The boom in China is jeopardizing the supply chain for Europe

It is hard to imagine, but in China some PCB orders are only placed if the customer can prove the availability of laminate. No OEM wants its delivery times to be significantly overstretched because the PCB manufacturer has not ordered the base material on time.

While the industry in Europe is only slowly picking up speed at the beginning of this year, the market in China is booming. The Chinese New Year, in mid-February for the Year of the Ox, otherwise a home vacation for many millions of Chinese workers, was largely canceled. On the one hand, the central government wanted to prevent coronavirus-related infection-spreading travel with drastic quarantine periods; on the other hand, the good order situation came in handy for many manufacturers. They worked through.

Warnings from China: "order for next year"

It's better to order now for next year, was the headline of a well-known electronics weekly from Munich recently. This refers to power electronics components and especially power MOSFETs. Well-known manufacturers such as Infineon, Nexperia and STMicroelectronics are said to have increased delivery times from 16 to around 50 weeks. Vishay is mentioned with an increase in lead times from 12 to 40 weeks and Toshiba with an increase in delivery times from 14 to 28 weeks.

PCB manufacturers from Asia are warning their customers: Recently, as you know, due to the rapid increase of the price of copper, tin, and CCL at the end of last month, the PCB price is also going up quickly. As expected by the upstream material supplier (e-glass, resin, copperfoil etc.) the price will keep increasing in the following months, because the global economy is recovering gradually. I would like to kindly remind you to have a plan. If possible, place your orders soon, so that you can lock the purchasing price and delivery time as soon as possible.

Where is LP base material manufactured?

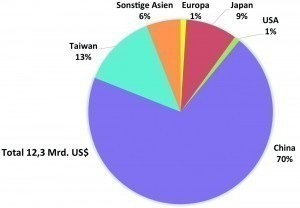

The manufacturers of base material for PCBs are located where the market is. China has long been the dominator with 70%, followed by Taiwan with a 13% market share(Fig. 1). Japan has increasingly specialized in sophisticated special materials with 9%. Europe and the USA only play a regional role with a market share of around 1% each. Fig. 1: PCB laminate in $ by manufacturer country. Total market volume $12.3 billion in 2019

Fig. 1: PCB laminate in $ by manufacturer country. Total market volume $12.3 billion in 2019

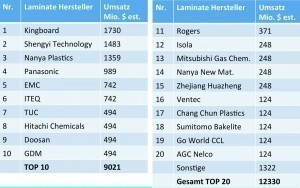

The four market leaders are Kingboard, Shengyi Technology, Nanya Plastics and Panasonic(Fig. 2). Fig. 2: Top 20 manufacturers of PCB base material worldwide 2019 sales in millions of dollars (data: NTI, Prismark 5/20; graphic: PCB-NETWORK)

Fig. 2: Top 20 manufacturers of PCB base material worldwide 2019 sales in millions of dollars (data: NTI, Prismark 5/20; graphic: PCB-NETWORK)

Nanya Plastics from Taiwan is the only fully vertically integrated laminate manufacturer. In the plant areas in China and Taiwan, there are glassworks that produce glass yarn and glass weaving plants that produce glass fabric. Other units produce copper foil and others produce their own epoxy resin. Everything together is processed into PCB base material on treaters in the laminate factories and in some cases further processed into PCBs by the company's own PCB manufacturers.

The advantage is obvious: the supply chains can be coordinated, the quality is consistent throughout and the development department has access to all processes.

Highest copper price for 9 years

There has been a supply shortage on the copper market for some time now.

A reduced supply, because many copper mines have restricted their production due to the pandemic, continues to be met by strong demand, particularly from China. The significant increase in the production of battery electric vehicles (BEV) in particular triggered the renaissance of the industrial metal. With prices of around 9,600 USD per tonne, copper has reached its highest price in nine years in recent weeks(Fig. 3). At the same time, some of the largest copper producers in Chile and Peru are warning that supply is likely to be below the recently published forecasts for the rest of the year due to ongoing pandemic-related restrictions, which is why the copper market could be heading for a supply deficit of up to

400,000 tons could be on the way. The copper price is therefore likely to remain stable in the upper price segment in the near future.

The European base materials market yesterday and today

For younger people who have only found their vocation in the PCB industry in the last 10 years, it is difficult to imagine that in 2000 there were still 7 base material manufacturers with 11 production sites in Europe(Fig. 4). On the other hand, there were also around 600 PCB manufacturers in Europe, so that the ratio was right again.

Today, the European laminate market for rigid material has a volume of around € 170 million, including special materials such as flex and HF, with a laminate area of around 5 millionm2.

Only 2 laminate manufacturers still produce in Europe, as the historic table from 2014 shows: Isola, which belongs to the US Isola Group in Düren in the Rhineland, and Panasonic Industrial Devices Materials Europe GmbH in Enns/Austria, a subsidiary of the Japanese Panasonic.

In addition, well-known laminators such as EMC, Hitachi Chemicals, ITEQ, Kingboard, NanYa Plastics, Rogers, Shengyi Technology, TUC, Ventec etc. are represented by distributors.

Distributors or smaller specialty manufacturers include Aismalibar in Spain, CCI Eurolam in France and Germany, COM.INT.EL. in Italy, Detrolam BV in the Netherlands, Göttle GmbH & Co. KG in Germany, Holders Technology from the UK and branch in Germany, MSC Polymer AG in Germany, TECHNOLAM GmbH in Germany and Ventec in the UK and Germany.

Price increases and availability

The boom in China and the shortage of raw materials for PCB laminates are having a major impact on availability and prices, as is the shortage of containers from Asia to Europe. As a result, existing customers are being supplied with a maximum of their previous average demand for base material. It is therefore no wonder that prices are in flux worldwide.

The following price increases have already been announced in Europe for deliveries from the beginning of this year:

- Rigid base material: 15 % to 35 %

- Thin laminate: 6% to 20%

- Prepreg: 5 % to 15 %

Further price increases for deliveries from April 1, 2021 have been communicated and will probably be implemented. Delivery times in Asia alone are currently 4 to 12 weeks, depending on the type of base material. This does not take into account the transportation time of several weeks from Asia to Europe.

Laminate manufacturers producing in Europe have similarly long delivery times, partly due to the shortage of raw materials. Here, of course, the long transportation route does not apply.

To the point:

- Around 70% of the LP base material volume by value is produced in China and 13% in Taiwan. Japan specializes in sophisticated special laminates with a 9% share of the global market. Europe and the USA play a regional role with around 1% each

- The growth markets for printed circuit boards over the next 4 to 5 years are IC substrates at 11.4% p.a., followed by the automotive industry at 7.1% p.a. and the communications segment at 5.4% p.a.

- The global market for base materials amounted to around USD 12.4 billion in 2019. And was led by Kingboard/China $1.7 billion, Shengyi Technology/China $1.5 billion, Nanya Plastics/Taiwan $1.4 billion and Panasonic/Japan with $1 billion

- Copper reached its highest price in 9 years at $9600 per tonne and is likely to remain at the upper end for some time due to lower production volumes

- The European LP base material market has a volume of around € 170 million p.a., with a laminate area of 5 million m²

Electronics are booming in China and South-East Asia. Cherry picking is the order of the day for products that generate the highest contribution margin. For example, copper foil for BEVs (Battery Electric Vehicles) achieves a higher margin compared to copper foil with treatment for printed circuit boards. 20 foot containers from China to Europe are scarce, ergo prices explode from $1500 to up to $10,000 with immediate availability.

This has created a toxic situation for European PCB manufacturers, as prices for rigid laminate have risen by 15% to 35%, for thin laminate by 6% to 20% and for prepreg by 5% to 15%. It is absolutely necessary to pass this on to the OEMs, otherwise the shake-out, i.e. the closure of further manufacturers, will accelerate. It cannot be in the interests of the European electrical industry if the number of local PCB manufacturers continues to shrink.

I wish you an insightful start to the second quarter!

Best regards

Yours

Hans-Joachim Friedrichkeit