Like the USA, Japan and Germany, Russia is making efforts to significantly strengthen its electronics industry. The new electronics strategy aims to make the country less dependent on the global market and sanctions by 2030, particularly in microelectronics.

Comparisons show that Russia's efforts to improve national security are very similar in content to what is happening in the other countries mentioned. The Russian electronics strategy holds numerous business opportunities for German companies. In spite of the omnipresent and unfortunately increasing anti-Russia policy on the part of the USA and other NATO member states, German companies are still or have already returned to the Russian electronics market. For its part, Russia has been relying on technologies and equipment from Western countries, especially Germany, for many years.

Proof of this is the fact that German companies such as Rehm, IC-Haus and Würth Elektronik once again took part in this year's ElectronTechExpo in Moscow in April. Other companies such as Phoenix Contact, Siemens, Bosch and Wika have been in Russia for a long time. The new strategy for the development of Russia's electronics industry up to 2030 with its ambitious goals can offer companies from Germany promising business opportunities, so a certain minimum knowledge of them can be an advantage. After all, especially today, ambitious goals can usually only be achieved in the desired quality and time by using the international division of labor.

The new electronics strategy was developed in Russia in 2019 and adopted in January 2020. In 2019, other countries such as the USA and Germany, as well as the EU, also began to develop concepts for the rapid advancement of their national electronics industries in the coming years in light of the global changes taking place.

For example, in September 2019, the Federal Ministry of Education and Research (BMBF) published an impulse paper on the flagship initiative 'Trustworthy Electronics' (digital strategy). Its aim is to ensure the sustainable preservation of expertise and know-how in the field of microelectronics in Germany and to achieve greater technological sovereignty [1]. The measures introduced in the USA in 2020 and 2021 with the aim of securing supply chains and increasing domestic production were reported on in detail in PLUS 4/2021 [2]. With regard to EU projects, IPCEI, in particular IPCEI2 (microelectronics), which was announced in December 2020, should be mentioned. The abbreviation stands for 'Important Project of Common European Interest'. The project is intended to contribute to securing European technological sovereignty in microelectronics [3]. It is therefore logical to also describe the situation and plans of the Russian electronics industry in more detail in this article(Fig. 1).

Different starting point, similar goals

A closer look at the Russian strategy shows that although the respective starting points for the USA, Japan, the EU or Germany and Russia are very different, all of the projects mentioned above have clear similarities in terms of the reasons for their adoption. It is about greater strategic security for the respective region through more investment in important parts of its own electronics and microelectronics industry. However, the situation in Russia is not at all comparable with the countries and regions mentioned, but is considerably different and more complicated.

The strategy was developed at a very critical time for Russia's electronics industry. According to a statement from the Russian Association of Electronic Components Suppliers (www.aspecrf.org) in June 2019, the Russian market for electronic components declined by 5% compared to the previous year. The delivery volume had already fallen by 9% in 2017. This was a trend to which the Russian government had to respond. In 2019, the government-critical newspaper Komsomolskaya Pravda [4] wrote in an article that although a lot of money is being invested in the industrial sector, foreign microelectronics still dominate in devices that are manufactured domestically. In the new Sukhoi Superjet 100 (medium-haul aircraft), for example, 80 % of the components and systems, including the electronics, are imported(Fig. 2). Fig. 2: Examples of suppliers for the Sukhoi Superjet 100

Fig. 2: Examples of suppliers for the Sukhoi Superjet 100

According to [4], there are several reasons for the decline in demand for electronic components, only two of which are mentioned here:

- There is no healthy protectionism in the country and insufficient desire to develop the Russian electronics industry. Companies in the defense industry prefer to place their orders abroad, thus endangering not only domestic production but also the country's defense capability. The government is watching as domestic production is shut down one by one.

- A catastrophic situation not only in factories, but also in research institutes working on developments in the field of microelectronics. In the social sphere, the situation is critical for workers and specialists in the high-tech industry.

According to [4], the situation is as follows: Large companies in the electronics sector that previously depended heavily on orders from the state defense industry in the military-industrial complex are hardly getting any orders, so they have to lay off qualified employees. The authorities are reacting in the old-fashioned way - they are expanding and reorganizing the companies into 'giant monsters'. One example: Russia's largest holding Ruselectronics (part of the Rostec structure) continues to grow - more than 70,000 people now work in its companies. State investment in import substitution in the military-industrial complex has increased tenfold in recent years. A considerable proportion of these funds is spent on microelectronics, but the proportion of domestic components is not growing. In addition, there is nepotism and post creep in the top echelons of large companies and corporations, despite the proven incompetence of many 'senior executives' [4]. Microelectronics has become another 'black hole' for the Russian state budget.

Why do we need a new strategy for Russia?

The "Strategy for the Development of the Electronics Industry of the Russian Federation for the Period Until 2030" (hereinafter referred to as the "Strategy") was adopted by the government on January 17, 2020 as Resolution No. 20 [5]. The document includes a comprehensive action plan for the implementation of the strategy. The original in Russian comprises 33 pages. Development and discussion continued throughout 2019. The draft published at the end of 2019 served as the basis for the final version of the strategy, but ultimately underwent significant changes based on the figures for the current situation in the Russian electronics industry at the beginning of 2020.

The need for the government to develop a long-term 'compass' for the further development of the Russian electronics industry has intensified in recent years for a number of reasons. Table 1 illustrates one of these reasons [6]. It shows the production value of the electronics and optoelectronics industry of 13 countries from the two groups of industrialized countries and developing countries for the period 1995-2015 in time slices. The countries were ranked according to their turnover in 2015.

Tab. 1: Production value of the electronics and electro-optics industry of selected countries for the period 1995-2015 (billion USD) [6] (Source: J'son & Partners Management Consultancy, Russia, based on OECD data)

|

Country |

1995 |

2000 |

2005 |

2010 |

2015 |

CAGR 2000-2015 |

|

China |

46,7 |

142,9 |

366,8 |

806,3 |

1449,9 |

16,7 % |

|

Japan |

421,7 |

413,4 |

320,1 |

359,5 |

254,2 |

-3,2 % |

|

South Korea |

71,4 |

107,4 |

161,6 |

249,9 |

235,4 |

5,4 % |

|

USA |

95,3 |

115,6 |

103,0 |

102,9 |

120,0 |

0,3 % |

|

Germany |

79,0 |

81,0 |

108,4 |

113,3 |

90,9 |

0,8 % |

|

Malaysia |

20,3 |

61,9 |

91,3 |

79,5 |

49,2 |

-1,5 % |

|

Great Britain |

57,1 |

72,7 |

53,7 |

41,3 |

34,5 |

-4,8 % |

|

Italy |

33,8 |

32,9 |

45,7 |

48,7 |

32,3 |

-0,1 % |

|

France |

56,0 |

59,5 |

55,0 |

49,6 |

26,6 |

-5,2 % |

|

Thailand |

11,1 |

13,1 |

16,7 |

31,7 |

26,0 |

4,7 % |

|

India |

8,9 |

10,7 |

16,7 |

34,0 |

17,5 |

3,4 % |

|

Russia |

3,8 |

2,9 |

9,3 |

19,7 |

17,3 |

12,5 % |

|

Indonesia |

2,0 |

7,4 |

12,2 |

28,9 |

14,8 |

4,8 % |

The table with its statements regarding the ups and downs of production in individual countries is interesting in itself. For example, it indirectly explains from a quantitative perspective why the USA has been making greater efforts since around 2019 to bring electronics production outsourced to Southeast Asia back to the country [2]. However, Russia is also aware of the unfortunate situation that the country only occupies the penultimate place in the table in terms of electronics production - after Indonesia. Although electronics production grew by a factor of around 6 between 2000 and 2015, the absolute total is far too low compared to Western industrialized countries. Fig. 3: The production of optoelectronics at Svetlana in St. Petersburg has a long tradition

Fig. 3: The production of optoelectronics at Svetlana in St. Petersburg has a long tradition

In recent years, there have been public warnings to the Russian government to do more to ensure that the country does not completely lose touch with a modern, efficient electronics industry and thus forfeit crucial foundations for the modernization of the country and also for ensuring its own security(Fig. 3). The term 'security' is used in the new strategy in several dimensions: military security, but also political and social security through a well-supplied, satisfied population.

More efficient work is the be-all and end-all

The ever-increasing sanctions imposed by the USA and NATO against Russia are cited in the new strategy as a major reason for the inadequate development of the national electronics industry. Although these have had a slowing effect, there are also other serious causes such as those mentioned at the beginning. Not enough has been done in the last 20 years to establish and expand efficient domestic electronics production. This starts with the component base, continues with PCB production and EMS services and ends with the production of the final devices. The strategy text clearly points out massive problems in the effective organization of scientific and technical cooperation in Russia as a whole and, of course, also in the area of Minpromtorg. The latter is the Ministry of Industry and Trade responsible for the electronics industry. It was not without reason that the Russian government resigned in unison on January 15, 2020 after President Putin's critical New Year's address to make way for a more capable government. Just two days later, the aforementioned new strategy for the development of the Russian electronics industry up to 2030 was published. A coincidence of timing?

The strategy criticizes the lack of willingness on the part of some companies and institutes to cooperate effectively, with the result that the material and technical possibilities already available have not been used efficiently despite earlier government programmes sounding good(Fig. 4). Insular work that is not coordinated with other potential partners and sometimes duplication or multiple efforts are the order of the day. The strategy therefore calls for the formation of suitable consortia of institutes and companies in specific subject areas (clusters) in order to be able to solve individual tasks of a complex nature in a targeted manner, using the special experience and skills of the partners involved more quickly and more effectively. In some respects, the proposed formation of thematic consortia can perhaps be compared with the organization of funding projects that is common in the EU and also in Germany. In the USA, too, this interdisciplinary way of working has been common practice for a long time, both from a horizontal and vertical perspective of the development process of electronics, especially in the defense industry. The new committees established by the DoD and IPC are also oriented towards this [2]. The Russian media point out that the experiences of Asian countries (which ones?) were taken into account when developing the new strategy. Fig. 4: The Russian microelectronics producer Angstrem almost went bankrupt

Fig. 4: The Russian microelectronics producer Angstrem almost went bankrupt

More strategically important production at home

Growing parts of Russian electronics production have been outsourced to Asia over the past 25 years, e.g. to South Korea and Taiwan. The Taiwanese company TSMC, for example, is used by Russian microelectronics design companies as a foundry for their IC designs. However, the reasons for this partial outsourcing are more complex than similar processes on the part of the USA or Western Europe. In addition to economic effects such as cheaper production, it was also a matter of circumventing the effects of the sanctions against Russia as far as possible and mitigating the company's own technological and quality weaknesses, or there were no suitable high-performance IC production facilities in Russia. One of the demands of the new electronics strategy is therefore to produce more domestically in future, and to do so with the necessary speed and quality.

In view of the growing international tensions, the increasing threat of the US-China trade war and the continuation of unilateral sanctions on the import of electronic components, equipment and materials by the US and NATO for Russia, the new Russian strategy must be designed to take the aforementioned risks into account and mitigate them as much as possible, according to studies by J'son & Partners Consulting Russia. However, J'son & Partners carried out the research on this before 2020.

The author assumes the following: If they had been realized during 2020 and the strategy had only been completed at the end of 2020 or the beginning of 2021, it would probably still look somewhat different, i.e. with even more stringent requirements for the future development of the Russian electronics industry. At the beginning of 2020, the full extent of the potential threat to supply chains from pandemics such as Covid-19 was not known either in Russia or in developed Western industrialized countries. In addition, the fact that parallel natural disasters, accidents and the failure of global transportation facilities or power supplies could further exacerbate supply and delivery problems in the worst-case scenario was not yet firmly anchored in the minds of experts. A 'good' example of this is the major Japanese semiconductor manufacturer Renesas. The massive production losses following the super earthquake on March 11, 2011 and the earthquake on February 14, 2021 were followed by a fire at the Naka semiconductor plant on March 22, 2021. As a result of the latter, the global supply of computer chips will become an even greater bottleneck by the summer.

A compelling conclusion: the more complicated the electronics/microelectronics, the more differentiated the division of labour, the greater the globalization of production and the further the supply routes, the greater the environmental problems to be recorded and the more unstable the political conditions, the more sensitive and vulnerable production becomes worldwide. Apparently, this causal chain has now reached a 'quality' that is forcing fundamental changes in many countries.

Think global - manufacture regional

Since last year, not only in the USA, Japan, the EU and Germany, there has been a growing realization that concentrating the production of strategically important parts and device components in a few mega-factories somewhere in Southeast Asia could, in the worst-case scenario, almost paralyze large parts of global electronics production and lead to huge economic losses, possibly combined with safety problems. The projects initiated in the above-mentioned countries to manufacture more locally again prove that a decisive rethink has begun. 'Economy first' is now not always the top criterion for decisions, but 'nice to have'.

Europe's economic recovery from the consequences of the coronavirus pandemic and its long-term future depend on attention to the electronics industry, according to a new IPC study Digital Directions, Greener Connections (An Industrial Policy Report on European Electronics Manufacturing) from April 2021 [7]. This is all the more true for Russia, which now wants to massively expand its electronics industry by 2030. The Russian government's new strategy already takes into account the IPC study's warning that the importance of the electronics industry for the country will continue to grow significantly in the coming years and that an efficient electronics industry will determine its future.

For Russia, this means that ever more persistent efforts are required to implement the import substitution policy as a result of the massive sanctions, especially for critical components. This is now likely to be compounded by the new experience gained since 2020 regarding disrupted supply chains and the further increase in the need for security.

Basic objectives and foundations of the strategy

The strategy for the development of the electronics industry defines the main directions of state policy in the development of the electronics industry of the Russian Federation for the period up to 2030. It aims to create a new competitive image of the electronics industry of the Russian Federation. The content can be briefly outlined as follows [5]:

- Development of scientific, technical and human resources potential

- Optimization of production capacities, their modernization and technical re-equipment

- Creation of new technological directions and technologies

- Introduction of pioneering industrial electronics technologies

- Improvement of the normative and legal basis

The aim is to meet the needs of the state and other customers (e.g. civil society and businesses) for modern products of the electronics industry.

Among the numerous laws and regulations listed in Section I of the document, which were taken into account during the development of the strategy, one occupies the absolutely most important position: National Security Strategy of the Russian Federation (Law No. 683 of 31.12.2015). It emphasizes that a modern, stable economy that is as unassailable as possible from the outside is the crucial backbone for the stability and security of the country and its population. All measures of the electronics strategy were tested against this law for their expediency or necessity. Here, too, certain parallels can be drawn with the measures taken by the US government to improve security in electronics production described in [2]. However, recent history has shown that Russia is in a fundamentally different situation to Germany and the USA, for example, and consequently approaches legislation and strategy in a different way.

Data on the state of the Russian electronics industry

Section II of the strategy defines the Russian electronics industry in its breadth and outlines its current state [5]. According to this, the electronics industry is an economic sector associated with the development and production of electronic devices, modules, components and embedded software. It also includes the developers and manufacturers of materials, technological equipment and software tools for the creation process of electronics. This definition characterizes the breadth of the adopted strategy and implementation measures.

The electronics industry comprises around 1600 to 1700 organizations, represented by industrial companies, research institutions with their own and without production, design offices, scientific organizations, development funds, industry training organizations and professional associations (other sources speak of around 3000 organizations).

According to the strategy, the dynamics of the total number of employees in the sector are characterized by stable growth. The average number of employees in 2018 was 6.6% higher than in 2008. The proportion of academic staff is growing. The remuneration of employees of organizations in the sector increased 2.9-fold between 2008 and 2018.

Table 2 roughly describes the tripartite structure of the Russian electronics industry and its share of industry turnover.

Table 2: Structure of the Russian electronics industry in 2019

|

Type of organization |

Number of organizations |

Share of industry turnover (%) |

Notes |

|

Organizations with state participation |

422 |

55 |

Of which 370 in the register of the military-industrial complex |

|

Organizations with private Russian capital |

1200 |

23 |

Mainly SMEs. Other sources: approx. 2000 organizations |

|

Organizations with foreign capital |

30 |

22 |

The organizations with state participation consist mainly of large companies (partly successors of the large Soviet enterprises), while the organizations with private Russian capital are mostly SMEs founded after 1992.

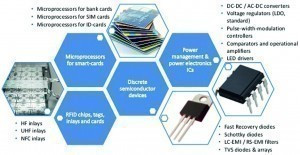

In microelectronics, 10 organizations are active in the mass production of microelectronics(Fig. 5). In addition, there are about 65 design centers for the design of circuits. There are also around 90 manufacturers of passive components. Fig. 5: Mikron is one of the most important Russian microelectronics companies with a large product portfolio

Fig. 5: Mikron is one of the most important Russian microelectronics companies with a large product portfolio

Part 2 of this article(PLUS 7/2021) draws conclusions about the economic situation of the Russian electronics industry based on available information from 2018. It also looks at technological problem areas and possible solutions.

References:

[1] www.elektronikforschung.de/dateien/bekanntmachungen/impulspapier_vertrauenswuerdige_elektronik.pdf

[2] Plus 4/2021, p. 474-488

[4] www.kp.ru/daily/26994/4054881/

[5] www.garant.ru/products/ipo/prime/doc/73340483/ (in Russian)

[6] www.tadviser.ru, Microelectronics section, Russian market

[7] https://emails.ipc.org/links/IPC-Manufacturing-Ecosystem-Decision.pdf