In issue 1/2023, Dr. Nakahara began his column on the up-and-coming PCB industry in Southeast Asia, which is becoming increasingly important. After taking a close look at Thailand, China and Taiwan, our columnist now turns his attention to Vietnam, India and Malaysia. Nakahara is probably the only PCB expert to have traveled extensively in these countries - over many years - and reports on the vibrant developments he has been able to discover.

Vietnam

Taiwanese manufacturers have been talking about new plants outside China for at least 15 years. The major Taiwan-based PCB manufacturers Chin Poon, APCB and APEX have been operating in Vietnam for many years. However, there is also a small Taiwan-based manufacturer, Sung Ching Electronics, which mainly produces SSBs in Vietnam near Ho Chi Minh City. With Xi Jing Ping elected for a third term as China's head of government, it is expected that he will rigorously enforce further lockdowns due to the zero Covid policy. This will likely lead to even more Taiwanese manufacturers setting up new PCB plants in freer countries in Southeast Asia instead of China.

Vietnam's PCB industry was dominated by the Japanese until a few years ago. When Samsung Electronics built two smartphone factories in succession in Bac Ninh and Thai Nguyen, both about an hour north of Hanoi(Fig. 1), more than a dozen South Korean PCB manufacturers, mainly flexible PCB producers, rushed to build new factories in Bac Ninh and the surrounding area.

The Samsung Electro-Mechanics PCB plant (SEMCO) is located on the Samsung Electronics campus in Thai Nguyen. It manufactured HDI and rigid-flex boards, but SEMCO stopped production of these products and converted the existing plant to manufacture advanced flip-chip BGA products with an investment of about $1 billion, partly with support from Intel. When Apple introduced OLED for iPhones a few years ago, the driver circuit was realized on a rigid-flex PCB supplied by SEMCOM Vietnam, BH Flex and Interflex, all South Korean manufacturers. The reasons for choosing the rigid-flex solution were the lower costs. Now SEMCO is out of the running and Apple is said to be looking for a third supplier. TLB from South Korea is building a new plant for module circuits (IC substrate-like PCBs) near Hanoi.

Nitto Denko is investing around $600 million over the next few years to expand its production capacity for flexible circuits in Vietnam (near Hanoi) and in Japan, but probably more in Vietnam. The Japanese company Kyosha built a plant for double-sided printed circuit boards south of Hanoi in 2021 and has recently started to further increase its production capacity until 2023. The Kyosha Group has been active in the field of PCB production for over 50 years. It is one of the leading PCB manufacturers in Japan, although it is nowhere near the sales of the Japanese board producers at the top of the NTI 100 list. According to the 2015 NTI-100, the Kyosha Group ranked 80th on the list in terms of sales in 2015. In NTI-100 for 2021, the group ranked 90th with a turnover of $196 million.

In addition to Vietnam, Kyosha has four other production sites: two in Japan (Kyoto and Kyoshu) and one each in China (Guangzhou) and Indonesia (Jakarta). The Group's total capacity amounted to over 400,000 m2 per month in 2020 and is likely to have increased significantly with the new building in Vietnam.

Meiko Electronics has two production sites for printed circuit boards in Vietnam: Thac Tat and Thanh Long, both north of Hanoi. The manufacturer expanded further with the construction of the 4th plant in Thac Tat. In Thanh Long Industrial Park 1, Sumitomo Electric Industrial has an efficient factory for flexible circuits. Mektec Vietnam is located in Thanh Long Industrial 2, about 55 km southeast of Hanoi. Thanh Long is also spelled 'Thang Long'. Vietnam is a large production country for flexible printed circuit boards.

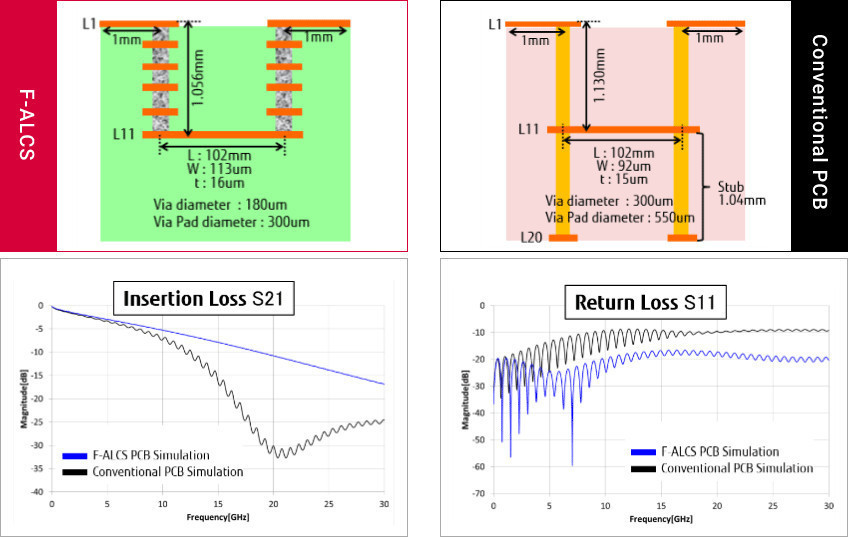

The first ever foreign PCB factory was built by Fujitsu near Ho Chi Minh City. Fujitsu Vietnam is now owned by a Japanese investment company and is called FICT Vietnam. The manufacturer promotes the advanced F-ALCS structure technology(Fig. 2). It enables both high-speed signal transmission and high-density wiring capacity for better product competitiveness.

F-ALCS ensures highly reliable connections between vias through paste filling and metal bonding, enabling more than twice the wiring density than before. According to the company, it is ideal for difficult designs that were previously considered impossible. The company writes that F-ALCS can reduce manufacturing process steps by 50 percent and reduce PCB design constraints, ultimately reducing the number of design process steps. This means a drastic reduction in production lead time and short delivery times [2].

Fig. 2: Comparison of the transmission characteristics of a conventional and an F-ALCS PCB

Fig. 2: Comparison of the transmission characteristics of a conventional and an F-ALCS PCB

Malaysia

TTM Technologies from the USA (ranked 7th in NTI-100 for 2021) laid the foundation stone for the construction of a multilayer plant in Penang on April 25, 2022, with an initial investment of $130 million. The plant is located near Ibiden Penang. Looking ahead to November, construction work appears to be progressing as planned, meaning that the total revenue of $2.249 billion from 2021 could be even higher by the end of 2022. Whether the group will rise in the NTI 100 list rankings in 2022 remains to be seen, as the board manufacturers ahead of it, Tripod (rank 6) and Compeq (rank 5), are also investing, but in China.

Many are aware of the EUR 1.8 billion investment in advanced package substrates by AT&S in the Kulim Hi-Tech Park in Kedah, about 25 km east of Penang(Fig. 3). As in the case of SEMCO Vietnam, part of the investment sum is provided by Intel. AT&S generated total revenue of $1.895 billion in 2021 according to the NTI-100. The Group will probably move up from 11th place in 2021 in 2022 due to its huge investments - if everything goes according to plan. Fig. 3: Kulim Hi-Tech Park in Kedah (Malaysia)

Fig. 3: Kulim Hi-Tech Park in Kedah (Malaysia)

Simmtech from South Korea built a plant in Penang in 2021 with an investment of around USD 160 million. It has been in operation since the beginning of 2022. The products manufactured by the company are standard printed circuit boards and chip substrates. The company was ranked 23rd in the 2021 NTI 100 list with a turnover of $1.2 billion. It is possible that Simmtech will move up a few positions in the 2022 NTI 100 list, depending on the behavior of the companies ahead of it.

If you count Kedah, which consists of a small island connected to the mainland by two bridges, as part of Penang, you can see that the city supports a number of PCB manufacturers: TTM, AT&S, Simmtech, Elna (owned by GBM from Taiwan) as well as two local manufacturers, QDOS and GUH. The area is fast becoming a major center for board manufacturing in Malaysia.

As far as Singapore is concerned, there are only a few smaller PCB manufacturers in and around Johor, north of Singapore. To the best of the author's knowledge, no new PCB manufacturing facilities are being built in Singapore, Indonesia or the Philippines.

Competition between countries

Annual PCB production in Thailand is around 3.2 billion dollars. Vietnam also has an annual production of around $3 billion. Although Malaysia's production is less than $500 million now, it will catch up with Thailand and Vietnam respectively when AT&S, TTM and other new plants are in full operation in a few years - although Thailand and Vietnam could each produce $4 billion or more worth of PCBs at that time.

Singapore is not an option at all for new PCB plants. It is too expensive for new plants to operate profitably here. High labor costs as well as high costs for water, waste treatment and energy stand in the way.

There are three board manufacturers in Singapore, Sanmina, Additive Circuits and Lincstech (formerly Hitachi Chemical), but their total production is not growing strongly because their factory space cannot be expanded.

The three Indonesian PCB manufacturers are also stagnating, as are some Japanese manufacturers in the Philippines. But there is one exception; Ibiden Philippines, which manufactures IC packaging substrates. Why are Taiwanese PCB manufacturers not building plants in the Philippines?

Why not India?

India is not an option for significant investment by foreign PCB manufacturers. Lack of infrastructure is the main reason. To the best of the author's knowledge, no foreign PCB manufacturers are investing in India. Due to its large population, almost 1.4 billion, India sounds attractive(Fig. 4). However, there are many foreign EMS companies operating in India. Apple (actually its service providers like Foxconn) is increasing its operations in India, but this does not require large amounts of water and electricity. However, board production needs both in significant quantities. Virtually no essential equipment and materials for PCB manufacturing are produced in India. The PCB production volume of this huge country is only about 1/10 of the volume of Vietnam or Thailand. Fig. 4: Skyline of Mumbai, India

Fig. 4: Skyline of Mumbai, India

The crucial question

Which country could be the best 'China+1' country? The author's view is in the direction of Thailand and Vietnam. Thailand has 76 million inhabitants and Vietnam almost 100 million, but Malaysia has only 23 million, which is roughly equivalent to Taiwan's population. Securing workers in Malaysia is problematic. Many companies operating in Malaysia employ a large number of 'imported' workers from Bangladesh, Nepal, India and Indonesia, while both Thailand and Vietnam have sufficient domestic labor.

However, it is a challenge to find experienced workers and engineers in the PCB manufacturing industry in Thailand and Vietnam. Existing PCB manufacturers are afraid of losing their experienced workers and engineers as they are often lured away by newcomers with ridiculously higher salaries. Labor costs in Thailand are less than half of those in China and Vietnam, often less than 1/3, although wages are rising in both these countries.

Where do the Cu laminates come from?

The regional supply of Cu laminates plays a crucial role in the further development of PCB production in the countries of Southeast Asia. Thailand has three major CCL manufacturers:

- Thai Laminate in Lat Krabang near the new airport, which produces the copper clad laminates for multilayers mainly for companies in the KCE Electronics group

- Panasonic with laminates for single-layer boards (phenolic PCB made of paper) in Ayutthaya

- Kingboard Chemical with an FR-4 laminate plant in Ayutthaya directly opposite the Panasonic plant.

Mitsubishi Gas Chemical, which operates a CCL plant in Rayong, should also be mentioned in Thailand. AGC Nelco has a CCL production facility in Singapore. However, support from Taiwanese CCL manufacturers is expected here soon.

Taiwan's board manufacturers are increasingly looking to Thailand

In its publications, the Taiwanese PCB association TPCA frequently mentions the potential investment activity of Taiwan's PCB manufacturers in the countries of Southeast Asia. This has increased particularly in the last year. One reason for this is the uncertainty about the direction in which China's policy will develop. As an example of such publications, an excerpt from an article published by the TPCA on October 27, 2022 is presented below. Its title translated from English: Thailand is attractive for Taiwanese PCB manufacturers (Fig. 5). The original can be found at [3]. Fig. 5: Bangkok at night

Fig. 5: Bangkok at night

To cope with the impact of the ongoing trade war between the US and China, Taiwan-based PCB manufacturers are considering relocating factories in China or setting up additional factories outside China in Southeast Asia. According to industry sources, Thailand has been favored among Southeast Asian countries.

Recently, the Taiwan Electrical and Electronic Manufacturers' Association (TEEMA) and the Taiwan Printed Circuit Association (TPCA) jointly organized a trip by members of both associations to Thailand to assess the feasibility of setting up new factories there.

CCL manufacturer ITEQ will set up a factory in Thailand in the first quarter of 2023 as the automotive supply chain in Thailand has developed most maturely among Southeast Asian countries, said the company's chairman Dennis Chen. He added that the factory will focus on the production of CCL, which are used in automotive components and servers. Technological development is driving the advancement of materials for electronic products, and to build production capacity for high-end products, ITEQ's investment budget for 2023 will be higher than that for 2022, he said.

Flexible CCL manufacturer Taiflex Scientific invested around $35 million in Thailand in the first quarter of 2022 in the first phase of building a factory, with production scheduled to start in the first half of 2024. CCL producer Elite Material will choose either Thailand or Malaysia to build its new factory.

Unitech Printed Circuit Board is evaluating the possibility of setting up a factory in Southeast Asia, with Thailand, Vietnam and Malaysia to choose from.

IC substrate manufacturer Kinsus Interconnect Technology will follow IC packaging/testing service providers in setting up factories overseas. Southeast Asia is not a choice for now as the development of the semiconductor supply chain there is not yet mature, noted the company's CEO and president Scott Chen.

According to TPCA, Thailand's PCB production value already exceeded $3.2 billion in 2021, an increase of about 20% year-on-year. Japan-based Fujikura and CMK as well as Taiwan-based Mektech have already established PCB factories there.

New figures published in Digitimes Asia on September 23, 2022 show just how dynamically Taiwan's board industry is developing: The total revenue of Taiwan's PCB manufacturers in the first half of 2022 increased by 18% year-on-year to NT$419.7 billion ($13.256 billion), mainly due to strong shipments of IC substrates, which have increased by over 30% in five consecutive quarters according to the report [4].

Translation, editing and additions: Dr.-Ing. Hartmut Poschmann

References

[1] NTI-100 for 2021, PLUS 10/2022

[2] www.fict-g.com/en/technology/falcs.html

[3] www.digitimes.com/news/a20221027PD206/pcb-taiwan-thailand.html

[4] www.digitimes.com/news/a20220923PD202/hdi-pcb-tpca.html