Materials scientists at the University of California (UCLA), together with colleagues from Irvine, Istanbul, Hangzhou and Hsinchu, have found the main reason why perovskite solar cells degrade in sunlight, causing their performance to decrease over time. A subset of perovskites, the metal halide perovskites, are of great research interest because of their promising application for energy-efficient thin-film solar cells.

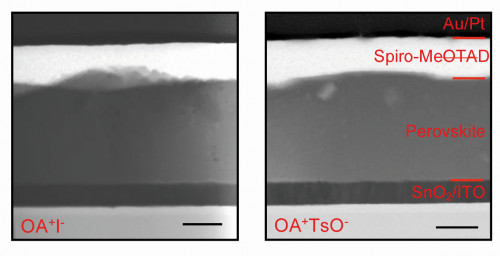

A common surface treatment to remove solar cell defects involves the application of a layer of organic ions (e.g. octylammonium ions), which charges the surface to negative. Although this treatment improves the energy conversion efficiency during the manufacturing process of perovskite solar cells, it creates a more electron-rich surface. The ordered arrangement of the atoms is destabilized more quickly and the perovskite solar cells become increasingly inefficient over time.

STEM image of the aged solar cells. Left: OAI-treated and right: OATsO-treated component cross-sections. All scale bars represent 200 nM

STEM image of the aged solar cells. Left: OAI-treated and right: OATsO-treated component cross-sections. All scale bars represent 200 nM

The researchers found a way to counteract the long-term degradation of the cells by pairing the positively charged ions with certain anions (including tetrafluoroborate, p-toluenesulfonate and trifluoroacetate) during the surface treatment. This change makes the surface more electron neutral and stable, while maintaining the integrity of the surface treatments to prevent defects.

The team tested the endurance of their solar cells in the lab under accelerated aging conditions and 24/7 illumination that mimics sunlight. The cells retained 87% of their original power when converting sunlight into electricity for more than 2,000 hours. By comparison, solar cells produced without the correction only achieved 65% of their original performance after the same tests and under the same conditions.

Nature (2022), DOI: 10.1038/s41586-022-04604-5

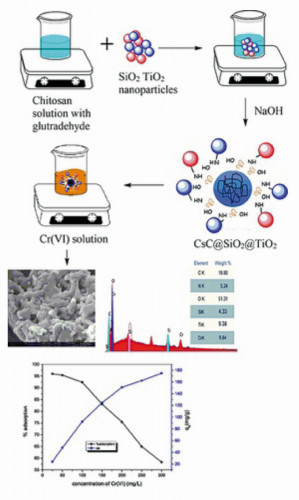

Cr6+ removal by adsorption

Chitosan is a naturally occurring biopolymer used in water treatment, engineering, paper industry, cosmetics, agriculture, health and biotechnology. Chitosan can be easily modified to achieve new properties. Scientists from Morocco and India have synthesized a bio-nanocomposite of chitosan by incorporating amorphous SiO2 and nanocrystalline TiO2 into a chitosan matrix using glutaraldehyde as a crosslinker (CsC@SiO2@TiO2). This composite was selectively used for the removal of Cr6+ from aqueous solutions by batch adsorption studies.

Under the optimum conditions of pH 3.0, contact time of 120 min, adsorbent dose of 50 mg and Cr6+ concentration of 100 mg L-1, an adsorption capacity of 182.43 mg g-1 was observed in a single layer. Kinetic studies show that the nanocomposite follows pseudo-order kinetics for the sorption process of Cr6+. The sorption of Cr6+ was explained by the Langmuir isotherm model indicating single layer adsorption on a homogeneous surface. The synthesized composite adsorbed more than 90% Cr6+ under optimal conditions and more than 80% in the presence of other interfering ions, demonstrating its selectivity towards Cr6+. The material was regenerated with 0.5 M NaOH with little change in adsorption capacity over the five adsorption-desorption cycles. The integration of these two nanoparticles (NP) not only increased the thermal and mechanical stability of the chitosan-based biopolymer, but also significantly improved the adsorption rate and capacity compared to pure chitosan.

Environ. Nanotechnol. monitoring management 2022 (18), 100695

Market forecasts for precious metal chemistry

The precious metal plating chemicals market is projected to reach USD 1.8 billion by 2027, after having an expected CAGR of 4.1% during 2022-2027. Precious metal plating chemicals are used in a wide range of industries. In the "Covid year" 2021, silver dominated the material segment in the precious metal coating market. Silver plating continues to be used in various areas of consumer electronics, solar cells and decorative applications. Due to its diverse properties and wide range of applications, the silver-plating of metals portfolio will continue to expand over the forecast period. The upturn in the solar industry in the coming years could lead to increased use of silver coating applications. Palladium plating is used in the production of automotive catalytic converters, and the booming automotive sector will increase its use over the forecast period.

Interestingly, electroless plating process dominated the precious metal plating chemicals market in 2021. Electroless plating process offers higher reliability, which improves productivity and increases corrosion resistance of parts. Electroless plating with gold and silver on additively manufactured parts from the laser powder bed fusion process has recently been successfully implemented. This high utilization of electroless plating process will increase demand over the forecast period. The electrolytic process will witness significant demand over the forecast period. This massive expansion in the global electrical and electronics industry will increase the usage of precious metal plating chemicals in the manufacturing of various electronic products, which will contribute to the growth of the market during the forecast period.

https://www.industryarc.com/Research/Precious-Metal-Plating-Chemicals-Market-Research-504342

Electric vehicles in India

According to media reports, South Korean carmaker Kia Motors is developing an electric SUV for India, which could be based on a flexible platform on which both ICE and electric variants can be built. In India, the share of electric vehicles in total sales of four-wheeled vehicles is still low, but the total number is growing. According to official figures, registrations of electric vehicles have multiplied considerably from 4,220 in 2020 to 14,601 in 2021 and 11,669 in the first three months of 2022. Tata Motors accounted for around 90% of electric four-wheeler registrations in India.

East Asian car manufacturers are keen to invest in the Indian electric vehicle market. Hyundai Motor announced at the end of 2021 that it would invest 400 billion Indian rupees (just under 5 billion euros) and launch six electric vehicles in India between 2022 and 2028. Hyundai has received approval from the Indian government to incentivize investment in advanced chemical cell manufacturing in India. Suzuki, the leading passenger car brand in India, announced in March that it would invest 150 billion Japanese yen (1.1 billion euros) in India, including an electric vehicle plant, an electric battery plant and a vehicle recycling plant. MG Motor, which is owned by SAIC, also announced an investment of 20 billion Indian rupees (nearly 248 million euros) in the Indian electric vehicle market in March and established MG Charge to set up 1,000 AC charging stations in residential areas within 1,000 days.

In the recent hot summer weeks, many dozens of electric two-wheelers were registered and caught fire, suggesting that a less developed local battery ecosystem could be an obstacle to the ever-increasing sales of electric vehicles in India. At this stage, demand is growing strongly as more consumers realize the value of the product, and investment is increasing as companies look to grab a share of the new market. The fire in electric two-wheelers can be caused by poor cells, poor battery design or a poor battery management system. However, from an industry perspective, it is evident that the development of the battery supply chain in India has unfortunately not kept pace with the rapid growth of electric two-wheelers. Most of India's demand for battery cells is met by imports, mainly from China, which may not suit the tropical and political climate. Also, electric two-wheeler manufacturers may face quality constraints due to cost and time constraints as lithium-ion batteries are in excessive demand globally and consumers are highly price sensitive.

India's EV sales growth is driven by electric two-wheelers and three-wheelers. India's electric two-wheeler OEMs, unlike those of three-wheelers, use nickel-manganese-cobalt batteries for their products, which pose a higher risk of explosion than lithium iron phosphate batteries used by e-tricycle OEMs. The latter have a more stable but less energy-intensive battery cathode chemistry. Only the e-two-wheeler manufacturer Okaya currently uses lithium iron phosphate batteries in its newer models.

Growth sector jewelry industry

Competition between India's federal states is becoming increasingly fierce in order to attract investment. The state of Gujarat is known to be quite successful in this regard. Most of the world's diamonds are polished in the city of Surat in Gujarat. The government of neighboring Maharashtra has offered to provide land and infrastructure for setting up a jewelry machinery manufacturing cluster to promote the production of high quality jewelry at globally competitive prices.

An industrial park for more than 1,000 companies with over 150,000 jobs is being set up in Navi Mumbai. Until now, jewelry production has been carried out more traditionally. With an eye on the international market, it is now being recognized that this industry will become a highly technical sector requiring various technologies such as 3D design, wax casting, electroplating, 3D metal printing and even process automation.