Robots work 24 hours a day, all year round, without a break, they have no vacations, are never sick and complete their tasks with consistent, reproducible quality. With the use of AI and increasingly complex control systems, the scope of work has also increased. This is giving rise to new business models such as 'robots as a service', which are also being accelerated by demographic change.

Other market drivers: Key market trends include the re- and nearshoring of production to secure supply chains. The aim is to increase resilience and flexibility. Cost-effective robotics are opening up new customer segments and out-of-the-box solutions with simple setup and installation are creating new applications. High-mix and low-volume production is a result of the growing demand for highly customized products. However, this is labor-intensive and creates a need for robotic solutions due to the shortage of skilled workers. Above all, the idea of 'Industry 4.0' with fully digitalized production from order entry to delivery is a key factor. The areas of application are diverse. They range from logistics and agriculture to surgical robots in surgery and professional cleaning robots.

Cobots open up new degrees of freedom

Cobots are collaborative robots that interact directly with humans without safety cages. The highest safety requirements must be met. This requires fast and precise sensors, microcontrollers with safety functions and efficient power electronics.

Robots have long been the workhorses of production lines in modern factories. Manufacturers worldwide benefit from increased productivity and cost optimization.

Against the backdrop of Industry 4.0 and the smart factory, the latest generation of industrial robots are now revolutionizing traditional production processes. Cobots work together with humans, support them in the respective production processes and increase the quality of the manufactured products thanks to their highly precise and safe operation.

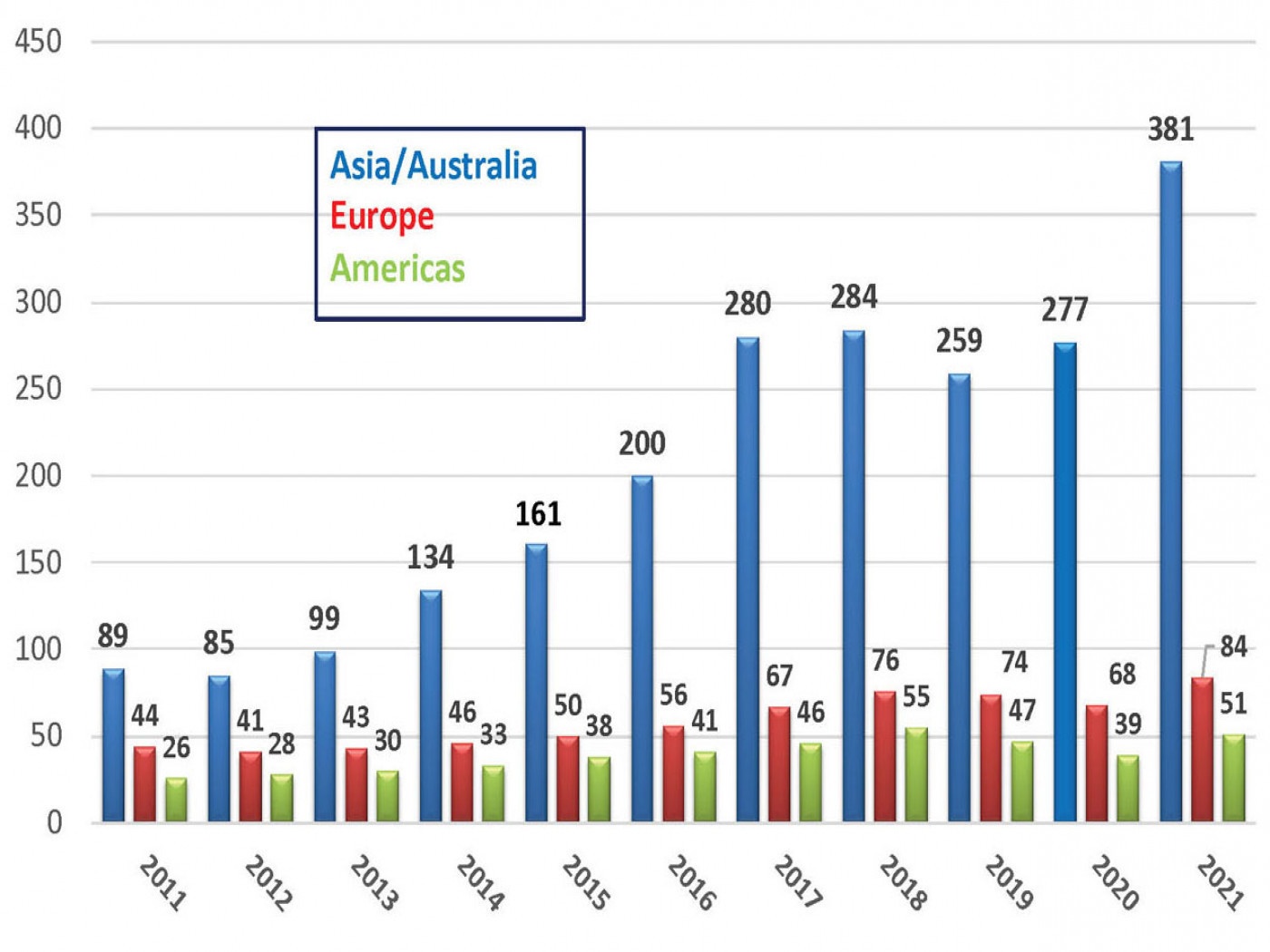

Growth market for industrial robots +14% p.a.

The total number of industrial robots worldwide amounted to 3.5 million units in 2021, with growth averaging 14% p.a. since 2016(Fig. 1). China's operational stock of industrial robots is growing at an average rate of 28% p.a., exceeding the one million mark in 2021 with a total of 1.2 million units (+27%). The Japanese stock increased by 5% to just under 400,000 units in 2021. The European stock of robots amounts to just under 700,000 units.

Fig. 1: Annual installation of industrial robots in thousands of units (data: VDMA)

Fig. 1: Annual installation of industrial robots in thousands of units (data: VDMA)

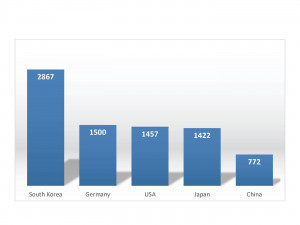

3/4 of global robot installations in five countries

The five most important markets for industrial robots are China, Japan, the United States, South Korea and Germany. These countries account for 78% of global robot installations.(Tab. 1)

| ABB | KUKA | CLOOS | NACHI | COMAU | NEURA ROBOTICS | DAIHEN |

| OMRON | DÜRR | Panasonic | EPSON | RISONG | ESTUN ROBOTICS | STÄUBLI |

| FANUC | UNIVERSAL ROBOTS | GÜDEL | WITTMANN | Kawasaki | YASKAWA | YUANDA ROBOTICS |

| Table 1: Major international manufacturers of industrial robots (Data: IFR) | ||||||

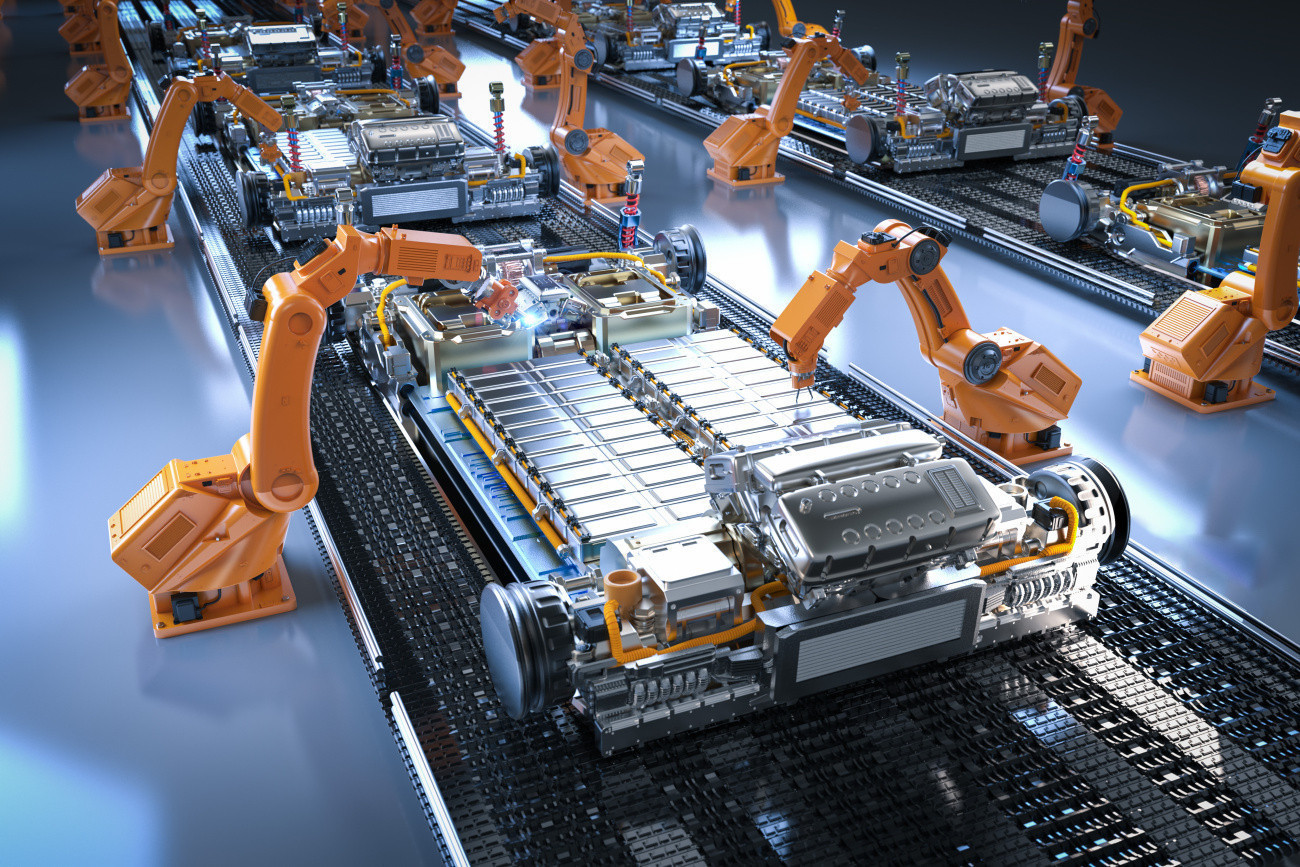

Robot assembly of battery cell modules in a 'Battery Electric Vehicle' (BEV)China has been the world's largest industrial robot market since 2013. In 2021, the People's Republic accounted for 52% of total installations. Japan is also experiencing above-average growth in robot installations, although the country already has a very high level of automation in industrial production. The country accounted for 9% of global robot installations in 2021, while the United States accounted for 7% of robot installations. With 7%, the United States displaced South Korea in third place with 6% of annual robot installations. Germany is the fifth largest robot market worldwide, ranking 4th with an installation rate of 5% in 2021.

Robot assembly of battery cell modules in a 'Battery Electric Vehicle' (BEV)China has been the world's largest industrial robot market since 2013. In 2021, the People's Republic accounted for 52% of total installations. Japan is also experiencing above-average growth in robot installations, although the country already has a very high level of automation in industrial production. The country accounted for 9% of global robot installations in 2021, while the United States accounted for 7% of robot installations. With 7%, the United States displaced South Korea in third place with 6% of annual robot installations. Germany is the fifth largest robot market worldwide, ranking 4th with an installation rate of 5% in 2021.

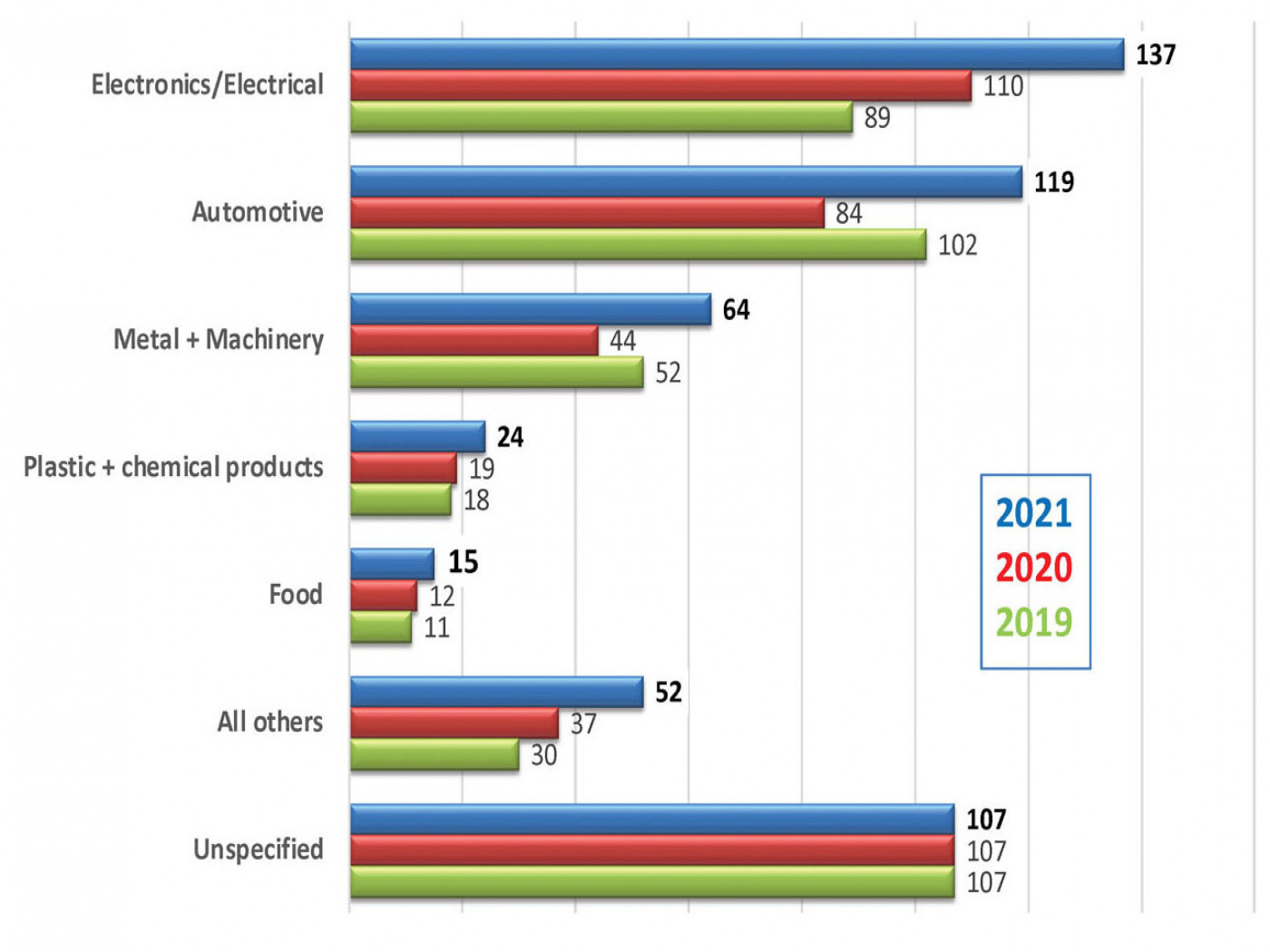

Electronics industry leads the way in installations (Fig. 2)

Fig. 2: Annual robot installations by industry/world (1,000 units) Data: IFR

Fig. 2: Annual robot installations by industry/world (1,000 units) Data: IFR

Fig. 3: Robot density in the automotive industry in 2021 - installed robots per 10,000 employees (Data: IFTheelectronics industry overtook the automotive industry in terms of annual robot installations in 2020 and maintained this position in 2021, with 26% (+ 1%) of all robots installed.(Fig. 3) The automotive industry followed with 23% of installations (+2%), mainly driven by the supplier segment. The metal industry and mechanical engineering installed 12 % (+ 1 %), the plastics and chemical industry (5 %) and the food and beverage industry (3 %). It should be noted that no information on the customer industry is available for 20% of robot installations (-2%).

Fig. 3: Robot density in the automotive industry in 2021 - installed robots per 10,000 employees (Data: IFTheelectronics industry overtook the automotive industry in terms of annual robot installations in 2020 and maintained this position in 2021, with 26% (+ 1%) of all robots installed.(Fig. 3) The automotive industry followed with 23% of installations (+2%), mainly driven by the supplier segment. The metal industry and mechanical engineering installed 12 % (+ 1 %), the plastics and chemical industry (5 %) and the food and beverage industry (3 %). It should be noted that no information on the customer industry is available for 20% of robot installations (-2%).

To the point

China has also become the world leader in industrial robot installations since 2013. In 2021, 268,000 new robots were installed, out of a total of 1.2 million units.

The Japanese industry, although already highly automated, ranks second with 47,000 installations in 2021 with growth of +22%.

The USA is in third place with 35,000 new installations (+14%) and South Korea in fourth place with 31,000 installations (+2%).

Germany takes fifth place with 24,000 installations (+ 6 %) in 2021.

With average annual growth of 14%, there is no doubt that the robot market is a flourishing market. The potential is huge, if you only think of service robots in the field of elderly care or in hospitals. Japan is boldly leading the way here. The Henn-Na Hotel in Nagasaki, Japan, is unique in the world. This is because robots predominantly work in this hotel. In the past, robots were machines that carried out programmed tasks. By linking them with AI, learning robots are now being created that gradually improve their skills through machine learning.

An exciting future market with lots of electronics.

Stay tuned for the 2nd quarter.

Yours

Hans-Joachim Friedrichkeit