In the third quarter of 2022, incoming orders in the German machine tool industry rose by 9% compared to the same period last year. Domestic orders increased by 3% and orders from abroad by 12%. In the first nine months of 2022, demand rose by 26% overall. Domestic and international orders contributed equally to this, with growth of 25% and 26% respectively.

"Orders in our industry have held up well so far despite all the adversity. Although there is a clear slowdown in growth, both September and the third quarter are positive," commented Dr. Wilfried Schäfer, Executive Director of the VDW (German Machine Tool Builders' Association), Frankfurt am Main, on the result. "Nevertheless, producer prices in the machine tool industry rose by 8 percent in the third quarter. Adjusted for prices, the result is thus stagnating. As everywhere else, inflation is eating into our growth," Schäfer continued. For the year as a whole, incoming orders are only 7% below the record volume of 2018 in nominal terms. While the record level was reached abroad, the domestic figure is a fifth lower.

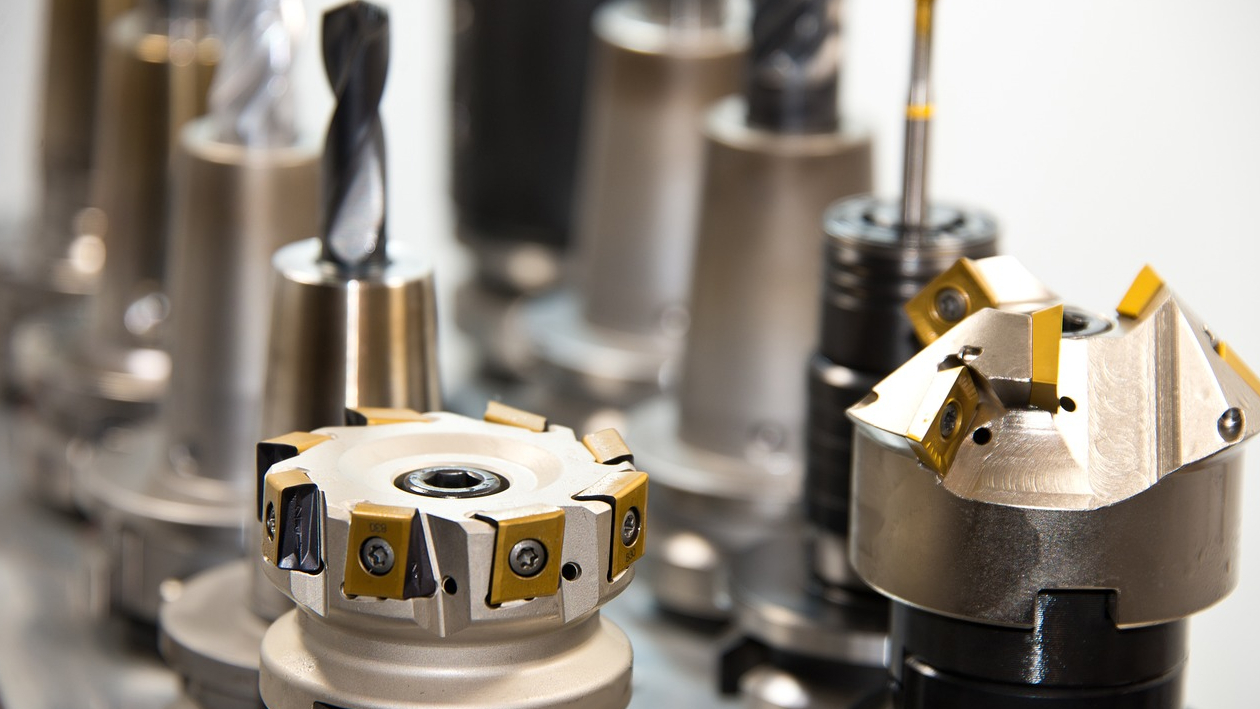

At the same time, capacity utilization rose to just over 90% in October of this year. "The supply bottlenecks are easing slightly, we assume," says Schäfer. Fortunately, turnover has also increased, by 10 percent in the first nine months. Here, machining, the larger sector in the machine tool industry with a heterogeneous customer base, is pulling ahead of forming with a 17 percent increase. It is dominated by the press sector, is frequently used in large-scale projects and shows less cyclical fluctuations. After nine months, turnover here is down by 6 percent. However, this can be explained by the strong prior-year basis. Forming technology grew by a fifth in 2021, while machining only grew by 3%.

The industry is expecting a noticeable slowdown in orders in the fourth quarter. Germany and Europe in particular are lagging behind, while Asia and America, which have been less affected by the energy crisis, are expected to provide support. "Nevertheless, we will close with a plus in production," Schäfer summarizes the outlook. The strong order backlog will ensure that production remains high because orders can only be processed slowly.