The global semiconductor market will have grown by 21 to 27% to a sales volume of USD 533 to 559 billion this year. The ZVEI outlined this once again at its traditional press conference on November 30, 2021. "The drivers are digitalization and the green transformation with its great demand for CO2-reducing technologies," explained Stephan zur Verth, Chairman of the Semiconductor Components Division.

TheEuropean market is participating in this growth with around 20% to USD 45 billion. Germany also recorded high sales growth of around 20% to $14 billion. The ZVEI's optimistic outlook: "In the coming year, we expect global sales to increase by between four and ten percent to between 556 and 615 billion dollars. In Europe, we expect an increase of eight percent to 49 billion dollars."

TheEuropean market is participating in this growth with around 20% to USD 45 billion. Germany also recorded high sales growth of around 20% to $14 billion. The ZVEI's optimistic outlook: "In the coming year, we expect global sales to increase by between four and ten percent to between 556 and 615 billion dollars. In Europe, we expect an increase of eight percent to 49 billion dollars."

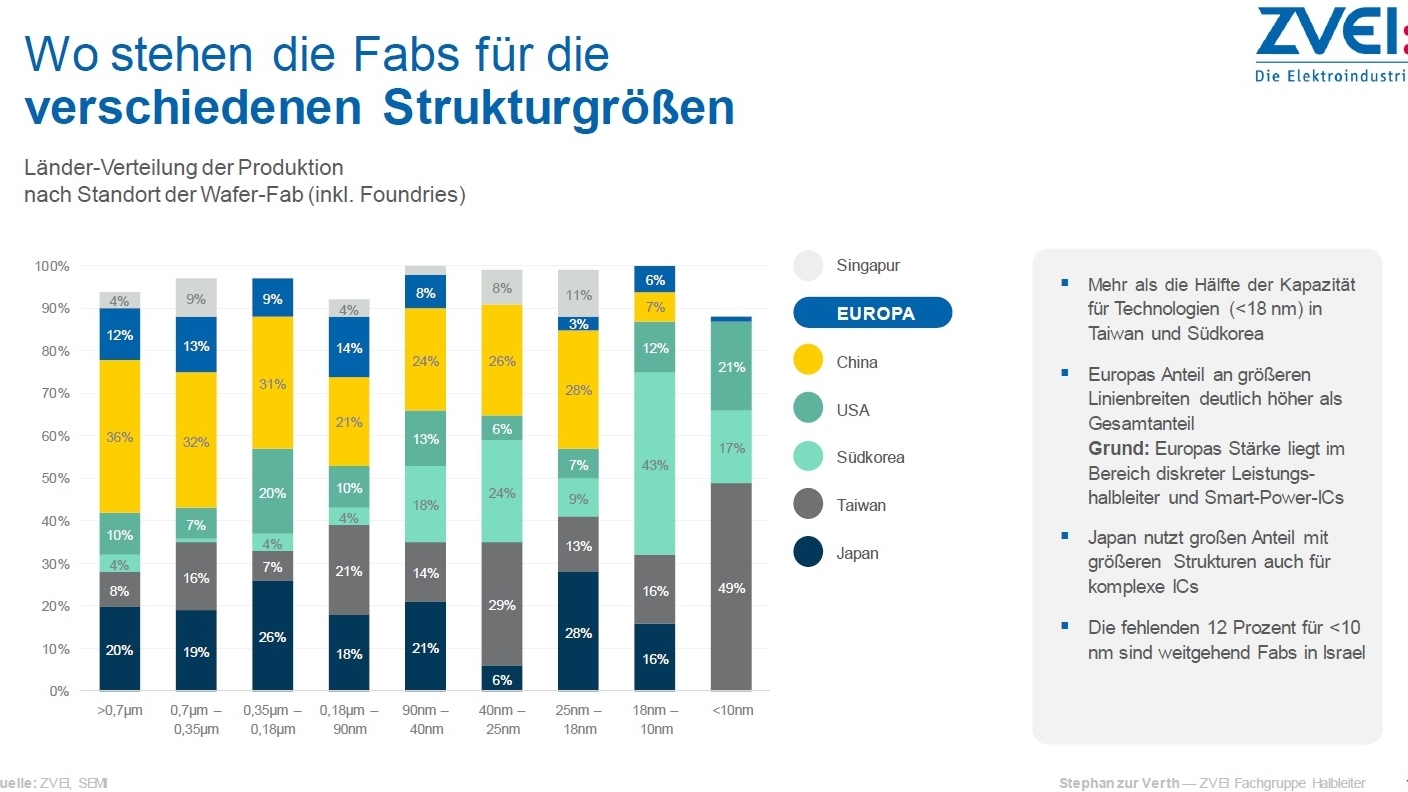

Currently, around 23% of all chips are produced in China, but for the most part not by genuine Chinese companies. just under 8% are manufactured in Europe and around 10% in the USA. Overall, US companies are still (or are again) developing 50% of all circuits, while Chinese companies only develop 5%. Europe's share is almost twice as high at 9%. However, Europe's share of global sales markets is only 9%.

To stimulate an increase in Europe's share of production, the EU Commission formulated an ambitious "political target" in March of this year: from just under 8% today to 20% by the end of the current decade. This sounds simpler than it is: with the global semiconductor market expected to double to 1 trillion US dollars, with other regions accounting for a correspondingly larger share, the ZVEI estimates that this means expanding European production capacities more than fivefold. This would only be possible with cooperative alliances and an R&D 'boost' at national and international level.

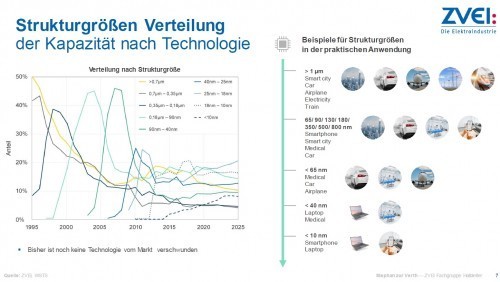

The ZVEI responds to the sometimes exaggerated focus of new production on 'leading edge' structure dimensions in the lower nanometer range by referring to the status of current applications in Europe: "This is essentially automotive manufacturing. Of the average 960 semiconductor circuits per vehicle, two thirds have structures of 130 nm and larger. In power electronics, the dimensions are above 1 µm.

On a positive note, the ZVEI notes that the coalition agreement of the next government intends to promote microelectronics as a key technology. "This is the only way that Germany and Europe will continue to be among the seven regions active in the semiconductor industry in the future," says zur Verth. According to the ZVEI, there is no short-term political solution to the current supply bottleneck. It is important to focus on medium-term funding projects such as IPCEI in order to secure Europe's technological sovereignty in the long term. "The ZVEI has been involved in IPCEI from the very beginning and is committed to ensuring that the project picks up speed." The European Chips Act and the European Industrial Alliance for Processors and Semiconductor Technology should also be tackled as quickly as possible.