Should Europe rebuild its own solar industry and thus free itself from dependence on China in this sector? Industry representatives and scientists recently called for this step. Dr. Martin Metzner, head of the DGO and head of the electroplating department at the Fraunhofer Institute for Manufacturing Engineering and Automation (IPA), developed photovoltaic process technology at his institute over a decade ago. Can a new attempt succeed? And what prospects does it offer the industry? Galvanotechnik asked.

The situation in the photovoltaic sector is overwhelming: most components and products within the photovoltaic (PV) supply chain are currently manufactured in China. For example, the country has 96% of the global production capacity for silicon wafers, the basis for solar cells. In order to reduce the major dependencies in the PV energy sector, a group of PV industry stakeholders is now calling on politicians to take urgent measures to ensure fair and equal competitive conditions in the upstream value chain of the PV industry. This is the only way to build resilience across the entire PV value chain.

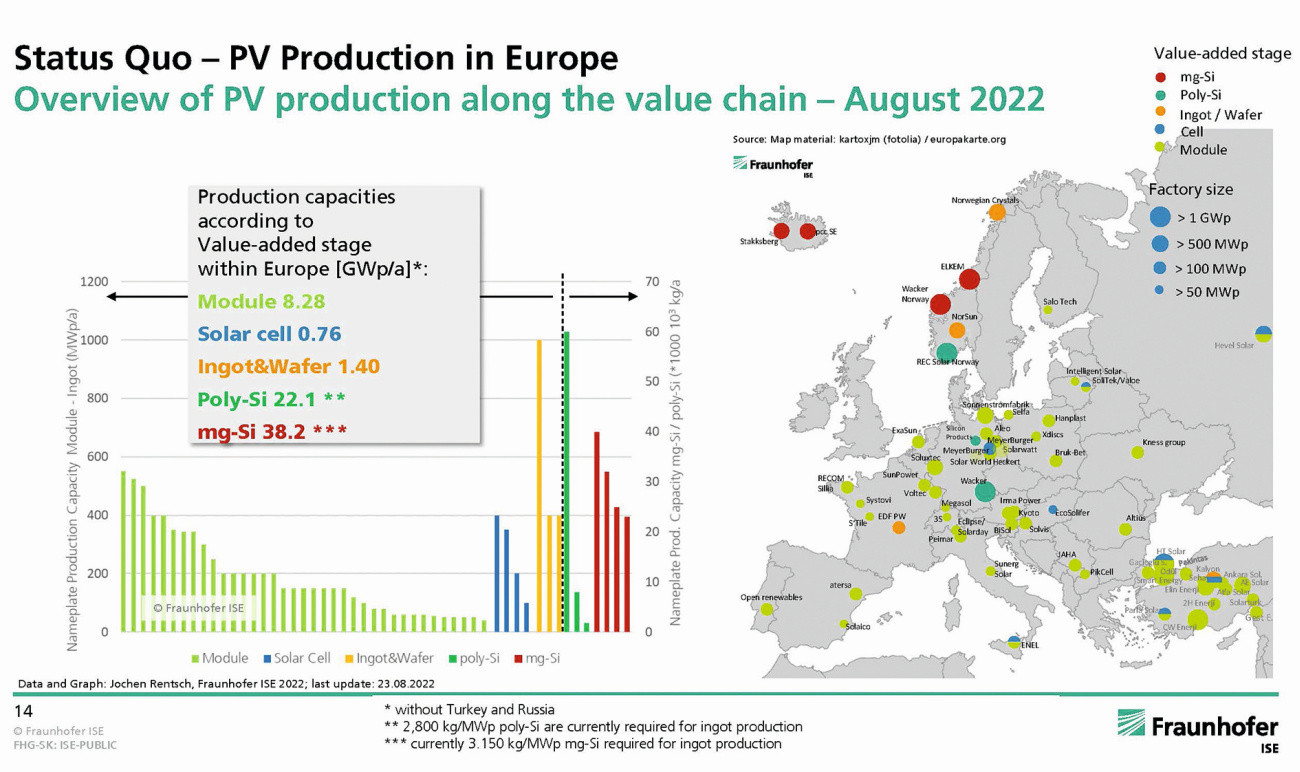

Current PV production capacities in Europe (Graphic: Fraunhofer ISE/Jochen Rentsch)

Current PV production capacities in Europe (Graphic: Fraunhofer ISE/Jochen Rentsch)

Alliance to expand the value chain

Agriphotovoltaics, i.e. solar cells on agricultural land, have been the talk of the town recently.The upstream value chain inparticularis severely underdeveloped due to the high investment and operating costs of production facilities for poly-silicon, silicon crystals and silicon wafers. Representatives of the European photovoltaic industry therefore met some time ago to discuss ways and means of establishing a European PV value chain in good time and protecting existing capacities. The participants included polysilicon manufacturer Wacker, solar cell and module manufacturer Meyer Burger, silicon ingot and wafer manufacturers NorSun and Norwegian Crystals, silicon ingot and solar cell equipment manufacturer ECM Group and the research institutes Fraunhofer Institute for Solar Energy Systems ISE and Fraunhofer Center for Silicon Photovoltaics CSP.

Agriphotovoltaics, i.e. solar cells on agricultural land, have been the talk of the town recently.The upstream value chain inparticularis severely underdeveloped due to the high investment and operating costs of production facilities for poly-silicon, silicon crystals and silicon wafers. Representatives of the European photovoltaic industry therefore met some time ago to discuss ways and means of establishing a European PV value chain in good time and protecting existing capacities. The participants included polysilicon manufacturer Wacker, solar cell and module manufacturer Meyer Burger, silicon ingot and wafer manufacturers NorSun and Norwegian Crystals, silicon ingot and solar cell equipment manufacturer ECM Group and the research institutes Fraunhofer Institute for Solar Energy Systems ISE and Fraunhofer Center for Silicon Photovoltaics CSP.

Critical materials in the upstream PV value chain are silicon, ingots and silicon wafers, as a prerequisite for the production of solar cells, photovoltaic modules and ultimately photovoltaic power plants. According to industry representatives, dependence on PV products from a single country jeopardizes the use of solar energy in Europe in the event of possible supply disruptions. In a joint statement, the stakeholders call for immediate action to enable the development of a local, sustainable value chain for the solar industry.

In their view, effective measures could include subsidies for investment in production capacity, support for the manufacture of PV products, a guaranteed and competitive electricity price and incentives for lowCO2 emissions in the manufacture of products. The overarching goal is to create fair conditions for the industry and thus ensure fair competition.

Difficult conditions for expanding production

But is the development of a European solar industry even realistic? Martin Metzner has mixed feelings about this. "You have to look at why things got this way with the dependence on China," he says, looking back. China has massively promoted its solar industry, giving it a competitive advantage. "But nothing really new was developed. China produces existing technologies as cheaply as possible with the highest possible throughput - now with a market lead of 10 years," he summarizes.

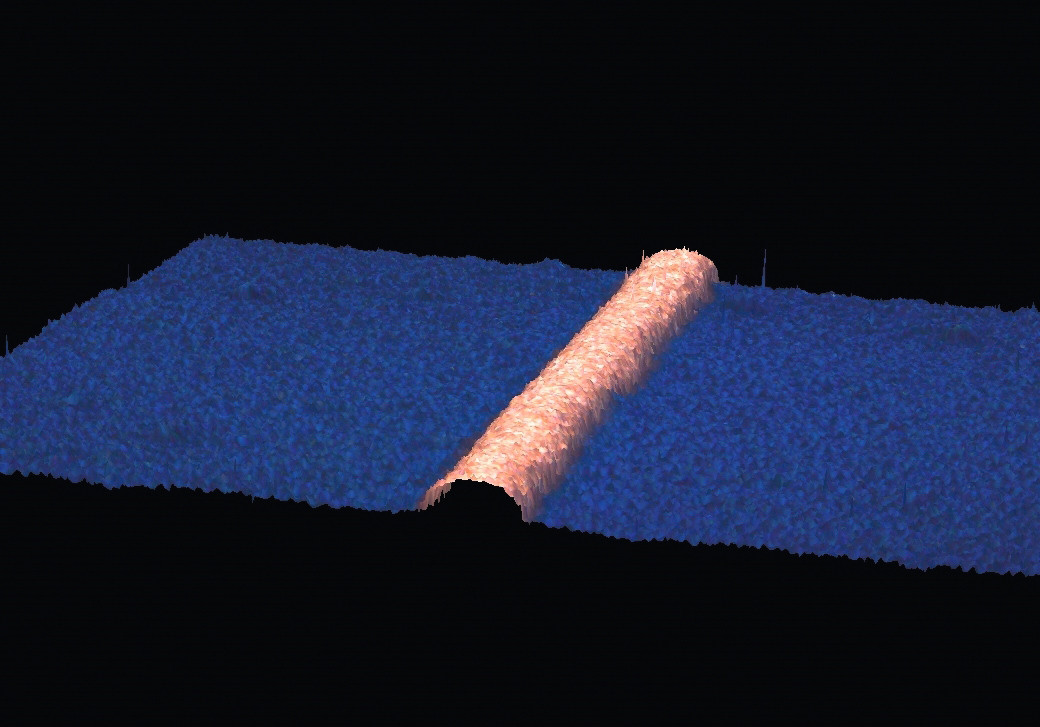

3D confocal microscope image of the copper conductor track of a solar cell produced using the laser-assisted PV2+ process. Researchers at Fraunhofer ISE recently succeeded in replacing silver with copper in the electroplating of solar cell circuit boards. Copper is easier to obtain and cheaper

3D confocal microscope image of the copper conductor track of a solar cell produced using the laser-assisted PV2+ process. Researchers at Fraunhofer ISE recently succeeded in replacing silver with copper in the electroplating of solar cell circuit boards. Copper is easier to obtain and cheaper

Metzner was working in the research and development of photovoltaic modules at Fraunhofer IPA at the time. "We had a roll-to-roll system here at the institute," he recalls. "The idea was to stretch a strip at the front, run it through a normal roll-to-roll electroplating process, as is common in strip electroplating, and finally obtain functional semiconductor crystals with a heat treatment. We had already mastered the individual process steps, we just couldn't combine them because we didn't have the funding to do so." Looking back, it didn't take much to prove the process. Then the funding dried up because only "existing technologies" were to be funded. The plant was sold. After a final project together with Fraunhofer ISE on the coating of contact fingers, research and development in the PV sector at Fraunhofer IPA came to an end. Over a decade ago, the German solar industry came to an end at the same time as development was halted.

Dr. Metzner believes that the approach of bringing the technology back into the country is the right one, but also points out that resistance from citizens' initiatives is to be expected in this country when setting up production facilities that use chemicals. "We don't want nuclear power, but we also don't want a power line on our doorstep to transport renewable electricity from north to south. That's so contradictory that I'm already asking myself whether this can even be implemented in our industry," he says, using an example to substantiate his doubts.

Jobs, energy independence and sustainable production beckon

Parking lot with solar roof. There are many ways to use solar energy (Photo: Adobe Stock)Fraunhofer ISE Director Prof. Dr. Andreas Bett, on the other hand, is confident: "We are convinced that a sustainable European PV production industry can be revived with the help of government support to promote the installation and operation of PV production facilities," he says and is looking forward to reducing energy dependency and creating economic value and jobs at the same time. And Carsten Rohr, Chief Commercial Officer at NorSun, adds that the development of energy-intensive upstream production steps such as ingot and wafer production also offers the opportunity to benefit from sustainable production, "both in terms of high environmental standards - including a lowcarbon footprint- and social standards".

Parking lot with solar roof. There are many ways to use solar energy (Photo: Adobe Stock)Fraunhofer ISE Director Prof. Dr. Andreas Bett, on the other hand, is confident: "We are convinced that a sustainable European PV production industry can be revived with the help of government support to promote the installation and operation of PV production facilities," he says and is looking forward to reducing energy dependency and creating economic value and jobs at the same time. And Carsten Rohr, Chief Commercial Officer at NorSun, adds that the development of energy-intensive upstream production steps such as ingot and wafer production also offers the opportunity to benefit from sustainable production, "both in terms of high environmental standards - including a lowcarbon footprint- and social standards".

Metzner believes that a European solar industry based on sustainable standards is certainly possible. According to the scientist, recycling processes could even open up new prospects for galvanic manufacturing processes. "I see great opportunities for wet-chemical processes in recovery processes, in urban mining. If we want to move away from dependence on raw materials, we need to close the material cycles," he emphasizes, noting: "After all, there are considerable raw material problems in all industrial processes." China bought deposits in Africa or Asia when they didn't have the raw materials themselves." In addition to consistent recycling, it is therefore also important to exploit our own deposits. And there are also opportunities here: The media recently reported on new deposits of rare earths in Sweden, and there are also large deposits of lithium under the Rhine trench. But here, too, the question arises: is mining possible?

Best prospects for electroplating plants

Dr. Martin Metzner is Head of the Electroplating Technology Department at the Fraunhofer Institute for Manufacturing Engineering and Automation (IPA) and also the first Chairman of the German Society for Electroplating and Surface Technology (DGO). The scientist and industry representative was one of the developers of photovoltaic process technology until the end of the German solar industry over 10 years ago. (Photo: Robert Piterek)If a European solar industry is established, Metzner is optimistic - also for electroplating and surface technology. "PV modules contain a lot of surface technology, and electroplating technology is also required for some components, e.g. for contact finger bonding. With appropriate research, we can even tap into one or two wet-chemical processes," he says. For simple substrates, the HFCVD process (chemical vapor deposition) could be economical. However, he has high hopes for the roll-to-roll electroplating process, which he considers to be both economical and material-efficient. The establishment of a state-of-the-art solar industry is also possible. However, he argues that this would be hampered by the Chinese market lead. If the go-ahead is given for a European solar industry, he believes this will also bring new business opportunities for German electroplating companies. All electroplating companies involved in the roll-to-roll process could benefit. "There are certainly ten larger companies in Germany," estimates Dr. Metzner.

Dr. Martin Metzner is Head of the Electroplating Technology Department at the Fraunhofer Institute for Manufacturing Engineering and Automation (IPA) and also the first Chairman of the German Society for Electroplating and Surface Technology (DGO). The scientist and industry representative was one of the developers of photovoltaic process technology until the end of the German solar industry over 10 years ago. (Photo: Robert Piterek)If a European solar industry is established, Metzner is optimistic - also for electroplating and surface technology. "PV modules contain a lot of surface technology, and electroplating technology is also required for some components, e.g. for contact finger bonding. With appropriate research, we can even tap into one or two wet-chemical processes," he says. For simple substrates, the HFCVD process (chemical vapor deposition) could be economical. However, he has high hopes for the roll-to-roll electroplating process, which he considers to be both economical and material-efficient. The establishment of a state-of-the-art solar industry is also possible. However, he argues that this would be hampered by the Chinese market lead. If the go-ahead is given for a European solar industry, he believes this will also bring new business opportunities for German electroplating companies. All electroplating companies involved in the roll-to-roll process could benefit. "There are certainly ten larger companies in Germany," estimates Dr. Metzner.

"The renaissance of a manufacturing industry for renewable energies is strategically smart and urgently needed," says Gunter Erfurt, CEO of Meyer Burger Technology AG, one of the industry representatives who are now raising their voices. "In addition, the energy sector is of national security interest. The solar industry with its manufacturing facilities in Europe must become a political priority against the backdrop of the ongoing multiple global crises. If this happens, the energy transition, independence from raw materials and probably also more sustainable production of the technology will be strengthened, as will companies in the electroplating and surface technology sectors. Perhaps funding will then even flow to Fraunhofer IPA again - and give the innovation drivers at Stuttgart's Fraunhofer IPA, together with the Fraunhofer Institutes ISE and CSP, a second chance to develop the latest technology for photovoltaic expansion.