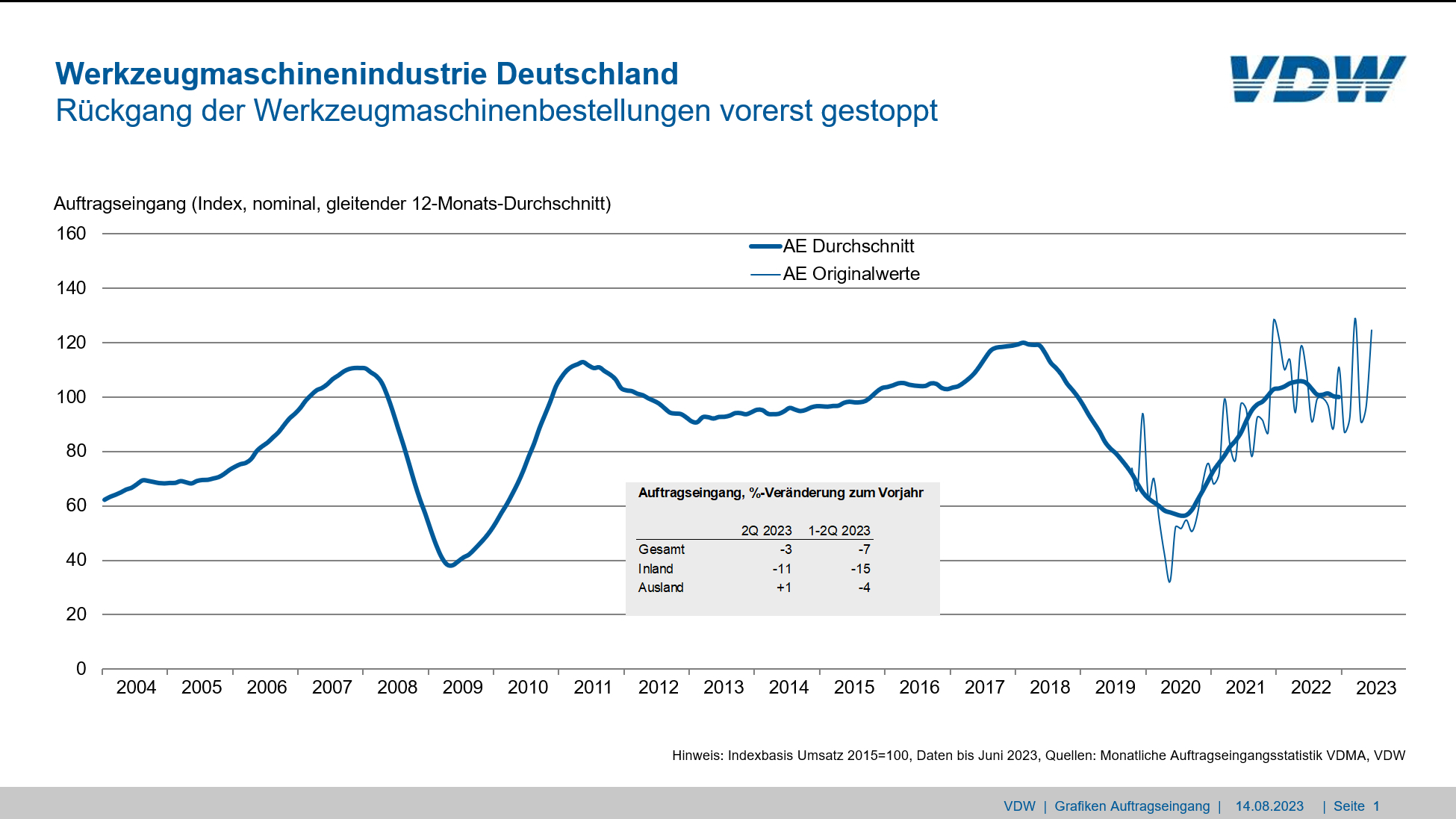

In the second quarter of 2023, incoming orders in the German machine tool industry fell by 3% in nominal terms compared to the same period of the previous year. Domestic orders were down 11% on the previous year, while foreign orders rose by 1%. In the first half of the year, incoming orders fell by 7% overall. Domestic orders were down 15% on the previous year, while foreign orders were down 4%. In real terms, this means a 13% drop in orders.

"At the end of the second quarter, orders once again rose surprisingly, similar to March," reported Dr. Wilfried Schäfer, Executive Director of the German Machine Tool Builders' Association (VDW) based in Frankfurt am Main. The impetus in the second quarter came from the euro countries. The increase in orders at the end of the second quarter was also spread across both machining and forming. "Of course, we know from experience that a monthly result does not signal a trend reversal," Schäfer continues. Rather, the fluctuations are based on the project business, especially in forming technology. Orders from growth sectors such as e-mobility, wind power, aerospace and defense are also supporting the order intake. The standard machine business, on the other hand, tends to be weaker, as small and medium-sized customers are uncertain and are postponing their investments. Credit-financed machine purchases are proving difficult due to the rise in interest rates.

Turnover remains at a high level. In nominal terms, it grew by 21% in the first half of the year and by 13% in real terms. Capacity utilization rose slightly again in July of this year, from 88.3% to 90.5%. The order backlog is only falling slowly. "This is why the VDW forecast of 10% production growth in the current year remains valid," concluded Schäfer. The driving force remains abroad, and Asia alone with a positive balance.