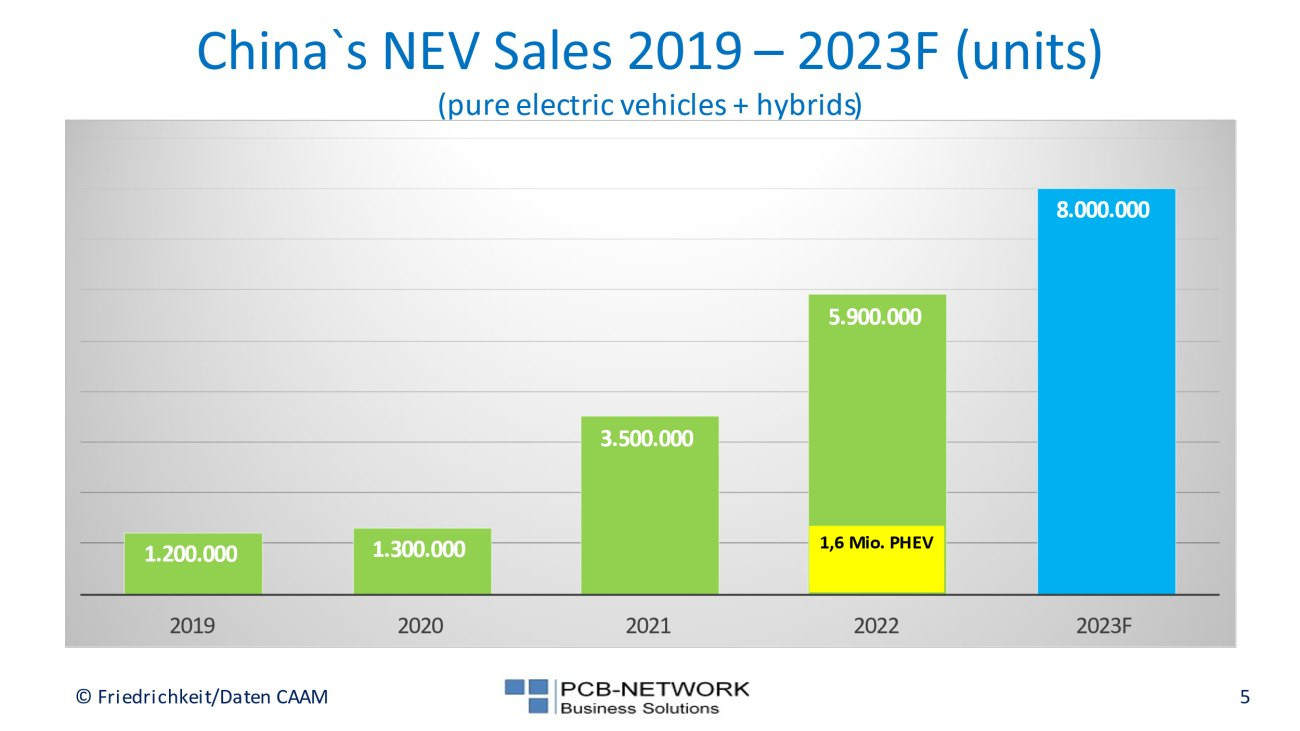

In China, the world's largest car market with 23.5 million cars, German brands sold around 4.4 million vehicles in 2022, primarily combustion engines. This corresponds to a market share of 19% of the Chinese passenger car market. However, electrification in China is becoming a game changer with 5.9 million new electric vehicles (NEV) (Fig. 1), of which 1.6 million were plug-in electric vehicles (PHEV). German brands were involved with a full 250,000 e-cars, a modest 4.2% market share.

The China Association of Automobile Manufacturers (CAAM) forecasts around 8 million NEVs for 2023. By 2030, more than 50% of newly registered cars could be new electric vehicles.

Fig. 1: China's NEV sales 2019 - 2023F in units, pure electric vehicles + hybrids

Fig. 1: China's NEV sales 2019 - 2023F in units, pure electric vehicles + hybrids

VW loses market leadership in China

For years, Volkswagen was the market leader for combustion vehicles in China. Around 39% of all Volkswagens were sold in China in 2022. The Volkswagen Group sold 8.3 million vehicles worldwide.

Just behind China with a 38% share of sales is VW's home market of Europe and the USA with 16%(Fig. 2) .

The loss of sales in China is painful for VW(Fig. 3). In the years 2017 to 2019, the tipping point was reached with 4.2 million combustion vehicles. Last year, there were 1 million fewer vehicles, with total global production of 8.26 million cars. "Peak China?" asked the Economist on its front page in May.

German e-cars flop in China

Volkswagen's whole dilemma becomes clear when you look at the sales figures for the first quarter of 2023. While BYD, the new market leader, sold 550,000 e-vehicles, Tesla still managed 230,000 NEVs, but FAW-Volkswagen only 40,000 sales. No wonder the car bosses in Wolfsburg are more than nervous.

Volkswagen produces its ID 3 and ID 4 e-models in China. They are therefore not export vehicles from Germany or Europe.

The combustion engine market share of 20% in China will melt away like ice in the sun over the next few years with rapidly growing electrification.

The Chinese government has set itself the goal of NEVs, which include battery-powered and hybrid electric vehicles (EVs), accounting for 20% of new car sales by 2025.

"By 2030, the share of NEVs in new registrations in the Chinese market could reach 70%. Chinese brands have overtaken other brands on a technical level," said Wang Chuanfu, CEO of Chinese NEV manufacturer BYD, at an industry conference in the south-western Chinese city of Chongqing.

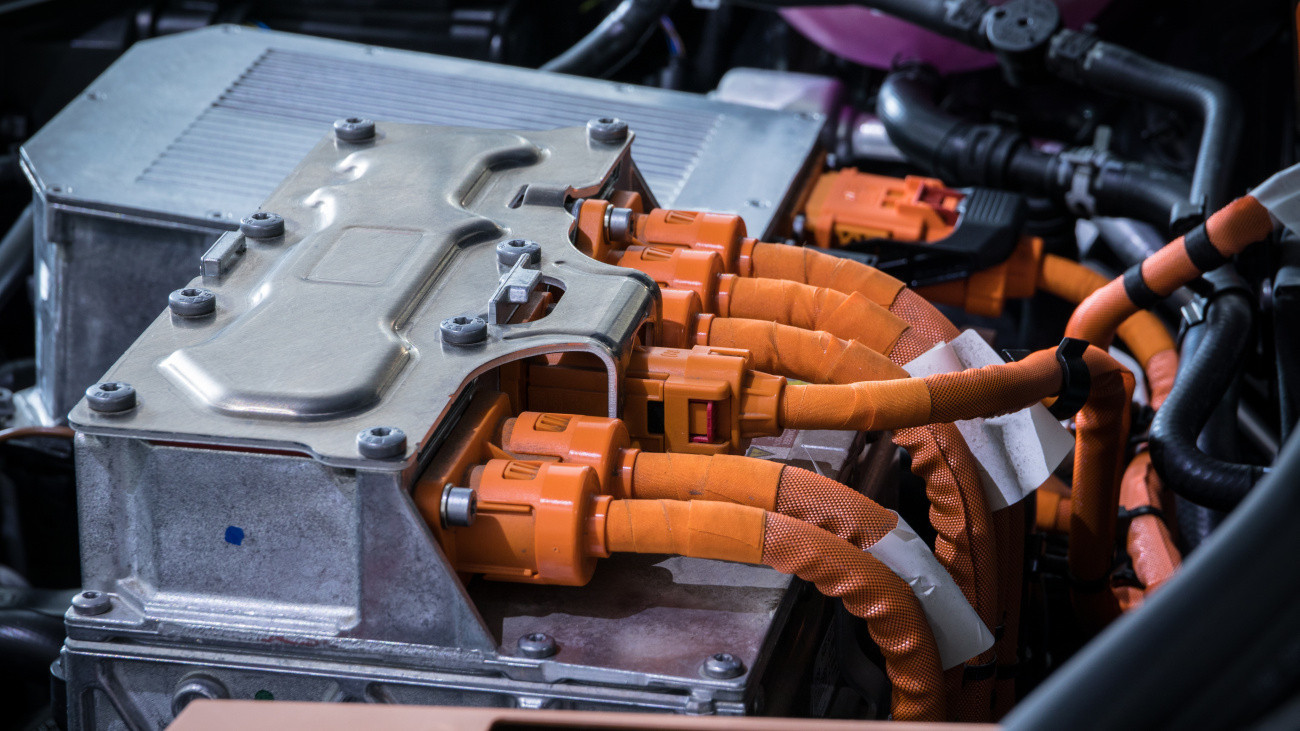

Fig. 4: Cables connect the electric motor, inverter, traction battery and air conditioning compressor

Fig. 4: Cables connect the electric motor, inverter, traction battery and air conditioning compressor

Growth market for automotive components for electric cars

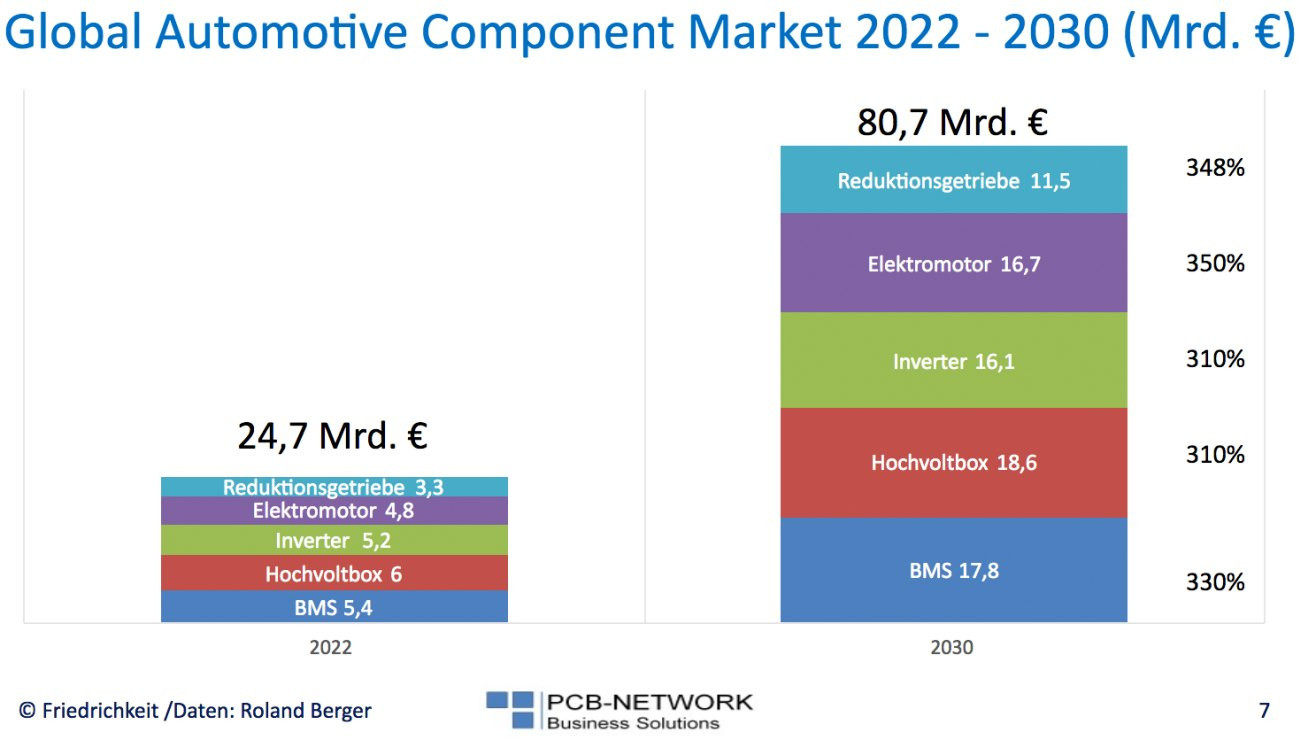

According to a study by Roland Berger, the global market for key components for electric cars is worth €24.7 billion. These are the battery management system (BMS) and the high-voltage box or power electronics. Furthermore, the inverter, which converts direct voltage into alternating voltage, and the electric motor. All these components have a significant influence on the power consumption in KWh per 100 km, but also on the charging speed of the battery.

As electrification progresses, the global market volume is expected to grow to €80.7 billion by 2030, i.e. by 310% to 350% depending on the component family.

Insourcing, how VW wants to take work away from its suppliers

At the beginning of electrification, there were plenty of studies on how many jobs would be lost in the automotive industry. Manufacturers of pistons, dual-clutch gearboxes, exhaust systems or injection pumps and many other mechanical parts are said to be looking for alternatives.

A modern combustion engine with transmission has around 1400 parts, while an electric drive and battery have 200 to 250 components. A correspondingly large amount of work content or added value is lost.

The Volkswagen Group is therefore justifiably concerned about the employment of its employees. The key word is "insourcing". From 2025, VW wants to produce significant parts of the electric drivetrain itself. A power electronics center was recently opened at the Kassel plant with 17,000 employees.

Large and small suppliers such as Zahnradfabrik Friedrichshafen (ZF), Bosch, Vitesco, Mahle, Valeo etc. have been startled.

Tesla and the Chinese manufacturers Nio and BYD have long been using insourcing.

The plan to extract added value from suppliers is not only being implemented by Volkswagen. BMW is already using inverters developed in-house for the iX e-SUV and Mercedes is also looking into producing its own power electronics components.

Bosch and Valeo are currently supplying the inverters for the Volkswagen MEB series. According to the French market research company Yole, the ID 3 inverter from Valeo costs US$ 1095, while BMW's own inverter is said to cost over US$ 5400.

Costs and quality between in-house production and external specialized suppliers will set the course.

In a nutshell

- VW Group, BMW and Mercedes sold 4.4 million passenger cars in China in 2022 out of a total Chinese market of 23.5 million passenger cars.

- New Electric Vehicle (NEV) accounted for 5.9 million BEV and PHEV. The German market share amounted to 250,000 vehicles, corresponding to 4.2 %.

- Volkswagen is losing market leadership to BYD due to electrification. The sales share in China of 39% last year is existential for Volkswagen.

- Volkswagen has also already lost 1 million passenger cars in the combustion market. 4.2 million passenger cars were sold in 2019, compared to 3.2 million in 2022.

- The global market for components for the e-car market is expected to grow by more than 300% from €24.7 billion in 2022 to €80.7 billion by 2030.

With 800,000 employees, the automotive market in Germany is not only the largest employer, but also the only industry of global significance. China is a substantial market for Volkswagen, Mercedes and BMW, accounting for 39% to 33% of their own sales, and therefore also for the German economy. The flopping of German e-cars on the Chinese market in the first quarter of this year, with market share slipping from 20% (combustion engines) to 4% (e-cars), is a cause for great concern. Added to this is the transformation away from the combustion engine with the loss of work content, 1400 components versus 200 components for e-cars.

The European Parliament could simply pass a ban with the "combustion engine phase-out from 2035", but where is the alternative strategy? As the Handelsblatt wrote "Germany is suppressing its problems. China meanwhile the competition"

I wish you a successful start to the second half of the year

Best regards

Yours

Hans-Joachim Friedrichkeit