The order books in the mechanical and plant engineering sector filled up strongly in March. Orders increased by 29% in real terms compared to the previous year.

Not only did foreign countries record a significant increase of 34%, but the domestic market also posted a pleasing result (+20%). "On the one hand, the coronavirus pandemic already left its first traces in the order books in March of last year, so the basis for comparison is correspondingly low. On the other hand, companies are now benefiting from the fact that incoming orders are clearly accelerating," explained VDMA Chief Economist Dr. Ralph Wiechers. Orders from the eurozone rose particularly strongly in March (+43%), while orders from non-euro countries increased by 30%.

For the first quarter of 2021 as a whole, this results in real growth in incoming orders of 9% compared to the previous year. Domestic orders remained unchanged in this period, while orders from abroad increased by 15%. An increase of 18% was recorded from the euro countries and 13% more orders came from non-euro countries. "It is also positive that the orders are significantly increasing the utilization of machine capacities again," added the VDMA chief economist. While the figure was still at 79.9% in January, it reached 86.3% in April, slightly exceeding the long-term average of 86.1% for the first time since July 2019. "At the same time, however, production bottlenecks due to shortages of key supplies increased. This is sand in the gears of an otherwise pleasing recovery," warned Wiechers.

Cautiously optimistic outlook for electronics machinery manufacturers for the 2021/2022 financial years

Most companies started the new year with a high level of incoming orders and the outlook for the year as a whole is optimistic overall.

The situation on the materials side is viewed with concern. One example of this is the shortage of steel and 30 to 40-week delivery times on the distribution side for electronic components, resulting in production disruptions.

Business developments have become more volatile due to concerns about the next wave of the pandemic combined with the general shortage of materials and their transportation media.

Since 2020, the VDMA trade association EMINT (Electronics, Micro and New Energy Production Technologies) has been conducting a business climate survey among its member companies twice a year, in which the companies give their assessment of the order backlog, sales expectations, investment levels in research and development, the employment situation, personnel development, price development of their systems, returns on sales, measures to increase competitiveness, the distribution of sales by country and the effects of the Covid-19 pandemic.

The four departments Battery Production, Micro Technologies, Photovoltaic Production Equipment and Productronics (electronic machine construction) are united under the umbrella of the EMINT trade association.

The effects of the Covid-19 pandemic(Fig. 1): On the supply side, companies see mainly minor and noticeable effects, with noticeable effects expected in the future.

Fig. 1: shows the assessment of electronics machinery manufacturers in March 2021 regarding the impact of the Covid-19 pandemic on orders and supply, the current order situation, sales expectations for 2021 and 2022 and the distribution of sales by country

Fig. 1: shows the assessment of electronics machinery manufacturers in March 2021 regarding the impact of the Covid-19 pandemic on orders and supply, the current order situation, sales expectations for 2021 and 2022 and the distribution of sales by country

The order situation is largely considered to be better than in the same period of the previous year.

Turnover expectations are between 5% and 10% for 46% of companies. Further increases in turnover of between 10% and 30% are expected for 2022. This means that expectations are above the previous year's average figure of 4.9%.

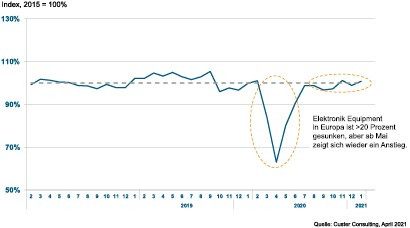

This assessment goes hand in hand with the development of production volumes in Europe(Fig. 2): Here, production fell by more than 20% in April 2020, but has risen steadily again since May and is now back to pre-crisis levels.

Fig. 2: Production volume of electronic equipment in Europe (January 2021)

Fig. 2: Production volume of electronic equipment in Europe (January 2021)

The distribution of sales by country has shifted further towards Asia: with a share of 37%, Asia is ahead of Germany and Europe. In September last year, Germany was still ahead of Europe (29 %) and Asia (16 %) with just under 41 %. This trend could be due to the rapid recovery of the Chinese economy from the Covid-19 pandemic.

Around 50% of companies are investing >10% of their turnover in research and development this year; in September 2020, more than 70% invested between 5% and 10% in this area.

Over 50% of companies are aiming to increase their workforce, but > 20% are also planning to reduce staff.

The price situation for their machinery and equipment is rated as good by the majority of companies. The majority of companies also report a very good to satisfactory earnings situation. In terms of measures to boost earnings, the focus is on increasing efficiency by optimizing production and logistics processes as well as increasing sales. To increase competitiveness, companies are concentrating primarily on research and development activities.

Opportunities for innovation and growth through digitalization and electrification

Digitalization and decarbonization of society are strategic goals of the EU and in order to achieve these, the European Commission is offering investments in the high double-digit billion range. Digitalization goals include developments in 5G/6G, cloud computing, big data, artificial intelligence (AI) and connectivity. Green energy generation (solar and wind energy), electromobility through the replacement of the combustion engine with the electric engine in combination with car sharing through 'Mobility-as-a-Service' are contributing to decarbonization.

These new infrastructure developments bring opportunities for the production of semiconductors, batteries, sensors and electronic engineering, among other things. The European Commission, for example, has set itself the goal of doubling semiconductor production capacity to 20% of the global market by the end of the decade.

We want to take a closer look at electromobility and autonomous driving, the latter made possible by advancing connectivity:

Electromobility

Electronics are increasingly finding their way into vehicles, starting with the conventional combustion engine and increasingly through the electrification of the drivetrain. Electromobility places demands on assembly and connection technology, such as high reliability, increasing voltages and currents, batteries, which in turn require intelligent thermal management, e.g. through copper inlays. Energy efficiency, recovery and reduction are further important challenges in addition to weight and volume reduction.

Autonomous driving

Progressive miniaturization is continuing, from ECUs to PCBs in the direction of increasingly complex 'sensor fusion boards'. On the product side, this goes hand in hand with the growth in functionalities, with software playing an increasingly important role when it comes to implementing a wide range of variants and functions.

Memory solutions for automotive applications must ensure reliable operation even under extreme conditions: strong temperature fluctuations, sudden voltage interruptions and environmental influences.

The increasing variety of infotainment and dashboard applications in vehicles today requires significantly higher storage capacities than in the past, and so the demand for fast and high-capacity storage media is driving the development of embedded products.

Sensors are delivering ever larger amounts of data due to V2X communication and camera systems with ever greater resolution for all-round visibility. Increasingly networked systems require reliable protection of the electronics, which entails the need for trust in secure chips (protection against data theft).

This is a shift from a hardware-oriented industry to a software- and data-focused one with new functionality through wireless networking and 5G high-speed data transfer.

In order to identify technical industry-specific trends and their significance for electronics machine and plant manufacturers, the 'AK Foresight' working group was founded within the 'VDMA Productronic' specialist department at the beginning of this year. The initial aim is to develop trend maps for productronics-specific topics.

Sources:

VDMA announcement from 6.5.2021

CEO Roundtable, productronica advisory board meeting 04.03.2021

VDMA EMINT business climate survey March 2021

Article FAZ, 28.04.2021, "We make the announcements"

"SEMI Technology Policy Group Call", 01.12.2020

Custer Consulting Group