Investments create market opportunities from measuring devices to base stations. The mobile phone market has also seen a dip of -15% this year. Between 2011 and 2019, sales figures ranged from 1.8 to 1.9 billion units. CCS Insight's April forecast for 2020 is 1.57 billion, with a recovery to 1.8 billion in 2021 and almost 2 billion units in the following three years.

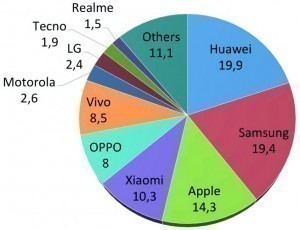

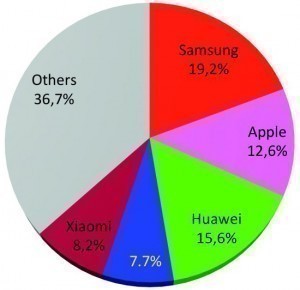

Looking at smartphones alone, sales in 2019 amounted to 1.541 billion units, with no significant growth compared to 2018. The Korean Samsung led the way in terms of market share with 19.2%, followed by Huawei (China) with 15.6%, Apple (USA) with 12.6% and the Chinese manufacturers Xiaomi with 8.2% and Oppo with 7.7%.(Fig. 1, 2)

Smartphones: China currently leads in terms of market share

Fig. 2: Smartphone market shares worldwide 2019 - Graphic: PCB-NETWORK, data: Gartner 3/20Inthe second quarter of 2020, 280 million smartphones were sold worldwide. Chinese companies have finally caught up with the long-standing global market leader Samsung. In Figure 3, Huawei leads with a 19.9% market share ahead of Samsung with 19.4% and Apple with 14.3%.

Fig. 2: Smartphone market shares worldwide 2019 - Graphic: PCB-NETWORK, data: Gartner 3/20Inthe second quarter of 2020, 280 million smartphones were sold worldwide. Chinese companies have finally caught up with the long-standing global market leader Samsung. In Figure 3, Huawei leads with a 19.9% market share ahead of Samsung with 19.4% and Apple with 14.3%.

The effects of the US trade dispute with China on semiconductors and software will be exciting in the future. After Intel, the Taiwanese chip giant TMSC is now only supplying Chinese smartphone manufacturers in the phase-out of existing orders. It will probably take until mid-2021 before stocks in China are exhausted.

According to the latest TrendForce forecasts, Huawei will lose significant market share to Samsung towards the end of this year for the aforementioned reasons.

Android world market leader in operating systems

While there were four operating systems in 2010, this has been reduced to two today. In 2010, Android had a market share of 23.3 %, Apple's IOS 15.6 %, Blackberry 16.0 %, Windows Phone 4.9 % and others 40.2 %. Last year, Android accounted for 86.6% and IOS for 13.4%. Nobody is talking about Blackberry, Windows Phone and others anymore. The US-China trade dispute will also be exciting here, as China will have to create substitutes for various software packages, meaning that the world could become more diverse again.

5G smartphone production is picking up speed

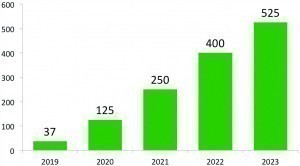

Only 2.5% of all smartphones produced in 2019 were 5G-capable(Fig. 5). This share is expected to grow by a factor of 10 to 400 million devices within the next three years. After smartphone sales have shown little growth in recent years, the 5G network could create new hype here.

5G: Cards reshuffled - infrastructure investments double

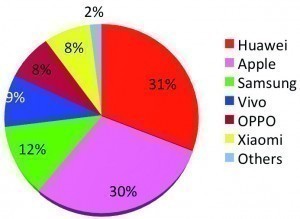

According to a new forecast by Trendforce, the market share of 5G-capable smartphones this year will show a neck-and-neck race between Huawei (31%) and Apple (30%)(Fig. 4). Samsung is initially trailing in third place with 12%, followed by the Chinese manufacturers Vivo (9%), OPPO (8%) and Xiaomi (8%).

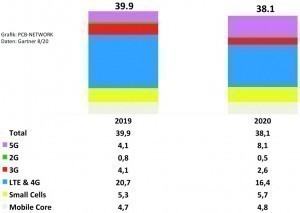

Figure 6 forecasts infrastructure investments of USD 39.9 billion in 2019 and USD 38.1 billion in 2020. The currently still dominant LTE & 4G investments will fall from $20.4bn to $16.4bn this year. Conversely, 5G investments will double from USD 4.1 million to USD 8.1 million.

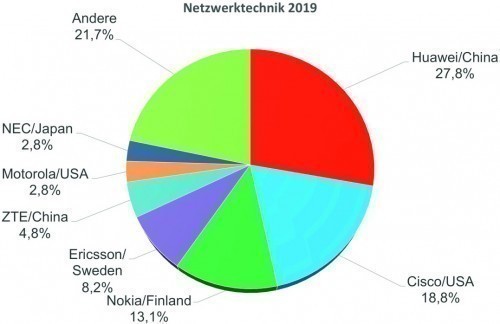

In network technology(Fig. 7), the Chinese companies Huawei and ZTE dominate the global market with a 1/3 share of sales. It is no wonder that the USA is reacting huffily when the key technology of communication is dominated by China and its intelligence services.

To the point :

- 1.54 billion smartphones were sold last year. The leader in terms of market share was Samsung with 19.2%, followed by Huawei (China) 15.6% and Apple (USA) 12.6% as well as the Chinese manufacturers Xiaomi 8.2% and Oppo 7.7%.

- In Q2 2020, Huawei was the global market leader with a market share of 19.9%, ahead of Samsung with 19.4% and Apple with 14.3%, with total sales of 280 million units.

- Production of 5G smartphones is picking up speed rapidly. After 37 million units in 2019, more than 10 times this figure (400 million units) is expected to be produced by 2022.

- In terms of operating systems, Android currently dominates with 87%, ahead of Apple's IOS with 13%. Blackberry, Windows Phone and others have disappeared from the market.

- In terms of infrastructure investments, 5G spending will double to USD 8.1 billion this year according to a new Gartner estimate. In contrast, the still largest investments for LTE & 4G networks continue to decline to $16.4 billion.

Fig. 7: Market share (revenue) network technology world 2019 -Chart: PCB-NETWORK, data: IT Candor

Fig. 7: Market share (revenue) network technology world 2019 -Chart: PCB-NETWORK, data: IT Candor

The impact of the trade conflict between the USA and China on smartphone market shares, operating systems and network technology will be exciting. The US ban on supplying certain high-performance chip processors to China has long since been bowed to by the largest US manufacturers such as Intel. Taiwan Semiconductor Manufacturing Company (TSMC), the world leader in semiconductor contract manufacturing and design, has also followed the ban. Only existing orders will be delivered. The same applies to operating systems, certain software packages and chip manufacturing equipment. Whether this will slow China down in the longer term remains to be seen. In any case, a critical attitude towards the social conditions in China is not inappropriate.

I wish you a bold start to the 4th quarter

Yours sincerely

Hans-Joachim Friedrichkeit