Even though the price of copper has stabilized - at a high level - the shortage of the metal remains a challenge for the PCB industry. PLUS has collected voices from the industry and dares to take a look at the background. The situation is complex: demand is increasing due to e-mobility and decarbonization, while the Covid-19 pandemic, supply bottlenecks and upheavals in copper mining are putting pressure on supplies.

E-cars require around three times as much copper as vehicles with combustion engines (©Wellnhofer Designs - stock.adobe.com)A theft with tragic consequences: Because unknown thieves stole around 100 meters of copper cable from a cement plant in Hanover in June, production had to be suspended for several weeks. The reason was a short circuit, which not only damaged an important excavator, but also seriously injured one of the thieves[1].

E-cars require around three times as much copper as vehicles with combustion engines (©Wellnhofer Designs - stock.adobe.com)A theft with tragic consequences: Because unknown thieves stole around 100 meters of copper cable from a cement plant in Hanover in June, production had to be suspended for several weeks. The reason was a short circuit, which not only damaged an important excavator, but also seriously injured one of the thieves[1].

The case is an example of a series of spectacular copper thefts reported by the police. Power cables, gutters, car parts, pipes and electrical devices of all kinds are stolen and then gutted.

The coveted target is always the same: copper. The steep rise in the price of the metal since the beginning of 2020 has made copper thieves increasingly creative and willing to take risks. This is because copper scrap has long been a sought-after commodity. Criminals in South America are even more ruthless and professional: In Chile, they seized a convoy of copper plates worth the equivalent of 600,000 dollars in August 2021 - using military weapons and drones[2].

The situation on the global market has eased since May 2021. At that time, a tonne of copper cost up to $10,700 - prices are now close to $9,500 with a slight downward trend. However, a continuing shortage of copper and a corresponding price level of around $10,000 per tonne is to be expected, as Hans-Joachim Friedrichkeit predicted in our magazine back in the summer[3].

In his article, Friedrichkeit dealt with two key reasons for the tense situation on the copper market: the hunger for raw materials of the People's Republic of China, which, together with other Asian countries, consumes 70 % of the copper smelted worldwide. But also the galloping rise of electromobility and the battery production required for this, which is causing demand for copper foils and cables to increase exponentially.

According to a study by the IDTEchEx Report, which was commissioned by the International Copper Association (ICA), more than 250,000 tons of copper per year will be used as part of the windings in electric traction motors in electric vehicles by 2030[4]. This will inevitably have an impact on the global market - and exacerbate the supply bottlenecks that have become even more apparent as a result of the Covid-19 pandemic.

Blocked bottleneck in Ningbo

Ningbo-Zhoushan, the world's busiest port - an important terminal here had to close for weeks due to coronavirus (©chungking - stock.adobe.com)In mid-August 2021, the partial closure of the world's largest port, Ningbo-Zhoushan (Shanghai), due to a coronavirus incident caused a shortage of raw materials. After a port worker tested positive for the virus despite having been vaccinated with the Sinovac vaccine, the important Meishan terminal remained closed for weeks: nothing worked[5]. When it reopened, 68 container ships were already waiting to be cleared - a serious traffic jam that can only be eased slowly.

Ningbo-Zhoushan, the world's busiest port - an important terminal here had to close for weeks due to coronavirus (©chungking - stock.adobe.com)In mid-August 2021, the partial closure of the world's largest port, Ningbo-Zhoushan (Shanghai), due to a coronavirus incident caused a shortage of raw materials. After a port worker tested positive for the virus despite having been vaccinated with the Sinovac vaccine, the important Meishan terminal remained closed for weeks: nothing worked[5]. When it reopened, 68 container ships were already waiting to be cleared - a serious traffic jam that can only be eased slowly.

The pandemic is only narrowing a bottleneck that has been known for some time. According to a flash survey by the Association of German Chambers of Industry and Commerce, supply chain difficulties (lack of containers and insufficient freight capacity on water, rail, road and in the air) as well as significant price increases for primary products and raw materials are causing serious problems for companies in all sectors and of all sizes. According to DIHK head of foreign trade Volker Treier, "they are affecting the German economy across the board." [6]. A quarter of the companies surveyed had to reduce or even halt production because suppliers were unable to keep their promises, resulting in longer waiting times and increased planning costs.

PCB producers worried

The market situation is also affecting the PCB industry, which is heavily reliant on copper as a raw material. "In general, the supply of materials is currently very tight," Bernd Schröder, Head of Production at Würth, told PLUS. "However, we recognized this in good time, ordered our materials in good time and concluded supply contracts, which gives our suppliers planning security."

Leiton, on the other hand, believes that the price trend has already peaked. "The worst seems to be over for now," estimates Managing Director Marcus Knopp. "After sharp price increases for FR4 at the beginning of last year, there are now even slight price reductions here and there. Major difficulties in material procurement now mainly arise when unusual material combinations are required, for example very thin inner layers with thick copper. Delivery times are often long and prices are high - and there are minimum purchase quantities."

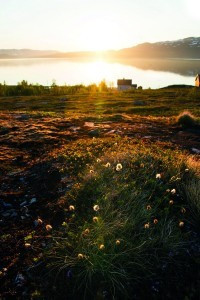

A mining project in the untouched nature of the Repparfjord (Norway) met with fierce rejection (Image: Natur og Ungdom/Creative Commons)Eberhard Heiser, Managing Director at Fela, is also concerned about the supply difficulties for parts and materials from Asia. He told the Neckarquelle/Südwest Presse newspaper that he feared that the industry would have to be increasingly patient with glass fibers, copper foil and special hardeners and accept much higher prices. At the moment, delivery times of over a year have to be accepted and it is not even known what price will ultimately be asked for the goods[7].

A mining project in the untouched nature of the Repparfjord (Norway) met with fierce rejection (Image: Natur og Ungdom/Creative Commons)Eberhard Heiser, Managing Director at Fela, is also concerned about the supply difficulties for parts and materials from Asia. He told the Neckarquelle/Südwest Presse newspaper that he feared that the industry would have to be increasingly patient with glass fibers, copper foil and special hardeners and accept much higher prices. At the moment, delivery times of over a year have to be accepted and it is not even known what price will ultimately be asked for the goods[7].

For PCB manufacturer MEKTEC, the problem of delivery times for copper foil has always existed. However, the company told PLUS that the existing gap has widened significantly in view of delivery times of around 45 weeks as a result of a "sharp increase in demand from the renewable energy and electromobility sectors." An electric vehicle requires four times as much copper as a combustion engine. If a 'force majeure' event such as the German flood disaster in July 2021 also occurs, which caused several rolling mills to shut down, the bottleneck will become even more acute. MEKTEC is now observing "a rethink in the downstream value chain". Word has got around that "bringing forward or increasing ordered quantities at short notice, even in the form of partial deliveries, is practically no longer possible". People are no longer asking how missing copper material can be "replaced 1:1 with market-available stocks of the same material from other sources", but are rather examining "which of the currently available materials is basically suitable for the required function." The willingness to use alternative materials is increasing - and customers are more willing to bear the additional costs of special procurements. "This very clearly suggests that the seriousness of the situation has been understood throughout the supply chain and that a lack of flexibility would mean further disruptions," concludes MEKTEC.

The copper shortage also poses a challenge for the PCB industry in China. Shenzhen-based MOKO Technology told PLUS that the shortage has been felt for some time: "Many materials in PCB manufacturing require copper, so electronic components and lead time have been affected by the shortage of copper, leading to an increase in PCB price." Corresponding delays due to copper shortages occurred mainly in May and June and affected the lead time of some products. MOKO was only able to guarantee normal deliveries again from July onwards. The PCB manufacturer is now positive about the future: "The shortage has eased as China continues to pursue a strategy for copper reserves. Copper prices have slowly fallen since July, as have prices for copper-related electronic components. Currently, there is no shortage of copper in the market, the production cycle of factories is not affected by shortages, although the price of related components is still higher than at the beginning of the year." Due to years of production experience, MOKO Technology can respond relatively well to fluctuations in material prices: "We have a large inventory of all kinds of materials, including a large number of copper-containing electronic components. The copper shortage has affected our production, but we have ensured normal delivery of most orders."

So is the worst over? Hans-Joachim Friedrichkeit is skeptical. He believes it is likely that the current copper shortage will prove to be structural [8]. In fact, several factors are influencing the future market trend.

Copper mining on the brink of change

Overall, copper mining is facing major upheavals. As announced at the 17th World Copper Conference in Santiago, 200 copper mines are set to close worldwide by 2035. Price increases and supply bottlenecks have been foreseeable for years [9]. In contrast, there are plans to expand existing mines from 2023 and develop new mining capacities of around 250 million tons of copper [10]. However, this is proving increasingly difficult. Copper mining is considered to be "particularly dirty, toxic and dangerous" [11], and society is increasingly unwilling to accept the serious environmental and social impacts of mining.

One example is the controversial Dominga mining project of the Chilean company Andes Iron, which envisages two open-cast mines and a port for shipping[12]. The Reserva Nacional Pingüino de Humboldt, a marine ecosystem with high biodiversity and known for its Humboldt penguins, would be affected. The Commission for Environmental Impact Assessment (Coeva) granted approval. However, the protests against Dominga continue and the final decision of the courts is uncertain.

Around a quarter of the copper smelted worldwide is extracted in Chile's copper mines (Image: Creative Commons)

Around a quarter of the copper smelted worldwide is extracted in Chile's copper mines (Image: Creative Commons)

A prestigious project by the German Aurubis AG, which wanted to operate a 'CO2-neutral' copper mine on the polar Repparfjord with the Norwegian mining consortium Nussir ASA, recently failed. However, the 'green mine' would have destroyed the livelihoods of Norwegian Sami in the area [13]. After lengthy protests by the indigenous minority, Aurubis abandoned the project - even though its spokesperson Michael Hellemann pointed out the importance of new opportunities for copper development: "Our responsibility in the supply chain is fundamental." The approach of a mine with "zeroCO2 emissions" is therefore to be welcomed, as long as "all sustainability criteria are met" [14]. This was not the case at Repparfjord.

'Sustainable copper' as a marketing strategy

Is such 'green mining' - as propagated by Aurubis - even possible or is it pure 'greenwashing'? Since 2018, the Chilean state-owned company Codelco, from whose mines around ten percent of the copper mined worldwide is brought to light, has been making efforts to improve its environmental footprint. "Today, our customers want transparency," emphasizes Patricio Chávez, Vice President for Sustainability at Codelco [15]. In a 'Cooperation for Sustainable Copper' (Responsible Copper Initiative) with the German car manufacturer BMW, both companies committed to environmental and social responsibility in the copper industry. In 2017, Codelco presented its 'Green Copper' initiative at the copper conference in Shanghai - according to Annika Glatz from the German-Chilean Chamber of Commerce, this was a historic turning point that was "euphorically" celebrated by the copper industry as the beginning of a sustainable raw materials era. At the end of 2020, 13 large copper mining companies in Chile voluntarily committed to reducing greenhouse gases as part of the 'Consejo Minero'[16].

So far, 'green copper' has been purely a marketing tool, admits Jorge Cantallopts, chief economist at the state copper commission Cochilco, the industry's supervisory body. However, whoever is the first to implement a sustainability standard for copper will have a competitive advantage in the industry as a trendsetter [17].

Codelco is trying to do this with its 'Rajoy Inca' project, which was launched in August 2021. In the El Salvador mine, whose rich copper reserves have been known to mankind since pre-Columbian times, more than 800 million tons of the 'red gold' are to be extracted in open-cast mining - and according to Chilean President Sebastián Piñera, this will be ecologically clean and sustainable ("pero también limpio y sustentable desde lo ambiental") [18].

Copper recycling is gaining in importance

Copper mining in Chile (Luis Sandoval Mandujano - stock.adobe.com)For environmental organizations, this is pure window dressing: ethically and ecologically clean copper remains an impossibility. But this finding is Janus-faced. After all, copper is indispensable for the 'green revolution' and plays a key role in decarbonization (solar and wind energy) in the global transition to renewable resources [19]. As copper can be used again and again without losing its physical properties, this sustainable aspect is becoming increasingly important.

Copper mining in Chile (Luis Sandoval Mandujano - stock.adobe.com)For environmental organizations, this is pure window dressing: ethically and ecologically clean copper remains an impossibility. But this finding is Janus-faced. After all, copper is indispensable for the 'green revolution' and plays a key role in decarbonization (solar and wind energy) in the global transition to renewable resources [19]. As copper can be used again and again without losing its physical properties, this sustainable aspect is becoming increasingly important.

Thanks to its simple, 100% recyclability, copper and its alloys are ideal for a resource-conserving circular economy [20]. Today, recycled copper already covers 35% of global copper demand [21]. In the EU, China and Japan, more than half of all copper is now recycled after use.

Accordingly, copper scrap is now a sought-after import commodity. In the first half of 2021, China, for example, imported 821 kt of copper scrap (gross weight) from Malaysia, Japan, the USA, Thailand, Taiwan, South Korea and Italy, among others - a considerable increase of 91% compared to the previous year's imports [22]. According to market analyst Roskill, this could have a significant impact on the development of copper prices. The Chinese government is trying to achieve its green sustainability goals by increasing scrap imports. The increasing scrap deliveries are displacing imports of refined cathodes (for processors) as well as concentrates, anodes and blisters (for smelters and refineries).

The PCB industry has long since adapted to this development. "Our companies have also been recycling copper in their own plants and returning it to the cycle for some years now," Bernd Schröder from Würth emphasizes to PLUS. "As we have to assume that there will be no easing on the raw materials market in the future, the topic of recycling management remains in focus, as waste from etching processes and pre-cleaning processes through to auxiliary materials made of copper still make up a large proportion. Of course, we can't handle the reprocessing ourselves, so we are trying to develop a recycling system with our suppliers." At MOKO Technology from Shenzhen, however, this is not planned. "We will not solve the scarcity problem by recycling copper, because we cannot process copper raw materials ourselves," the company told PLUS. "What we need are copper-containing components."

The risk of labor disputes is also increasing

However, further thoughts on recycling the metal are necessary in view of the ongoing copper shortage. In addition to the supply chain problems mentioned above, labor disputes in major copper mines can also noticeably curb supplies. In mid-August 2021, for example, a large-scale trade union strike at the world's largest mine owned by Chilean copper producer Codelco was only brought to an end after tough negotiations [23]. The unions - who are admittedly aware of the growing demand for copper and the rapid rise in prices - demanded wage increases and the reversal of a cut in health benefits and risk allowances. The miners had to continue working in the copper mines during the height of the coronavirus pandemic, which claimed the lives of over 37,000 people in Chile [24].

As around ten percent of the copper mined worldwide comes from Codelco alone, a prolonged strike would have put considerable pressure on prices and supply chains. The tacit agreement reached between employees and employers pacified the three-week labor dispute and immediately eased the copper price [25]. This was followed by further agreements in some areas of copper production [26].

In view of the global market situation, however, further industrial action is to be expected - with incalculable economic consequences. "The strikes are taking place at a time when the price of copper has stabilized at a high level," summarizes political scientist Viktoria Reisch. Due to the importance of the mineral for the energy transition and the recovery of the global economy after the pandemic, "the trade unions are demanding to benefit equally" [27].

This does not apply in all countries that are important for copper mining. According to the German Mining, Chemical and Energy Industrial Union (IGBCE), the trade unions in Peru, for example, from whose mines most of the copper ore processed in Germany comes, are very weak and, despite high copper prices, find it difficult to improve the lack of occupational safety and prevent damage to the environment and the agriculture of indigenous families. The IGBCE therefore considers it "unlikely that strikes will break the supply chain" in Germany.

Nevertheless, it is likely that 'red gold' will remain scarce and expensive.

The discussion about copper shortages will continue to accompany PCB production - at least that is the assumption of the companies we surveyed.

References

[1] www.ndr.de/nachrichten/niedersachsen/hannover_weser-leinegebiet/Kupferdiebstahl-in-Hannover-Dieb-erleidet-Stromschlag,aktuellhannover8792.html

[2] www.timeline.cl/delincuentes-ocupan-pistolas-y-drones-para-el-robo-de-cobre-a-convoyes-de-fcab-en-antofagasta/

[3] Hans-Joachim Friedrichkeit, The 'gold' of the e-industry, PLUS 6/2021

[4] German Copper Institute, E-mobility: Study shows: Demand for copper will increase, www.kupferinstitut.de/studie-zeigt-nachfrage-nach-kupfer-wird-steigen/

[5] www.wiwo.de/unternehmen/dienstleister/ningbo-zhoushan-der-groesste-hafen-der-welt-hat-corona/27514582.html

[6] www.dihk.de/de/themen-und-positionen/wirtschaftspolitik/konjunktur-und-wachstum/blitzumfrage-lieferengpaesse/kernaussagen-56744

[7] www.nq-online.de/lokales/industriebetriebe-leiden-unter-materialknappheit-und-hohen-preisen_50_112025448-16-.html

[8] PLUS, issue 06/2021

[9] www.elektronikpraxis.vogel.de/knappes-kupfer-bis-2035-schliessen-weltweit-200-minen-a-704986/

[10] www.kupferinstitut.de/kupferwerkstoffe/kupfer/vorkommen/

[11] wiwo.de/unternehmen/industrie/bmw-und-codelco-oekologisches-kupfer-ist-eine-fast-unmoegliche-mission/22942198.html

[12] www.amerika21.de/2021/08/253421/umstrittenes-bergbauprojekt-chile

[13] www.spiegel.de/ausland/klimawandel-warum-die-samen-in-der-arktis-gegen-ein-co2-neutrales-bergbau-projekt-kaempfen-a-2b7d6175-2ea9-42f3-8339-a3b053cafb86

[14] www.dgap.de/dgap/News/corporate/aurubis-aurubis-und-nussir-beenden-memorandum-understanding-ueber-kuenftige-konzentratlieferungen/?newsID=1472336

[15] www.wiwo.de/unternehmen/industrie/bmw-und-codelco-oekologisches-kupfer-ist-eine-fast-unmoegliche-mission/22942198.html

[16] www.international-climate-initiative.com/de/news/article/nachhaltiger_bergbau_in_chile

[17] www.wiwo.de/unternehmen/industrie/bmw-und-codelco-oekologisches-kupfer-ist-eine-fast-unmoegliche-mission/22942198.html

[18] www.valoraanalitik.com/2021/08/24/codelco-inaugura-proyecto-rajo-inca-incrementar-extraccion-cobre

[19] www.recyclingmagazin.de/2021/08/19/kupfer-mit-schluesselrolle-in-nachhaltiger-entwicklung/

[20] Dr. Ladji Tikana, Birgit Schmitz: Copper completely reusable (article), www.kupferinstitut.de/wp-content/uploads/2021/04/Auswirkungen-der-Einfuehrung-des-EU-Rahmenprogramms-Levels-auf-die-Bauwirtschaft.pdf

[21] www.kupferinstitut.de/kupferwerkstoffe/kupfer/vorkommen/

[22] roskill.com/news/copper-chinas-scrap-rebalancing-act-threatens-to-de-rail-the-price-recovery/

[23] www.unternehmen-heute.de/news.php?newsid=6477205

[24] https://www.jungewelt.de/artikel/408737.arbeitskampf-kampf-gegen-den-riesen.html

[25] www.mining.com/copper-price-down-as-supply-concerns-fades/

[26] www.infobae.com/america/agencias/2021/09/15/chilena-codelco-alcanza-acuerdo-laboral-con-sindicato-de-division-salvador/

[27] www.amerika21.de/2021/08/253468/kupfer-bergarbeiter-streiken-chile