambitious catch-up projects, especially in the 1980s.

A lot of money invested - and yet too little

Fabmatics and other Saxon technology companies re-automated Infineon's 200 mm fabs in DresdenIn total, around 30 billion GDR marks and another 4 billion Valuta marks flowed into the East German microelectronics program in the second attempt, historian Rainer Karlsch has calculated. "That was a lot of money for a small country like the GDR - and yet too little," he says. At the time, every single one of the leading Japanese companies invested a similar amount in microelectronics. However, while the chip manufacturers in the West were taking advantage of globalization, international division of labour and specialization, the GDR was creating an almost complete equipment industry for the semiconductor factories along with a chip industry in its entirety. During this time, it was possible to close the gap to international standards. However, the economic effects of the enormous expenditure remained limited until the end.

Fabmatics and other Saxon technology companies re-automated Infineon's 200 mm fabs in DresdenIn total, around 30 billion GDR marks and another 4 billion Valuta marks flowed into the East German microelectronics program in the second attempt, historian Rainer Karlsch has calculated. "That was a lot of money for a small country like the GDR - and yet too little," he says. At the time, every single one of the leading Japanese companies invested a similar amount in microelectronics. However, while the chip manufacturers in the West were taking advantage of globalization, international division of labour and specialization, the GDR was creating an almost complete equipment industry for the semiconductor factories along with a chip industry in its entirety. During this time, it was possible to close the gap to international standards. However, the economic effects of the enormous expenditure remained limited until the end.

Monetary union in 1990 then sent microelectronics - like most industries - to death in installments in East Germany. "On the night of 1 July, a large part of the GDR's capital stock was almost abruptly destroyed with the introduction of the Deutschmark," emphasizes Karlsch. The multiplication of wages from one day to the next meant that most companies, including the chip factories in the East, only survived for a short time: all that remained of the electronics factories in Frankfurt an der Oder and Teltow, for example, were rudiments. And the chip factories in Dresden and Erfurt would probably no longer exist today without state intervention. In Saxony in particular, the government under Kurt Biedenkopf (CDU) took a special approach and saved the ZMD through direct state involvement. This approach, which was criticized as 'state capitalism' by the then Minister President of Brandenburg, Manfred Stolpe (SPD), was controversial in view of the considerable ZMD losses, which were ultimately subsidized by the taxpayer for several years.

In retrospect, however, this was probably a wise decision: Dresden's microelectronics expertise and the trained personnel from the GDR era were - in addition to the substantial subsidies - key reasons for Siemens/Infineon and AMD/Globalfoundries to set up large chip plants in the Saxon state capital after reunification. After that, things initially only went upwards: the companies invested further, new players settled here and the direct and indirect effects on employment and value creation were considerable.

In 2007, there was another important success: the contract manufacturer 'X-Fab' - which emerged from the former Kombinat Mikroelektronik Erfurt - took over the former ZMD factory in Dresden. However, the international chip crisis and the looming global economic crisis then hit Saxony hard as a semiconductor location. The most prominent victim was the memory chip producer Qimonda. In addition, AMD gradually withdrew from Dresden and spun off its Dresden plant to the subsidiary 'Globalfoundries', which was founded specifically for this purpose. All in all, this has meant that Europe is no longer represented in the 'leading edge' sector of global microelectronics: Qimonda was the last European player to mass-produce the latest generation of dRAM memory chips. And since AMD has had its top processors produced by contract manufacturers such as TSMC in the Far East, Globalfoundries is also out of the race for ever finer semiconductor structures and ever higher levels of integration.

In economic terms, however, the site has weathered the crisis years 2007 to 2009 relatively well. Globalfoundries and Infineon have since reinvested. The billion-euro new Bosch semiconductor factory in Dresden followed in 2021, and smaller players also expanded their involvement during this period. Jenoptik recently announced a new optoelectronics factory in Dresden. And Vodafone wants to establish a research center for 6th generation (6G) mobile communications in the Saxon state capital.

200 mm fabs post-automated with Dresden robotics

Globalfoundries Dresden uses the universal sensor platform with AI support for the predictive maintenance of ultra-pure water valves, among other thingsOtherinteresting developments that have influenced the entire industry took place behind the scenes. In recent years, Infineon has upgraded its old factory modules, which produce logic chips on 200 millimeter wafers, to near full automation with the support of Saxon automation specialists. Today, the Dresden plants are regarded worldwide as a showcase example of how old 200 mm chip factories can be kept competitive in the long term through the intelligent and customized use of robots, even in Europe's high-wage countries.

Globalfoundries Dresden uses the universal sensor platform with AI support for the predictive maintenance of ultra-pure water valves, among other thingsOtherinteresting developments that have influenced the entire industry took place behind the scenes. In recent years, Infineon has upgraded its old factory modules, which produce logic chips on 200 millimeter wafers, to near full automation with the support of Saxon automation specialists. Today, the Dresden plants are regarded worldwide as a showcase example of how old 200 mm chip factories can be kept competitive in the long term through the intelligent and customized use of robots, even in Europe's high-wage countries.

Entrepreneurs and economic policymakers from Silicon Saxony now want to use this special expertise to promote Saxony to the top league of European robotics locations. To kick off this plan, a new 'Dresden Robotics Festival' was held in the state capital from September 16 to 22, 2021. This brought together decision-makers from the industry, visionaries and young founders from all over the world and was intended to shape their ideas: There is no way around Dresden in robotics in the future. This was explained by Managing Director Thomas Schulz from the organizer 'Robot Valley Saxony'.

"As Dresden Economic Development Agency, we see enormous growth potential in the robotics cluster and have been working intensively for some time to raise the profile of Dresden as a robotics location as a functioning ecosystem with its start-ups and established companies," added Robert Franke, Head of Dresden Economic Development Agency. Background: Franke and his team had already issued the slogan of 'Robot Valley Dresden' in 2020 - although they have since found like-minded people from the business world and extended the idea of a leading robotics cluster to the whole of Saxony. "We have ambitious goals," said Thomas Schulz. "We want to develop Dresden into a European robotics hub." This is the next logical step after Saxony has made a name for itself as a microelectronics location of international standing. "In five or six years, we want to cut the sash in front of the first large robot factory in Saxony," he said, formulating an ambitious goal.

Focus on cobotics and no-code robotics

Realistically, it is unlikely that the industry giants will rush to relocate their industrial robot production from their traditional locations in Japan, Switzerland, Scandinavia, southern Germany, China or France to Saxony. However, industry experts do not believe that Schulze's plans to relocate to Saxony are mere pipe dreams: if market demand continues to grow as strongly as it has so far and Saxony's robotics players continue to excel with innovations, for example in intuitive robot learning ('no code robotics') and collaborative robotics ('cobotics'), production capacities for a whole new generation of robots beyond the classic industrial robots could well be created here.

The demand for new robots is currently huge worldwide - and Saxony could jump on this bandwagon, argues Olaf Gehrels from the German Robotics Association (DRV) in Trier. The market drivers are, on the one hand, the long-term automation goals of many industrial companies, the corona recovery, but also the desire to use robots to close the gaps left by the growing demand for skilled workers. All of this is boosting robotics worldwide. "And we have to be careful not to miss the boat," warns Gehrels. This growth curve is a particular opportunity for Germany, but especially for Saxony.

It is no coincidence that German and European players are focusing more on robotics right now: the International Federation for Robotics (IFR) from Frankfurt am Main, for example, believes that robots could solve Germany's supply chain problems during pandemics and disasters and perhaps even lead to the re-industrialization of European industrialized countries. The reasoning behind this is that today's complex and adaptive robots can now also perform many tasks that Europe's industry used to delegate to developing or emerging countries due to the high personnel costs involved. Thanks to high automation and more flexible robotics, the labor cost advantages of China, India & Co. are also becoming less important.

Saxons see great market potential through predictive maintenance

"If predictive maintenance extends the service life of a system and reduces its energy consumption, this ultimately helps to reduce CO2 emissions," Anja Vedder, Industrial AnalyticsCoupledwith robotics and microelectronics, artificial intelligence (AI) and predictive maintenance are also emerging as two trend sectors in which the players in Silicon Saxony want to fill gaps in the market with specialized solutions. The idea here is that the accumulated experience with the post-automation of older chip factories can also be used for other companies whose machinery tends to be dominated by traditional technological approaches, but where Industry 4.0 approaches could still leverage considerable productivity reserves. For example, many machine tools in metalworking factories can be retrofitted with sensors and decentralized electronics so that an AI can assess their 'health' and degree of wear.

"If predictive maintenance extends the service life of a system and reduces its energy consumption, this ultimately helps to reduce CO2 emissions," Anja Vedder, Industrial AnalyticsCoupledwith robotics and microelectronics, artificial intelligence (AI) and predictive maintenance are also emerging as two trend sectors in which the players in Silicon Saxony want to fill gaps in the market with specialized solutions. The idea here is that the accumulated experience with the post-automation of older chip factories can also be used for other companies whose machinery tends to be dominated by traditional technological approaches, but where Industry 4.0 approaches could still leverage considerable productivity reserves. For example, many machine tools in metalworking factories can be retrofitted with sensors and decentralized electronics so that an AI can assess their 'health' and degree of wear.

From the data from the retrofitted vibration sensors, microphones, acceleration and other sensors, the AI can then 'hear' whether, for example, a shaft is no longer running smoothly, a valve is leaking or an anomaly is developing. The system can then make a repair recommendation to the engineer or technician responsible. Conversely, the predictive maintenance system also recognizes whether a component is still working very well, even though the time formally suggested by the manufacturer for replacement has already elapsed. In the first case, predictive maintenance may prevent a total failure of the entire system or cycle line; in the other case, it may prevent unnecessary replacement actions - and ultimately also reduces the throwaway mentality and waste of resources.

"This can save 30 per cent of maintenance costs alone," estimates expert Anja Vedder from the Berlin-based company Industrial Analytics, which specializes in artificial intelligence (AI) and the Internet of Things (IoT). Predictive maintenance can also ensure a more stable, highly reliable production process in the long term.

One example of this is a solution that Globalfoundries Dresden implemented with partners in the 'Digital Product Factory' of the 'Smart Systems Hub' for its ultrapure water supply: using sensor platforms from Sensry, the developer network upgraded the chip factory's ultrapure water valves to make them I4.0-compatible. Dresden-based software developers Coderitter then programmed machine learning algorithms with which the artificial intelligence in an edge cloud can recognize the actual valve status based on detected noises. A dashboard from T-Systems MMS then prepared the analysis results for the Globalfoundries engineers in order to find the right times to maintain, repair or replace the valves. This saves money and increases reliability in Europe's largest chip factory. The company now also monitors ion implanters in the clean room with foresight.

"In terms of pure maintenance costs, we see advantages of up to 20 percent compared to traditional preventive maintenance with fixed intervals," says Globalfoundries' senior engineer Axel Preusse. "The reduction in unplanned downtime and the associated damage brings further advantages." This is why the semiconductor experts now want to improve their PM technologies and use them more widely. Thanks to artificial intelligence, it will be possible in future to plan even complex systems with foresight - similar to what the colleagues at Bosch are currently preparing in their new Dresden chip factory.

20 to 40 percent sales growth expected per year

In view of these advantages, the sales potential for providers of hardware and software related to predictive maintenance is considerable: "Double-digit percentage growth is expected in the coming years," according to a study conducted by Roland Berger on behalf of the VDMA in 2017. More recent studies have already raised some of the forecasts: Analysts at QYResearch, for example, estimate current sales with predictive maintenance at around €6 billion for 2021 and expect annual rates of around 29%. The experts at Markets and Markets expect the global PM market to grow to around €10 billion in 2025. And many German and especially Saxon technology companies hope to participate significantly in this still young business segment in the coming years.

Circuit design and manufacturing technology inextricably linked

In mid-September, an event in Dresden focused on an industry trend that has been observed for several years: the International Conference on IC Design and Technology (ICICDT) showed that the design of integrated circuits (IC) can no longer be separated from the manufacturing technologies used. The microelectronics designer must think about both together in order to tease more performance, lower energy consumption or higher packing density of analog-digital components out of his design.

"The trend in the IC industry is towards specialized system designs and outsourcing production, for example in fabless design houses and wafer foundries," said the experts from the Fraunhofer Institute for Photonic Microsystems (IPMS) in Dresden, who had invited participants to the conference. "This also increases the need for people with multidisciplinary technical skills for cross-system collaboration."

The conference between September 15 and 17 focused, for example, on the design of gallium nitride power semiconductors, memristors and neuromorphic circuits as well as photonic circuits and the 3D integration of ICs. One central concern came to the fore again and again: crossing the boundary between design and process technology in product development and production.

Sources:

Bosch Symposium '60 Years of Microelectronics in Dresden',

Saxon Ministry of Economic Affairs (SMWA),

Globalfoundries, Industrial Analytics,