At the end of Part 1 of this article, the three-tier structure of Russia's electronics industry and its share of industry turnover was already mentioned.

The organizations with state participation consist mainly of large companies (some of which are successors to the large Soviet companies), while the organizations with private Russian capital are mostly SMEs founded after 1992. Fig. 5: Mikron is one of the most important Russian microelectronics companies with a large product portfolio

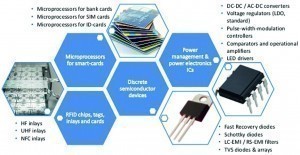

Fig. 5: Mikron is one of the most important Russian microelectronics companies with a large product portfolio

In the microelectronics sector, there are 10 organizations engaged in the mass production of microelectronics(Fig. 5). In addition, there are about 65 design centers for the design of circuits. There are also around 90 manufacturers of passive components. Table 3 contains some selected information that illustrates the economic state of the electronics industry in 2018. Combining the fragmentary data from Tables 2 and 3, it can be assumed that the total market for electronics (domestic production and imports) is currently worth around $50 billion or more and that the import value of electronics is around $25 billion. The government sector (including the military-industrial complex) could then have produced about $10 billion worth of electronics. Since nothing is known about the breakdown of imports by economic sector, we can only speculate that the military-industrial complex may account for (own production + imports) 20 to 25 billion dollars. This would mean about half of the total national market for electronics and would be a serious disproportion compared to other electronics-producing countries. From this it can be deduced that the supply of state organizations with the included military-industrial complex has so far absolutely 'ruled' the Russian electronics market.

Tab. 3: Key figures for the state of the Russian electronics industry in 2018

At 0.4%, the share of Russian electronics production in global production is negligible, as is the share of the electronics industry in Russia's GDP at 1.8%. A basic requirement of the new strategy is therefore to increase the share of GDP to 3 to 3.8% by 2030 and to increase exports of suitable products by a factor of around 2.5.

Tab. 4: Consumption structure of microelectronics by application area in Russia

|

Application area |

Share (%) |

|

Military and aviation electronics |

45 |

|

Energy and medical technology |

32 |

|

Consumer electronics |

11 |

|

Memory cards, RFID tags |

5 |

|

Server technology and similar |

3 |

|

IoT |

2 |

|

Automotive electronics |

1 |

|

Telecoms |

1 |

Table 4 once again confirms the dominance problem of organizations with state participation, this time in the microelectronics sector. The equity-based part of the private Russian economy is clearly underrepresented. As a result, almost half (45%) of the microelectronics processed in the country is used by the aviation and military sectors, which makes the country very vulnerable from a sanctions perspective.

Technological problem areas

Section II of the document takes a critical look at the current state of the Russian electronics industry. It is emphasized that its main problem is the lack of modern production equipment and associated control, measurement and testing technology from its own production. This shortage has a negative impact on the development and production of competitive high-tech electronics products(Fig. 6). There are problems supplying the industry with certain types of semiconductor materials, epitaxial structures, special consumables, CAD/CAM tools of Russian origin, system software and database management systems. Fig. 6: The processor of the Russian company Elvis is manufactured in the Taiwanese foundry TSMC

Fig. 6: The processor of the Russian company Elvis is manufactured in the Taiwanese foundry TSMC

The practice of concentrating financial resources on the purchase of equipment and software tools manufactured mainly abroad, which has been established for more than 20 years, is considered unsuitable for the new objectives of the strategy. The use of automated control and monitoring systems for technological processes has so far been fragmentary, and the use of information technologies without communication with the technological equipment is not effective enough. The small-scale production of many electronic products, often practiced as part of import substitution, mainly for defense and security needs of the state, hinders the introduction of new technologies and design solutions. In some cases, it makes it impossible to realize cost-effective production because the quantities purchased by Russian customers are too small due to imports.

Macro objectives of the strategy

After outlining the basic markets of the Russian electronics industry (traditional and new markets to be developed) in section III of the strategy paper and defining the basic tasks of the new strategy for the country in section IV, section V deals specifically with the objectives, targets, priorities and target indicators for the implementation of the strategy.

Tab. 5: Key figures from of Russia's strategy for the development of the national electronics industry by 2030 [5]

|

Key value |

Value 2018 |

Scenario |

Year |

||||

|

2021 |

2022 |

2023 |

2025 |

2030 |

|||

|

Production value of companies and scientific organizations in the electronics industry (billion rubles) |

1868 |

K Z I |

2400 2460 2470 |

2630 2710 2730 |

2870 2970 3010 |

3315 3490 3550 |

4370 5220 5590 |

|

Share of sales of Russian electronic products in the country's GDP (%) |

1,8 |

K Z I |

2,2 2,2 2,2 |

2,3 2,4 2,4 |

2,4 2,5 2,6 |

2,6 2,8 2,8 |

3 3,5 3,8 |

|

Share of civilian products in the total volume of industrial production (by turnover) (%) |

50,3 |

K Z I |

56,6 57,5 57,7 |

59,5 60,7 61,0 |

62,5 64 64,4 |

67,8 70 70,7 |

79,5 87,9 91,2 |

|

Share of civil electronic products manufactured by Russian electronics industry organizations in the total turnover of the domestic electronics market (%) |

31 |

K Z I |

35,3 37 37,2 |

37,5 39,6 40,1 |

39,5 42,2 42,9 |

42 45,8 46,8 |

42,7 57,4 63,3 |

|

Share of total electronics products manufactured by Russian electronics industry organizations in the total turnover of the domestic electronics market (%) |

50,8 |

K Z I |

53 54 54,3 |

53,9 55,4 55,9 |

54,7 56,7 57,3 |

54,6 57,4 58,4 |

49,5 59,1 63,3 |

|

Production per employee in the electronics industry (mill. roubles) |

4,8 |

K Z I |

6,1 6,2 6,2 |

6,6 6,8 6,8 |

7,2 7,4 7,5 |

8,2 8,6 8,8 |

10,5 12,5 13,4 |

|

Export volume of Russian electronic products (USD million) |

4160 |

K Z I |

5190 5340 5490 |

5660 5870 6090 |

6170 6460 6820 |

7260 7890 8710 |

10090 12020 14800 |

Note: K - conservative assumption Z - target value I - innovative value

Table 5 shows some of the macro targets of the new program based on point 1 of section V. They clearly show that the Russian government is striving to significantly change the situation by 2030. The share of civil electronic products manufactured by Russian electronics industry organizations in the total national electronics market is to increase from 31% in 2018 to between 42% and 63% in 2030, with a significant increase in the sales value of companies and scientific organizations in the electronics industry. The turnover is expected to skyrocket from 1868 billion roubles in 2018 to values between 4370 and 5590 billion roubles in 2030 (depending on the progress in the implementation of the strategy, i.e. which scenario of the three stages conservative-target-innovative value can actually be realized).

Examples of scientific and technical objectives

Point 2 of Section V lists the core projects and core objectives of the strategy as well as the measures required to achieve them. A number of key scientific and technical parameters are listed to underpin the content. The information in point 2 is systematically subdivided into eight key areas:

- Scientific and technical development

- Means of production

- Industry standards (normative basis)

- Human resources

- Cooperation

- Information base/ IT equipment

- Markets and production

- Economic efficiency/ profitability

Due to the considerable amount of textual information, only brief excerpts from the individual key areas can be presented here.

Scientific and technical development

The document defines the following: The main objective of the strategy is to ensure the development and independence of the Russian electronics industry in areas that are of crucial importance for national interests and are promising from the point of view of securing a leading position.

The absolute focus of the strategy is semiconductor technology. This involves measures for the development and industrialization of technologies for the production of digital electronics (processors, controllers, memory) including the necessary system software, power electronics, RF and microwave electronics, analogue electronics, optoelectronics, photonics and microwave photonics, sensor technology.

Examples of specific development and production projects:

- Silicon technologies and components based on them in the topology ranges 65-45, 28, 14-12 and 7-5 nm

- Si components in the 5 nm topology range with production of the circuits initially in foreign foundries and subsequent relocation to the Russian Federation

- Si-based memory ICs in the 25-30 nm topology range and a layer count of at least 96

- OLED displays of at least the 6th generation with 2048x2048 pixels and microdisplays based on 200 mm wafers

- Technologies for UHF components based on BiCMOS HBT, HEMT, pHEMT in the topology range 65-45 nm, heterogeneous integration on GaN on Si, SiGe and GaAs wafers

- Devices for the terahertz frequency range, based on InP and other materials, for radar devices, video systems, medical devices and other applications

- Photonics technologies, including heterogeneous integration of InP with Si technology, for the production of photonic integrated circuits and technologies for active and passive sensors for thermal imaging and other optical systems

- Technologies for the production of semiconductor lasers, e.g. based on GaAs, GaN, InP and compounds based on them for all application areas, including telecommunications equipment, laser scanners, lidars

- Technologies for the production of power electronics based on GaN and SiC, including for the range up to 6500 V/1200 A and high temperature up to 4500 °C

- Technology for the production of MEMS sensors with topologies down to 0.5 micrometers

- Encryption and crypto-protection technologies, including hardware implementation of blockchain technologies

- Technologies for the production of plastic housings, e.g. for the aforementioned semiconductor components

The development of manufacturing technologies for multilayer rigid, flexible and rigid-flex printed circuit boards with up to 32 layers, including those using organic materials, plays an important role. Fig. 7: Wafers are the basis of all circuit production

Fig. 7: Wafers are the basis of all circuit production

The provision of the necessary materials is crucial for the realization of the technologies listed. The strategy lists the following development and production tasks, among others(Fig. 7):

- Semiconductor materials in all required forms (polycrystalline and monocrystalline silicon, silicon carbide, monocrystalline diamond), epitaxial structures made of silicon, SOI (silicon on insulator), SOS (silicon on sapphire), KSDI (silicon structures with dielectric insulation), heteroepitaxial structures A3B5, A2B6, MCT (heteroepitaxial structures of the ternary compound cadmium-mercury-tellurium), etc.

- Materials for lithography, including photo, electron and X-ray resists, developers, planarization and anti-reflection coatings

- Technological consumables, including acids, solvents and etchants, specialty gases and gas mixtures, organometallic compounds, high-purity metals and alloys, targets, adhesives, pastes, lacquers, fluxes, sealants and potting agents

The technologies, special materials as well as exposure and measuring devices for the production of photomasks in the 250, 180, 90, 65 and 28 nm design ranges as well as solutions for the 22-20, 16-14 nm and lower design ranges play a key role in the realization of the strategy's semiconductor programme. They are crucial to the realization of the very extensive range of components envisaged, including GLSI circuits, monolithic integrated microwave circuits, discrete semiconductor components, MEMS, optoelectronic and photoelectronic components, microwave photonics with their various substrates made of Si, GaAs, GaN, SiC materials, SOI structures (silicon on insulator), A3B5 heterostructures (GaAs, GaN/SiC) and A2B6.

If the tasks to be solved by 2030 listed here alone seem daunting to the author, the strategy has further tasks such as these in store:

Processes for the production of monolithic microwave integrated circuits and semiconductor components based on A3B5 and A2B6 as well as electronic modules based on them, including the following mixed semiconductor technologies: GaAs (pHEMT, PIN, DHFET, BiHEMT, E/D, pHEMT, HBT), GaN (HEMT, pHEMT), GaAlInSbAs (mHEMT), GaSb/InAs (HEMT), InP (HEMT, HBT), Si (DMOS), SiGe (HBT BiCMOS), FBAR (AlN/Si/Mo/SiO2) and DDRV (Si and SiC).

At this point, the following statement in the strategy on the current state of Russian microelectronics should be borne in mind: The pace of creation and development of industrial production of civil electronics does not fully correspond to the capacity of the domestic market, especially the capacity of such sectors of industrial products as telecommunications and medical equipment, household appliances, energy networks and security systems. In this regard, the development of modern electronic technologies should ensure the demand and growth of the share of Russian electronic products in the domestic market.

Means of production

By analogy with the functioning of the 'Western' microelectronics industry, the Russian electronics industry is oriented towards the increased collective use of design and manufacturing centers with a certain division of labor. The strategy specifies the construction of the following production facilities, among others:

- Foundries for the production of digital integrated circuits in the 28, 14-12 and 7-5 nm topology range

- Factory with hetero-integration technology for the production of microwave components and sensors in the 65-45 nm topology range

- Factory based on SiGe technology for MIS for the production of complex functional systems on a chip for RF systems in the 100 GHz and higher range

- Factory for the production of nanometer electronics, MIS or complex functional systems on a chip and RF systems in the submillimeter range up to 1 THz, based on GaN-on-SC, InP and diamond technologies

- Production facility for photo stencils for the production of microelectronics in the nanometer range with the necessary quality and quantity

- Production facility for silicon substrates (including high-resistance) with a diameter of 200 to 300 mm and for polycrystalline diamond wafers with a diameter of up to 100 mm

- Production for OLED and microdisplays

- Silicon factory for the production of solid-state data storage devices (SSD)

- Factory for multilayer boards up to 32 layers and up to accuracy class 8 according to GOST (author's note: L/S size probably min. 25 µm, possibly also for chip substrates and chiplet technologies) [8]

The electronics industry is to receive support in the development, production and use of Russian design tools as well as system and application software, including through the creation of a trustworthy industrial technology platform. It is planned to create software and hardware for computer-aided design systems, libraries of complex functional blocks and design technologies for integrated circuits of various integration levels as well as complex constructive solutions (e.g. system-on-chip, silicon-on-insulator, etc.). Furthermore, the methodological and technological prerequisites for working on the basis of foundries are to be developed. For this purpose, normative technological and IT-technical standardizations (unifications) are to be implemented. Another area of work is the development and provision of the necessary control, measurement, inspection and testing technology.

Industry standards (normative basis)

Modernization and expansion of the electronics industry require the modernization of the standards system in accordance with existing and future international requirements for products, technologies and organizational processes. Initially, the focus is on national standards for promising electronic products with their subsequent conversion into international standards.

Personnel

In view of the high average age of employees in the Russian electronics industry, the government sees a primary task in increasing the attractiveness of the industry for employees and also for younger potential recruits. The training and qualification of personnel should be increasingly carried out in accordance with technical trends, future products and markets on the basis of long-term planning of the workforce potential.

Cooperation

In order to achieve the objectives of the strategy, the focus will initially be on the broader use of existing production, scientific and technical resources. Partnerships with foreign organizations are to be expanded. To this end, priority areas of cooperation with foreign manufacturers for the creation and gradual localization of basic microelectronics technologies, equipment and materials will be defined. At the same time, a better information policy on existing cooperative manufacturing and design capacities will be introduced.

Great importance is attached to

- Removing regulatory and organizational obstacles that slow down the development of cooperation

- Organization of the collection, analysis, generalization and dissemination of best practices in cooperation

Information base/IT equipment

The creation and development of industry-specific databases should contribute to increasing the efficiency of the industry. These will include reliable registers of technical equipment, basic electronic components, skills and capacities of companies (author's note: according to [2], the approach of the US DoD and the Russian Minpromtorg is similar). The strategy also provides for the development and standardization of instruments for the exchange of information in the industry, i.e. an industry-internal information system. This will include a data collection system to monitor and control the development of the industry. A new computerized system for managing and monitoring the life cycle of electronic products will help to make traceability and life cycle data a broad basis for work.

Markets and production

An important goal of the strategy is to ensure that larger parts of the industry can participate in national and federal projects and programs (note: this is also in line with the recent activities of the DoD and the IPC according to [2]). In order to increase the share of Russian products in the Russian electronics market, demand for the industry's products must be stimulated, including through the introduction of quotas for the purchase of electronics products manufactured in Russia.

At the same time, the export of Russian electronics products to global markets must be increased, including through the export of systems engineering solutions, platforms and services.

The implementation of the strategy will include the introduction of regular analyses and forecasts of the development of the electronics markets in the interests of systematic planning of the industry's projects. For security reasons, the critical information infrastructures to be built will be realized on the basis of Russian software and hardware systems. The state promises support for priority sectoral projects and the formation of production consortia. However, it also identifies areas in which the use of Russian technical solutions will become a key priority in the face of cyber threats and sanctions pressure.

Implementation stages of the strategy

Section 7 deals with the approaches to strategy implementation. According to point 1 of the section, the strategy is to be implemented in three stages:

1st stage 2020-2021

- Increasing the share of Russian electronics in the domestic market, mainly due to traditional markets and participation in the implementation of national projects

- Preparation of active promotion on international markets, including aspects such as technological base, rules of the game, business models, product and service offerings, diversification of investments

2nd stage 2022-2025

- Promotion of Russian electronics in existing markets and entry into new international markets, including comprehensive proposals and partnerships with foreign partners, as well as increasing the volume of investment projects

Stage 3 2026-2030

- Steady growth of the industry and securing its leading positions in promising markets

- Ensuring global technological leadership and emphasizing priority aspects of development

Development of the industry structure during the implementation of the strategy

Point 2 of Section VII defines the main paths for the development of the electronics industry. A number of institutions are formed to ensure the achievement of the industry's strategic development goals. Examples in short form:

- Technological competence centers

- Organizations with the function of industry champions

- Network of design centers

- Regional collective project planning centers to support the design centers

- Consortia

- Strategic alliances

- Project offices to support measures within the framework of strategy implementation

- National Science Center for Electronics

Particular importance is attached to consortia. These can be associations of research and production, sales organizations and consumers that are formed to carry out projects for the development, production, marketing and development of electronic products or a range of products. A consortium can include educational and scientific organizations, developers of hardware and software components, product manufacturers, development institutions, venture companies, consumers and other interested organizations. Consortia may include foreign manufacturers interested in creating and localizing enabling technologies and manufacturing components, devices and materials. The main conditions for participation in consortia of foreign organizations are a high degree of localization of production and the transfer of intellectual property rights to Russian residents. An additional condition for a foreign partner to join the consortium is the establishment of a joint venture with a share of Russian residents of more than 50%.

Section VIII deals with the financing of strategy projects, Section IX with the monitoring, control and administration of strategy implementation.

Concluding remarks

This article will conclude with a brief assessment of the strategy from the author's personal perspective. Back in the 1970s, he had the opportunity to deal professionally with the GDR/USSR microelectronics programs and later with corresponding Russian state target programs. What all the programs had in common was that they were always very extensive in terms of content with very ambitious objectives. Ultimately, they could only be realized in fragments for very different reasons. The complex reasons for this have already been outlined in this article. The new strategy also gives the impression that much of what would be necessary for the further development of the Russian electronics industry and semiconductor technology in particular was written into it like a 'department store catalog' if it wanted to at least partially catch up with international standards and at the same time achieve a certain degree of independence, especially from sanctions. In addition to the influence of sanctions, the main problems lie at home. Solving them successfully is likely to be the main problem for the government.

With a population of 146 million, the country probably has neither the manpower nor the financial resources to successfully implement its strategy. Japan, for example, has a population of 126 million and can only realize its far less extensive range of components by using its production capacities, some of which are located abroad. The Russian government is aware of its limited resources and is therefore focusing on involving interested foreign companies in solving key tasks.

Gulnara Khasyanova, General Director of PJSC 'Mikron', assessed the situation in Russia in 2019 in [9] as follows: "Advancing microelectronics in the country is a fundamental task, but in reality there is more at stake. In fact, we are talking about the need to create a full-fledged industrial ecosystem around microelectronic products in Russia, i.e. rebuilding the chip manufacturer-module manufacturer-device/system manufacturer-user chain. This was lost at the end of the 1990s due to the absolute opening of the domestic market to cheap imports. Without the creation of such an ecosystem, we will not get far."

The comprehensive objectives of the strategy regarding greater domestic production could also be seen indirectly as an indication that, on the one hand, the stronger cooperation with China in microelectronics announced a few years ago has not yet contributed significantly to improving the supply of important semiconductor products to Russian electronics production and, on the other hand, the Russian government knows that China may not be able to become a reliable partner in the current decade as hoped due to the US sanctions.

References:

[1] www.elektronikforschung.de/dateien/bekanntmachungen/impulspapier_vertrauenswuerdige_elektronik.pdf

[2] Plus 4/2021, p. 474-488

[4] www.kp.ru/daily/26994/4054881/

[5] www.garant.ru/products/ipo/prime/doc/73340483/ (in Russian)

[6] www.tadviser.ru, Microelectronics section, Russian market

[7] https://emails.ipc.org/links/IPC-Manufacturing-Ecosystem-Decision.pdf